Analysis of Wednesday's Trades

1H Chart of EUR/USD

The EUR/USD currency pair experienced upward movement for approximately half of Wednesday. The latest "surge" in the euro was particularly "impressive," although it was likely just another fall in the dollar. The euro and the pound remain mere bystanders in this Trump-led performance—only the dollar changes in price and attractiveness. Yesterday, the market spent half the day selling off the US currency amid slowing US inflation. In essence, the drop in inflation is just a formal pretext to sell the dollar. The Federal Reserve, in any case, expects consumer prices to accelerate. In April, Trump's tariffs didn't have time to affect US prices, as many retailers had prepared in advance by stockpiling goods and choosing not to raise prices immediately. Therefore, inflation will accelerate eventually, and the Fed will not lower the key rate anytime soon. Nonetheless, the market seized the opportunity to get rid of the dollar — and did so wholeheartedly. The downtrend remains intact but is relatively weak. The dollar still finds it extremely difficult to appreciate.

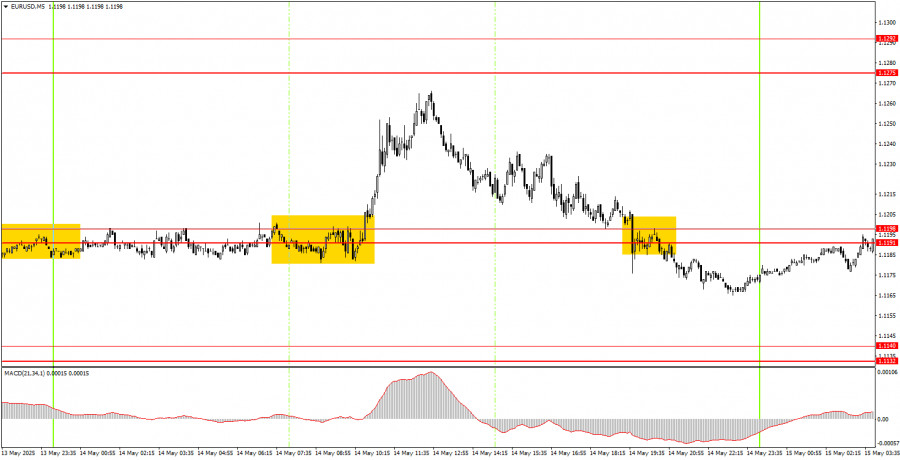

5M Chart of EUR/USD

On the 5-minute time frame Wednesday, two trading signals were formed. First, the pair struggled to break away from the 1.1191–1.1198 area, rising about 50 pips. Unfortunately, the price did not reach the nearest target level of 1.1275, so any profit on the trade could only be secured by closing it manually. The next signal formed around the same area was quite weak. The sell signal came too late, but would not have resulted in a loss.

Trading Strategy for Thursday:

On the hourly time frame, the EUR/USD pair has finally started something resembling a downtrend. Overall, market sentiment remains extremely negative toward the US dollar. However, Trump has taken steps toward de-escalating the trade conflict he initiated himself, which means the dollar could strengthen in the near term. The extent of dollar growth will depend on how many agreements can actually be signed.

On Thursday, the EUR/USD pair will trade based on technical factors, although the macroeconomic background may have a moderate influence throughout the day. Numerous reports will be presented, but none of them are considered critically important.

On the 5-minute time frame, consider the following levels: 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198, 1.1275–1.1292, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. In the Eurozone, GDP and industrial production reports are scheduled for release on Thursday. These are not the critical data points, especially the second estimate of Q1 GDP. Retail sales, the Producer Price Index, and jobless claims will be published in the US. The first two may slightly influence market sentiment.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.