Analysis of Tuesday's Trades

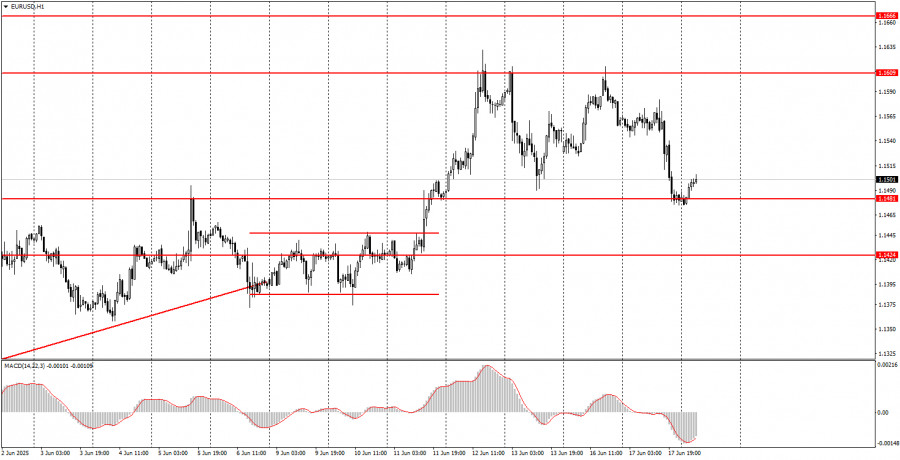

1H Chart of EUR/USD

The EUR/USD currency pair experienced a significant decline on Tuesday, and it is puzzling to understand why the U.S. dollar unexpectedly strengthened. The macroeconomic backdrop for the day pointed toward further weakening of the dollar, as the most important reports — on U.S. industrial production and retail sales — came in worse than expected. However, the market again ignored macroeconomic releases, this time in favor of the dollar, which was unexpected. We can only assume this was an "advance reaction" to today's upcoming Federal Reserve meeting or a technical rally before another drop. There were no fundamental reasons for the dollar's rise on Tuesday. Of course, technical corrections occur occasionally, but you won't find clear reasons for Tuesday's movements. One might also suppose that the dollar strengthened due to the anticipated escalation in the Middle East conflict.

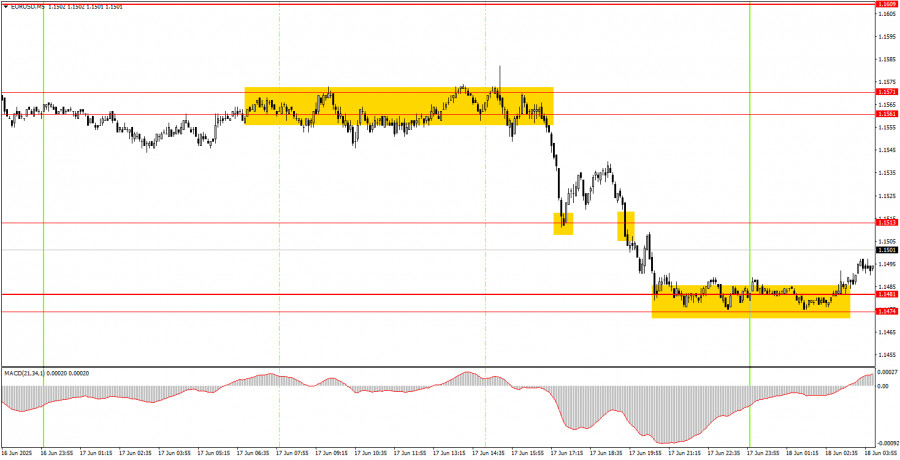

5M Chart of EUR/USD

In the 5-minute timeframe on Tuesday, several strong trading signals were generated. During the entire European session, the pair moved in a flat range, but at the start of the U.S. session, it finally broke away from the 1.1561–1.1571 area and began a fairly strong downward move. Therefore, novice traders could have entered short positions. Unfortunately, around the 1.1513 level, a false buy signal was triggered due to a clear bounce, but the long trade did not result in a loss—the price moved more than 15 pips in the right direction. This was followed by another sell signal around the same level, and the pair reached the next target area of 1.1474–1.1481. As a result, two out of three trades were profitable.

Trading Strategy for Wednesday:

In the hourly timeframe, EUR/USD continues its upward trend, which began under Donald Trump and will likely not end with the next president. For now, the mere fact that Trump is U.S. president is enough to keep the dollar in a downtrend. Even the escalating conflict between Iran and Israel hasn't had much impact on the dollar's overall position. The U.S. leader continues to issue threats, set ultimatums, impose or raise tariffs, and is ready to go to war with Iran. As a result, the market may not be selling the dollar every day, but it's also not looking to buy it in the medium term.

On Wednesday, the EUR/USD pair may move actively as Trump sends numerous signals of readiness to strike Iran. In the evening, we will get the Fed's rate decision.

In the 5-minute timeframe, consider the following levels: 1.1132–1.1140, 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1561–1.1571, 1.1609, 1.1666, 1.1704, 1.1802. No major macroeconomic releases are scheduled for Wednesday in the EU or U.S., but the Fed decision in the evening is expected to be the day's main driver.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.