Night of Escalation: Israel and Iran Exchange Heavy Strikes

Tensions between Israel and Iran surged overnight as Israeli forces launched airstrikes targeting Iranian nuclear facilities. In retaliation, Tehran fired a barrage of missiles and drones at Israeli territory. The air conflict has intensified over the past week, with neither side showing signs of backing down or seeking a diplomatic resolution.

America's Dilemma: Trump to Decide on U.S. Involvement Soon

The White House confirmed that President Donald Trump is expected to announce within the next two weeks whether the United States will intervene in the growing Israel-Iran conflict. The possibility of military involvement has sparked backlash among some segments of Trump's MAGA base, complicating the administration's decision-making process.

Markets on Edge: Investors Turn Cautious Amid Uncertainty

In global markets, caution prevailed. Asian futures for the Nasdaq and S&P 500 fell by 0.3 percent. With U.S. markets closed for the holiday, Asian trading lacked a clear direction.

The MSCI Asia-Pacific index, excluding Japan, edged up by 0.1 percent, yet remains on track for a weekly decline of about 1 percent. Japan's Nikkei index slipped by 0.2 percent.

Global Central Banks: Mixed Signals Across Regions

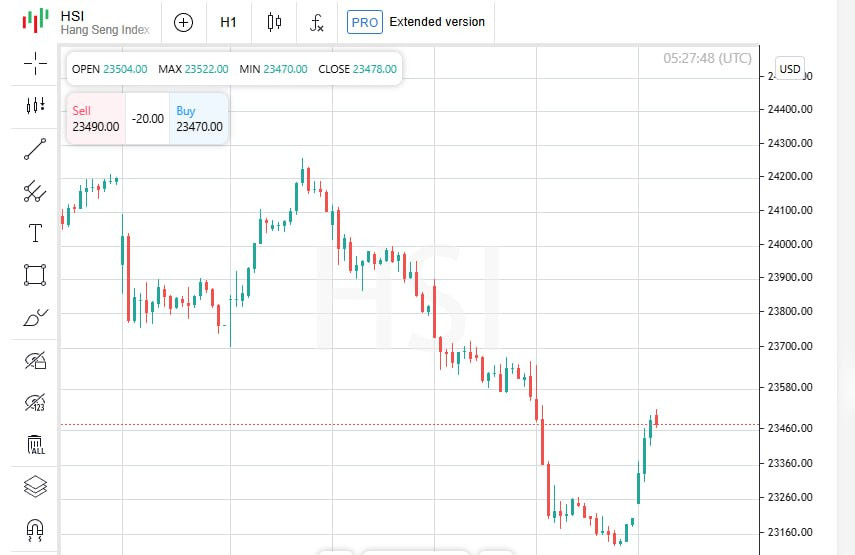

In China, markets responded modestly to the central bank's decision to keep its benchmark lending rates unchanged, as widely expected. The blue-chip index rose 0.3 percent, and Hong Kong's Hang Seng gained 0.5 percent.

Meanwhile, market watchers see limited chances of the Bank of Japan raising interest rates before December. Current projections place the odds slightly above 50 percent.

In a surprise move, Switzerland's central bank cut rates to zero and left the door open for negative rates in the future. The Bank of England held its policy steady but hinted at the need for more easing ahead. Norway's central bank caught markets off guard by cutting interest rates for the first time since 2020.

Gold Slips as Investors Turn Toward the Dollar

Gold prices edged down by 0.2 percent on Thursday, landing at $3363 per ounce. More notably, the precious metal is on track to post a weekly decline of around 2 percent, reflecting shifting investor sentiment amid global tensions.

Markets in Retreat: Global Stocks Fall, Dollar Gains Ground

Fears of U.S. involvement in the intensifying Israel-Iran air conflict sent shockwaves through global markets. Investors rushed toward perceived safe havens, causing the dollar to strengthen and equity markets to retreat.

Europe's STOXX 600 index declined by 0.6 percent, marking its third consecutive day of losses. Weekly performance dropped nearly 2.5 percent — the sharpest fall since April, when tariffs and trade uncertainty rattled investors.

Wall Street on Hold, But Futures Signal Volatility

U.S. markets remained closed on Thursday for a national holiday, but futures painted a worrying picture. S&P 500 futures dropped nearly 1 percent, indicating growing caution among traders despite the holiday pause.

Oil Surges on Supply Fears Amid Middle East Tensions

Crude oil was once again at the center of market concerns. Mounting fears of supply disruptions from the Middle East pushed oil prices sharply higher. Brent crude rose 2 percent on Thursday, reaching $78 per barrel — its highest level since January — capping a week where prices have jumped by about 11 percent.

Currency Moves: Dollar Rallies as Riskier Currencies Fall

On currency markets, the dollar extended its rally. The euro slid 0.2 percent to trade at $1.1462, while the Australian and New Zealand dollars — typically sensitive to risk sentiment — both dropped around 1 percent.

Fed Holds Rates Steady as Trump Voices Frustration

The U.S. Federal Reserve opted to keep interest rates unchanged on Wednesday, a move that drew criticism from Donald Trump. Despite political pressure, central bank officials reaffirmed their forecast of two potential quarter-point rate cuts by the end of the year but chose to pause for now.

Fed Chair Jerome Powell struck a cautious tone, warning that current trade tariffs, largely driven by Trump's administration, could trigger "significant" inflation down the road. His comments signaled that the Fed is hesitant to proceed with aggressive monetary easing in the near term.

Bank of England: Trade Uncertainty Keeps Growth in Check

Across the Atlantic, the Bank of England also maintained its policy stance on Thursday, leaving interest rates unchanged as widely anticipated. Policymakers noted that ongoing trade tensions continue to act as a drag on the British economy. This outlook put further downward pressure on the pound.

Nordic and Swiss Moves: Diverging Market Reactions

In a surprise to investors, Norway's central bank cut its benchmark rate by 25 basis points, triggering a decline in the value of the krone. The move signaled a shift toward a more accommodative stance amid rising global uncertainty.

Meanwhile, the Swiss National Bank followed expectations by lowering its policy rate to zero. While some had speculated a move into negative territory, the SNB's restraint actually strengthened the franc. The U.S. dollar fell 0.1 percent, settling at 0.8184 francs.

Platinum Soars: Shining as a Gold Alternative

On the commodities front, platinum prices surged to their highest level in nearly 11 years, topping 1300 dollars per ounce. Analysts suggest the metal's appeal has grown as consumers seek a more affordable alternative to gold in a volatile precious metals environment.