The GBP/USD currency pair closed below the moving average line on Thursday, and the dollar strengthened for three consecutive days. However, everything changed in the second half of the day. As noted earlier, the reasons behind the U.S. dollar's recent growth seem questionable. For instance, on Monday, the dollar strengthened after Trump decided not to raise tariffs on the EU starting June 1. But what did that decision actually change? Tariffs are still in place, the trade war continues, and whether an agreement between the U.S. and the EU will be reached remains a big question.

On Tuesday, the dollar strengthened again after a slightly less disastrous report on durable goods orders in the U.S. than expected. After a "miraculous" March, orders plummeted by 6.3%, though traders expected an even larger drop. Can we really call this an optimistic report to justify further dollar growth?

There was no news or event on Wednesday, yet the dollar kept inching upward. Finally, on Thursday night, news broke that the U.S. Court of International Trade ruled to overturn all tariffs introduced by Donald Trump. However, Trump's team immediately filed an appeal with the U.S. Supreme Court. According to most experts, the appeal is likely to be successful, as the majority of Supreme Court justices are Republicans.

Thus, one could have said that justice had prevailed on Thursday morning — but only temporarily. We have little doubt that the Court of International Trade's decision will be overturned by the Supreme Court. As we have pointed out before, the U.S. legal system has an enormous number of laws, many of which even top lawyers might forget about. Trump has cited laws dating back to the 18th century — laws crafted under highly specific circumstances that are irrelevant today. Yet, a law is a law and can be cited.

Let's also recall how many times Congress attempted to impeach Trump. One might think it would be straightforward — if there are calls for a vote of no confidence just two months after taking office, there must be serious grounds for it. And today, the reasons are clear to everyone around the world. These are not political games or partisan power struggles; they are decisions that could endanger the U.S. economy for years. Yet impeachment failed eight years ago and again in 2025 simply because the majority of senators in the Upper House are Republicans.

Thus, it turns out that Trump is untouchable. Impeachment is impossible. Reversing his controversial decisions is impossible. Forcing Trump to adhere to the letter of the law and push legislation through Congress is also impossible. Trump can declare a new state of emergency every day and rule the country single-handedly. America is transitioning from a democracy to something more resembling an autocracy — or, more accurately, a system where one man makes all the decisions, depending on whether he won his last round of golf.

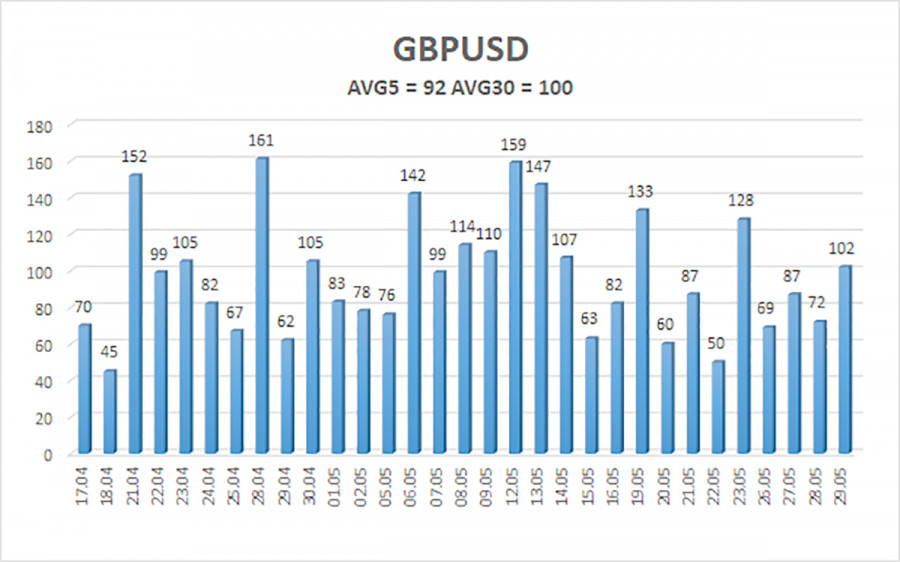

The average volatility of the GBP/USD pair over the past five trading days stands at 92 pips, which is classified as "moderate." On Friday, May 30, we expect the pair to move between 1.3394 and 1.3578. The long-term regression channel remains upward-sloping, indicating a clear uptrend. The CCI indicator has not recently entered extreme zones.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading Recommendations:

The GBP/USD pair maintains its uptrend and continues to rise, ignoring most developments. The de-escalation of the trade conflict stalled before it started, yet market aversion to the dollar persists. Every new decision by Trump or anything associated with him is viewed with hostility by the market. Thus, long positions are possible with targets at 1.3550 and 1.3578 if the price stays above the moving average. A consolidation below the moving average will allow shorts with targets at 1.3394 and 1.3306. Occasionally, the dollar may experience minor corrections. For stronger growth, we need new signs of a real de-escalation in the global trade war.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.