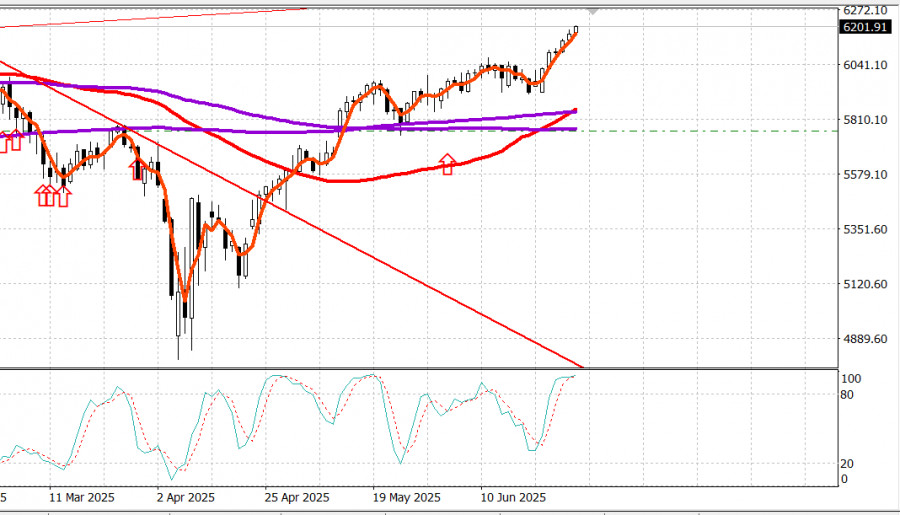

S&P500

The US stock market is ahead of a week of big news. The S&P 500 is eyeing 6,200

Snapshot of major US stock indices on Friday: Dow +1%, NASDAQ +0.5%, S&P 500 +0.5%, S&P 500 closed at 6,173, trading in the range of 5,700 to 6,300

The S&P 500 hit a new all-time high on Friday, both in the regular session and again during Monday morning's electronic trading. It also posted a record closing high on Friday.

Bulls found fresh motivation Friday morning following reports that the US and China had reaffirmed their trade framework agreement. The deal is expected to boost Chinese exports of rare earth metals and ease restrictions on tech exports to China. Furthermore, the US may be preparing to announce 10 more trade deals.

This news came ahead of the May personal income and spending report, which showed weakness in both income and spending, but higher inflation. Both the PCE Price Index and Core PCE rose year-over-year.

Despite the report's stagflationary tone, the market brushed it aside and traded higher, supported by trend momentum and a strong rally in Dow component Nike (NKE $72.04, +$9.50, +15.19%) following its earnings report. Continued strength in large-cap stocks helped push the S&P 500 to a session high of 6,187.68, up 0.8% by lunchtime on the NYSE.

That gain was completely wiped out in the afternoon after President Trump posted on Truth Social that the US was ending trade talks with Canada due to its 400% dairy tariff and a digital services tax. He added, "We'll let Canada know the tariff they'll be paying to do business with the United States of America." The update sparked broad-based selling over fears of tariff-driven inflation and concerns that more countries could soon face higher tariffs after the mutual tariff pause expires on July 9.

The bond market reflected these concerns: 10-year Treasury yields, which are sensitive to inflation, rose from 4.24% to 4.29%.

As expected, the stock market regrouped in the final hour with a wave of "buy-the-dip" interest, lifting the S&P 500 from 6,132.35 to a record closing high of 6,173.07.

Just as most stocks were part of the selloff, most also participated in the rebound into the close. 9 of 11 S&P 500 sectors closed higher, led by:

- Consumer Discretionary (+1.8%)

- Communication Services (+1.5%)

- Industrials (+1.0%)

The only sectors to close in the red were:

- Healthcare (-0.2%)

- Energy (-0.5%)

Friday's session took place amid Senate negotiations over what President Trump calls the "One Big, Beautiful Bill" — his tax and spending package.

Bloomberg reported that Senate Republicans had agreed to raise the SALT cap (state and local tax deduction) to $40,000 over five years, though it remains unclear whether enough Republicans in the House will support it.

CNBC separately reported that the Senate hopes to vote on the bill over the weekend. Treasury Secretary Bessent told CNBC there is a strong chance the bill will be on the president's desk by July 4. Update: The Senate passed the bill over the weekend.

Year-to-date performance:

- S&P 500: +5.0%

- Nasdaq: +5.0%

- DJIA: +3.0%

- S&P 400: -0.6%

- Russell 2000: -2.6%

Economic calendar on Friday:

* Personal Incomes fell 0.4% MoM in May (consensus: +0.4%) after a revised +0.7% in April.

* Personal Spending dropped 0.1% (consensus: +0.2%) after +0.2% in April.

* Real Personal Spending fell 0.3%, a potential drag on Q2 GDP forecasts.

* PCE Price Index rose 0.1% MoM, as expected.

* Core PCE rose 0.2% MoM (above consensus of 0.1%).

These changes pushed annual PCE inflation to 2.3% (vs. 2.2% in April) and Core PCE to 2.7% (vs. 2.6%).

Key takeaway: This report suggests stagflation—bad for growth, bad for inflation trends. Given the Fed's current focus on inflation, this likely rules out a rate cut at the July FOMC meeting.

University of Michigan Consumer Sentiment (Final, June): rose to 60.7 (consensus: 60.5) from a preliminary reading of 60.5. Final May reading was 52.2. A year ago: 68.2.

Takeaway

The June survey showed a broad improvement in sentiment, helped by a better outlook on personal finances, business conditions, and inflation, supported by the suspension of reciprocal tariffs (expiring July 9) and the stock market rally.

Energy market

Brent crude is now trading at $66.50, down about $1 from Friday, amid the end of the Iran–Israel war

Conclusion

The US stock market is posting new highs for the year, with the S&P 500 setting records. We continue to hold long positions, but plan no new buys until a meaningful correction.

Upcoming this week:

- ISM indices for June

- Jobs report (nonfarm payrolls) on Friday