Futures on US stock indices are trading almost unchanged on Monday, and traders continue to monitor the warning signals of the bond market. Futures for the Dow Jones index rose only slightly, while Futures for the S&P 500 showed only 0.2%. Nasdaq 100 rose 0.4%.

The most interesting event on Monday was the news that Elon Musk acquired more than 9% of the total share in the social network Twitter. Against this background, the company's securities on the premarket increased by more than 25%. Let me remind you that about a week ago, Musk surveyed his subscribers, asking whether he should make his social network according to the principles of freedom of speech. Based on Twitter's closing price on Friday, the value of the package is $ 2.89 billion. Tesla shares rose by 1% after the company published data on the supply of its electric vehicles. In the first quarter, the company delivered more than 310,000 electric vehicles compared to 184,800 a year earlier.

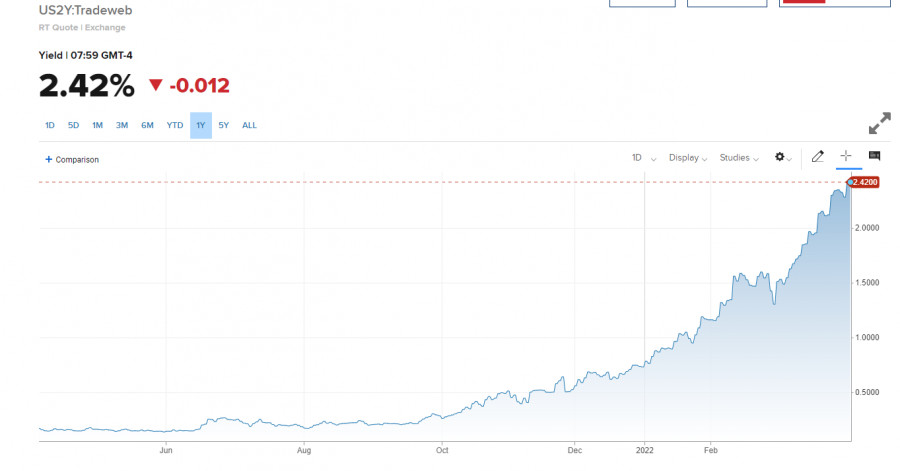

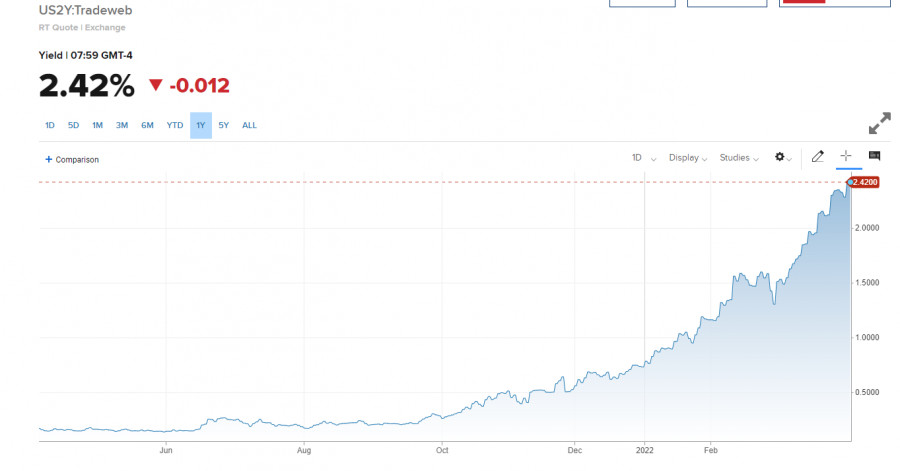

Returning to the economy and its assessment by investors, the markets were excited by the inversion of 2-year and 10-year treasury bonds, which occurred for the first time since 2019. This indicates the first signs of a recession. The observed changes in the yield curve are probably related to investors' fears that the Fed will raise interest rates more aggressively at the next meeting to harm inflationary growth. Many investors are also following the latest developments in Ukraine. German Chancellor Olaf Scholz said on Sunday that Western countries will impose additional sanctions against Russia in the coming days, which will necessarily negatively affect market sentiment. According to the latest data, Russian and Ukrainian negotiators intend to resume video talks today, but it is unlikely to bring a positive result.

Good data on the US labor market helped indexes on Friday partially recover their losses. The US economy added 431,000 jobs in March, while economists had expected an increase of 490,000. A strong labor market continues to give investors the green light, despite years of US inflation and the risk of higher interest rates. At the weekend, the president of the Federal Reserve Bank of New York, John Williams, said that only consistent steps can return rates to a more normal level. Mary Daly, president of the San Francisco Fed, noted in an interview on Sunday that rising inflation and labor market tensions strengthen the arguments in favor of a half-point increase in May.

This week on Wednesday, the Federal Open Market Committee will publish the minutes of the Central Bank's March meeting, which will give investors a deeper understanding of how the Fed plans to manage monetary policy further.

Premarket

Starbucks has suspended its share buyback program, which it says will allow it to invest in the future growth of the coffee chain. According to experts, this step is connected with the return of Howard Schultz for a third term as CEO. Starbucks fell 2.3% in the premarket.

In his annual letter to shareholders, JPMorgan Chase CEO Jamie Dimon said that the bank could face a potential loss of $1 billion as a result of investments made in the Russian economy.

JD.com (JD), Netease (NTES), Alibaba (BABA), and Tencent Music (TME) - Chinese shares registered in the United States are rising in the premarket after China proposed to revise the privacy rules regarding audit supervision. This could remove an obstacle to US-China cooperation. Promotions JD.com jumped 5.1%, Netease - 3.9%, Alibaba - 4.3%, and Tencent Music - 5.2%.

Goldman Sachs upgraded Logitech's rating to "buy" from "neutral", which is encouraged by the recent strong financial performance of the manufacturer of computer mice, keyboards, and other peripherals. Logitech jumped 4.3% in the premarket.

As for the technical picture of the S&P 500

Trading is conducted above the level of $ 4,539, which preserves a fairly significant chance of the market recovering back to $ 4,588. If this cannot be done at the beginning of the week, most likely, market pessimism will begin to prevail. Closing the market below $ 4,539 will cool the ardor of buyers, so you need to do everything not to miss this range. In case of a breakdown of $ 4,589, the nearest target of sellers will be the resistance of $ 4,665. Going beyond this level will open a direct path for the trading instrument to the highs of $ 4,722 and $ 4,818. In the event of a return of pressure on the index and a breakthrough of $ 4,539, we can expect a decline to the area of $ 4,488, but the longer-term target of sellers of the trading instrument will be at least $ 4,433, after which the bulls will have to start all over again.