S&P 500 and Nasdaq Set Fresh Highs as AI Hype Fuels Investor Optimism

Thursday's trading session closed with historic peaks for both the S&P 500 and Nasdaq indices, as standout results from Alphabet sparked renewed excitement for shares in artificial intelligence-driven tech giants. Meanwhile, Tesla shares slid after the electric vehicle maker released figures that failed to reassure investors.

Alphabet Lifts Tech Sentiment, Tesla Stumbles

Alphabet's stock advanced by one percent, buoyed by growing confidence from management that strategic investments in artificial intelligence are beginning to yield tangible returns.

By contrast, Tesla faced market disappointment as lackluster quarterly results dragged its share price down, highlighting ongoing uncertainties for the automaker.

UnitedHealth and IBM Face Pressure

UnitedHealth shares tumbled nearly five percent amid news of its cooperation with the US Department of Justice in an investigation focused on Medicare programs. Reports of fresh criminal and civil proceedings heightened market jitters around the insurer.

IBM saw its stock decline by almost eight percent, as second-quarter numbers fell short of expectations, primarily due to underwhelming performance from the company's core software division.

Honeywell Shares Drop Despite Beating Forecasts

Honeywell surpassed Wall Street's predictions and raised its annual outlook, yet that did not shield its shares from a decline of more than six percent.

Closing Figures: Market in Numbers

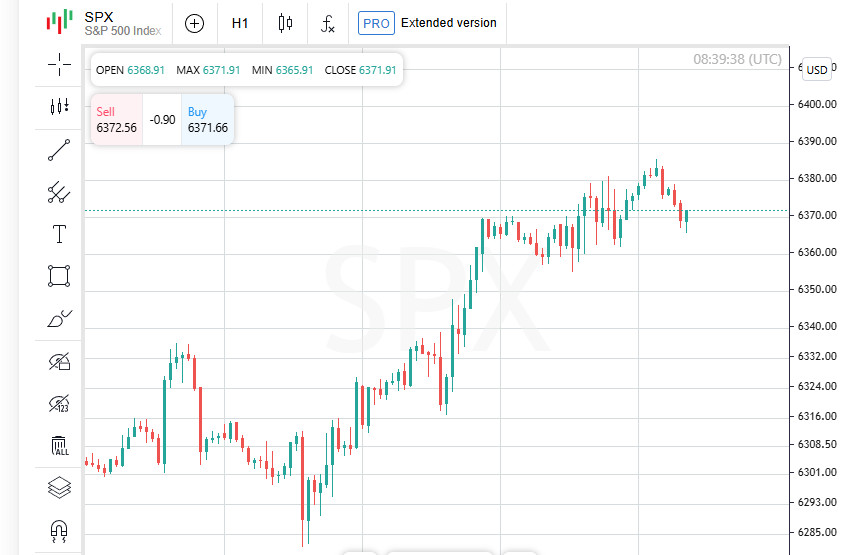

By the end of the session, the S&P 500 edged up by zero point zero seven percent, closing at six thousand three hundred sixty three point thirty five. The Nasdaq advanced by zero point one eight percent to finish at twenty one thousand fifty seven point ninety six. In contrast, the Dow Jones Industrial Average fell by zero point seven percent, settling at forty four thousand six hundred ninety three point ninety one.

American Airlines Shares Dive after Gloomy Forecast

American Airlines stock suffered a steep decline, tumbling nearly ten percent. The sharp drop followed the airline's warning about substantial third-quarter losses, attributing the expected shortfall to faltering demand for US domestic flights.

Trade Conflicts Shake Airline Sector

The aviation industry is now navigating through a storm of uncertainty not seen since the COVID-19 crisis. Global trade disputes initiated by US President Donald Trump have brought new challenges, unsettling the sector's recent stability.

Trump Heads to the Fed as Rate Speculations Swirl

Markets kept a close watch as President Trump prepared for his visit to Federal Reserve headquarters following a series of public criticisms directed at Fed Chair Jerome Powell over what Trump sees as excessively high interest rates.

The consensus among analysts is that the Fed will leave rates unchanged at its upcoming meeting. However, traders, referencing the CME Group's FedWatch tool, see a sixty percent chance that rates could be lowered in September.

US Jobs Market Shows Resilience

Positive economic data emerged from the Labor Department, as the number of new unemployment claims dropped to two hundred seventeen thousand last week, a result far better than forecasts and a sign that the labor market remains robust.

Inflation Signals Rising as Business Activity Picks Up

July saw US business activity accelerate across key industries, but companies responded by raising prices on goods and services. This trend supports economists' predictions of mounting inflation fueled in part by the introduction of higher tariffs on imports.

European Stocks Lose Ground on Trade Uncertainty

Friday brought losses to European equity markets, erasing previous session gains. The automotive sector was particularly affected as investors braced for updates on trade talks between Brussels and Washington before the looming deadline for new US tariffs next week.

STOXX 600 Retreats Following Six-Week High

The pan-European STOXX 600 index fell by zero point six percent to five hundred forty eight point sixteen in early trading on Friday. This decline comes after the index reached its highest point in six weeks the day before. However, the weekly trajectory remains positive.

FTSE 100 Pulls Back from Record Levels

Britain's FTSE 100 slipped by zero point four percent, stepping back from the all-time peak it set on Thursday. Most other regional exchanges mirrored this downward trend, closing the morning with losses.

Automakers Lead Declines Across Sectors

European automotive stocks were at the forefront of the sell-off, with the sector index sliding by one point four percent. The slump was exacerbated by shares of French car parts supplier Valeo, which plunged twelve point four percent after the company cut its annual sales outlook.

Volkswagen and Traton Lower Forecasts

Volkswagen, the continent's largest carmaker, saw its shares drop by two point four percent following a forecast downgrade prompted by tariff concerns. Traton, Volkswagen's commercial vehicle subsidiary, also faced sharp declines—falling eight point one percent—after it, too, reduced its annual projection.

Puma Suffers Sharpest Drop on Earnings Miss

Puma experienced the steepest drop among major stocks, tumbling eighteen point seven percent. The German sportswear manufacturer updated its outlook for the year downward and reported quarterly results that fell short of expectations.

A Negotiation-Filled Week Offers Some Relief

Despite persistent volatility and negative sentiment, investors were heartened by trade agreements reached with Japan, Indonesia, and the Philippines. Meanwhile, hopes remain alive for a deal between the United States and the European Union, as talks continue between the two partners.