The EUR/USD currency pair traded with a slight decline on Friday, which was driven by decent macroeconomic data from the U.S. However, reports from the Eurozone also turned out quite positive, as GDP in the first quarter unexpectedly grew by 1.5% year-on-year. Nevertheless, it's good that the market at least reacted to the American data. The euro lost some ground due to the market's neglect of the strong economic growth report.

Yet, even the labor market and unemployment data from the U.S. couldn't compete for the title "most interesting news." As we have repeatedly mentioned over the past 3–4 months, the market has been solely focused on the topic of the trade war initiated by Donald Trump. Of course, there are other hot topics like the "Big Beautiful Law" or the "U.S. withdrawal from many international organizations." Still, the trade war holds a special place in the minds and hearts of traders.

As we have repeatedly mentioned, there has been no positive news regarding this issue. About a month ago, the first signs of de-escalation appeared, but they never materialized. Trump resumed his pressure on China, criticism of the Eurozone, and tariff hikes. Trade deals — which the U.S. president talks about roughly 50% of his airtime — are still non-existent.

In a dramatic turn, Trump engaged in a heated argument with Elon Musk, resorting to his typical style filled with insults. But Musk is no pushover. The billionaire, though not holding political power and technically an immigrant, is still a very powerful figure. Once Musk realized Trump merely used him to secure the presidency, he unleashed a torrent of criticism toward the sitting president. When Musk realized his electric cars would no longer be subsidized and that Trump no longer needed him in the White House, he turned against him: suddenly, Trump was implicated in the Jeffrey Epstein case, all his laws became "disgusting," the trade war needed to end, and votes should go to the Democrats.

In short, Musk behaved no better than Trump usually does. He had tried to buy his way into the White House to gain influence and revenue for his companies. When this effort failed, the two most powerful men started an open war against each other. Musk now plans to spend millions to remove Trump from office, while Trump labels Musk "crazy" and refuses any reconciliation. It might seem like this feud is harmless for the U.S. economy, but who knows what damage they might cause during their showdown? Trump has demonstrated his ability to reverse decades of progress in just four months.

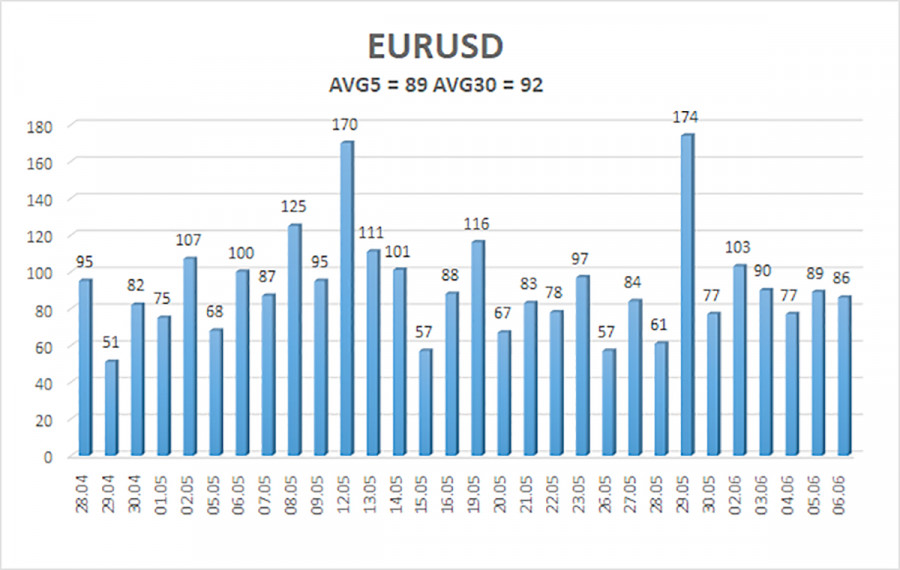

The average volatility of the EUR/USD pair over the last five trading days as of June 9 is 89 pips, which is considered "moderate." We expect the pair to move between 1.1305 and 1.1486 on Monday. The long-term regression channel is directed upwards, still indicating an uptrend. The CCI indicator dipped into the oversold area, and a "bullish" divergence was formed, sparking the resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

Nearest Resistance Levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1.1536

Trading Recommendations:

The EUR/USD pair is attempting to resume the uptrend. In recent months, we have consistently said that we expect only a decline from the euro in the medium term because the dollar still has no fundamental reasons for weakness apart from Trump's policies, which are likely to have devastating and long-term effects on the U.S. economy. Nevertheless, we continue to observe the market's complete reluctance to purchase the dollar, even when valid reasons for doing so exist, and a notable disregard for the few positive factors surrounding the dollar. If the price is below the moving average, short positions with targets at 1.1305 and 1.1292 are relevant, but a substantial decline should not be expected under current circumstances. Above the moving average, long positions can be considered with targets at 1.1475 and 1.1486.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.