In the last six months, Bitcoin and other cryptocurrencies have moved within an upward trend formed after establishing a local BTC bottom around $16k. Since then, digital assets have made several strong upward impulses and updated local highs. Bitcoin reached $31k, ETH $2130, and the total market capitalization of cryptocurrencies exceeded $1.2 trillion.

However, the latest downward impulse, triggered by a series of negative factors, has finally broken the structure of the upward movement of the main assets. At the same time, the market is experiencing a strengthening of bearish sentiments, parallel to the anticipation of the adoption of stressful macroeconomic decisions.

Factors for the Emergence of a Bearish Trend

The main factor for the strengthening of bears in the crypto market has been events in the United States. First and foremost, this refers to the Federal Reserve's policy and the key interest rate level. Events of the past week have shown strong likelihood that the regulator will once again raise the key rate to 5.75% due to the potential increase in the CPI level. Such a decision will strengthen the U.S. dollar and the yield of U.S. Treasury bonds, while at the same time pushing high-risk assets, especially cryptocurrencies, to the sidelines.

Another negative factor was the statement by former SEC lawyer John Reed Stark, who believes that the regulator will not approve a spot ETF for BTC in 2023. An anonymous agency employee expressed this opinion, noting that such a decision is unlikely in 2023. At the same time, the SEC continues its legal pursuit of Ripple, although it does not ask the court to recognize the asset as a security.

Investors Lost Faith?

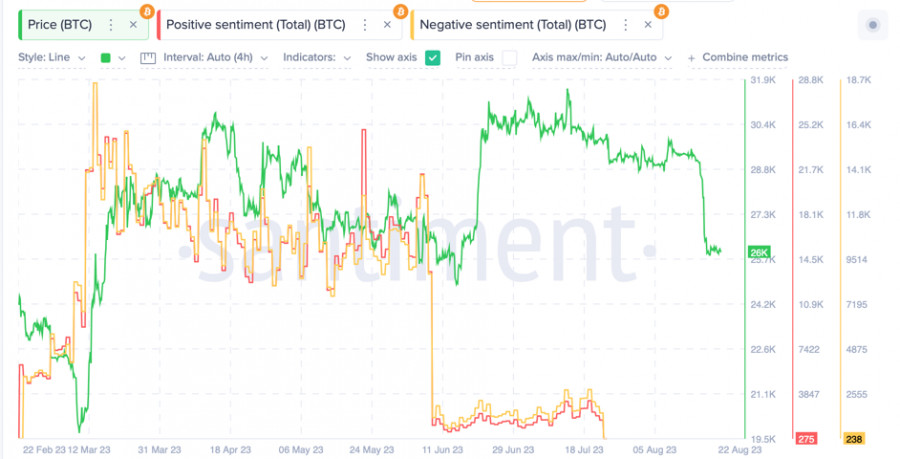

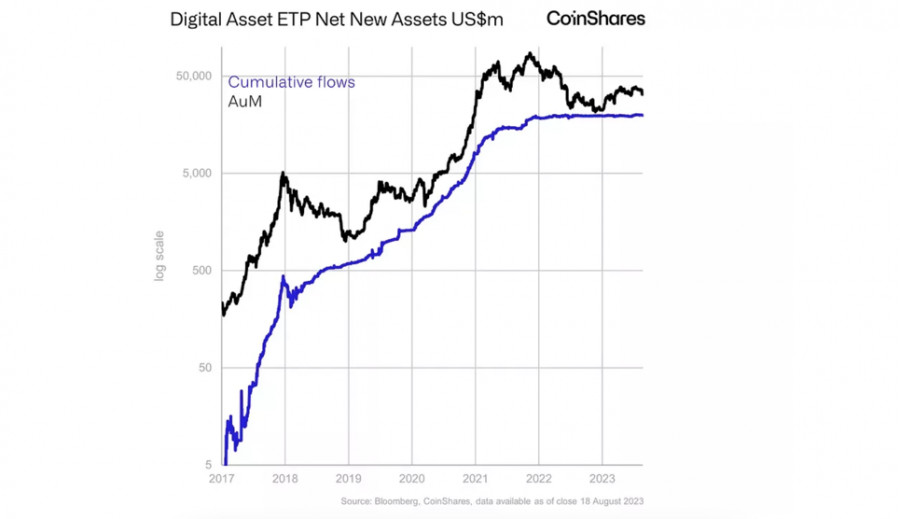

All these events, combined with global economic instability, are leading to a decline in interest in the cryptocurrency market. According to data from the analytics platform Santiment, the market is experiencing peak levels of negative sentiment since February 2023. CoinShares also reports an outflow of funds from crypto funds amounting to $55 million.

Glassnode also notes an increase in sales in the crypto market and believes that this trend will intensify in the coming weeks. Analysts of the portal note that more than 88% of short-term BTC holders are at a loss, and considering the negative sentiments caused by fundamental news, this trend will intensify.

BTC/USD Analysis

As we have already noted, we are expecting a prolonged consolidation of Bitcoin in the region of $26k. The asset has not yet formed an area for fluctuations, but most likely, it will be a wide range of $26k–$27.3k, where capital redistribution will occur. On the daily timeframe, both RSI and stochastic are in the oversold territory, suggesting that there will be an upward corrective movement followed by consolidation in the near term.

As for the potential targets of BTC, the least likely scenario is a resumption of the upward movement to the $28k level. However, with the successful implementation of this scenario, the bullish idea for Bitcoin becomes relevant again. Nevertheless, the most likely move is towards the key support level at $25k and the subsequent decline to the $22.3k–$23.5k area, where the main accumulation phase took place before the bullish move.

ETH/USD Analysis

As of August 22, Ethereum is trading at $1630 with daily trading volumes in the region of $5 billion. Considering the excessive level of Bitcoin's dominance, the main altcoin is moving in unison with BTC. The price has also broken through and consolidated below the upward trendline, transitioning to consolidation.

RSI is also in the overbought zone, so in the near future, we should expect a corrective movement approximately to the $1735 zone. As for the further targets of the bears, it is worth highlighting the key support level at $1500–$1540, as well as deeper targets near the levels of $1250–$1300. When analyzing the potential price maneuvers of ETH, it is important to pay attention to the behavior of BTC, as, at this stage, the entire market is looking at the main cryptocurrency.

Conclusion

The break of the upward trendline and the growing negative sentiment in the cryptocurrency market herald the formation of a new downward trend. In the coming weeks, significant price movements should not be expected. However, as the dates for the publication of inflation data and the Federal Reserve meeting approach, volatility will increase, and it is likely that we will see impulsive price movements in an attempt to form a lower high.