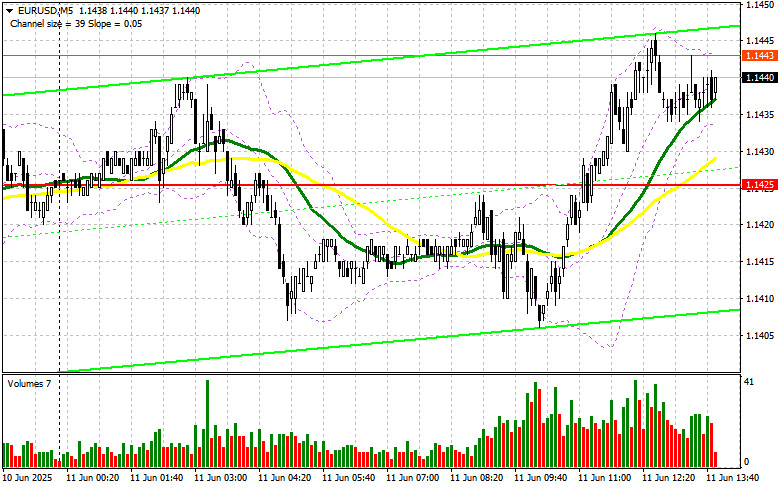

In my morning forecast, I highlighted the 1.1425 level and planned to make entry decisions based on it. Let's look at the 5-minute chart and examine what happened. The price rose above 1.1425, but without a pullback for a retest, so I didn't open any trades in the first half of the day. The technical outlook was revised for the second half.

To Open Long Positions on EUR/USD:

Further strengthening of the euro will directly depend on U.S. inflation data. Today's reports include the Consumer Price Index (CPI) for May and core CPI excluding food and energy. If inflation exceeds economists' forecasts, pressure on the euro will rise significantly, as this would allow the Federal Reserve to maintain high interest rates. Otherwise, the euro may find support, and the dollar would weaken further.

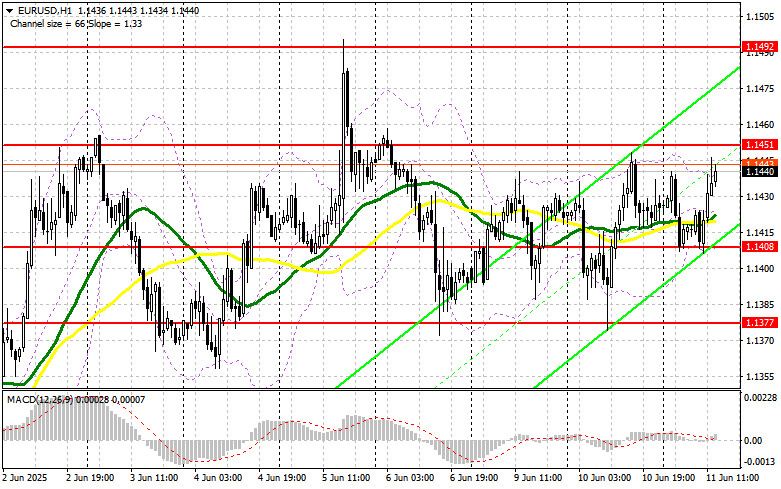

If the pair declines and the market reacts negatively to the data, attention will shift to defending the 1.1408 support level, formed during the first half of the day. A false breakout there would be a signal to buy EUR/USD in anticipation of a rebound toward the 1.1451 resistance. A breakout and retest of that zone would confirm the entry point, targeting the 1.1492 level. The furthest target would be 1.1530, where I plan to take profits.

If EUR/USD drops and there's no activity around 1.1408, pressure on the pair will rise quickly, leading to a deeper decline. Bears could then push the pair down to 1.1377. Only after a false breakout forms there would I consider buying the euro. Alternatively, I plan to open long positions on a direct rebound from 1.1347, targeting a 30–35 point intraday correction.

To Open Short Positions on EUR/USD:

Sellers tried in the first half of the day but failed to gain support from major players. They'll get another chance in the second half if U.S. inflation data shows a sharp increase, which would support the dollar. A false breakout near the 1.1451 resistance would be a signal to sell, targeting 1.1408, where the moving averages — currently favoring bulls — are located.

A breakout and consolidation below 1.1408 would provide a good selling opportunity, aiming for 1.1377. The furthest target would be 1.1347, where I plan to take profit. If EUR/USD rises further in the second half of the day and bears remain inactive near 1.1451, buyers may push the pair higher toward the 1.1492 monthly high. I'll consider selling there only if the breakout attempt fails. Alternatively, I plan to open short positions on a direct rebound from 1.1530, targeting a 30–35 point correction.

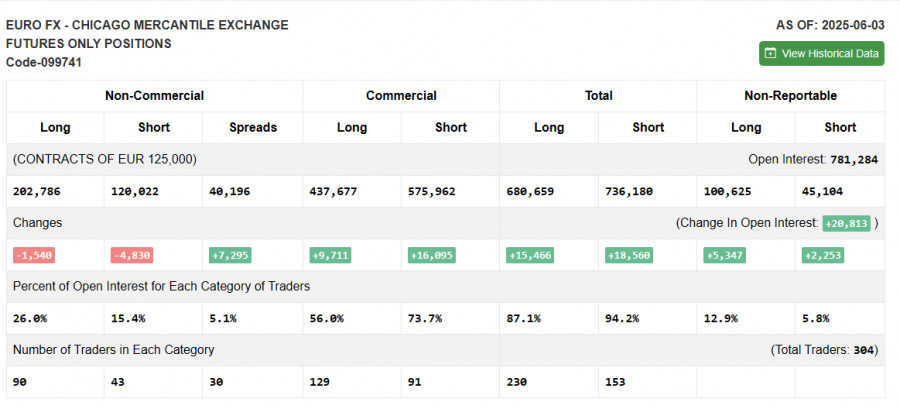

According to the COT (Commitment of Traders) report for June 3, both long and short positions decreased. The ECB's rate cut decision had been widely anticipated and did not significantly affect market sentiment. Expectations that the central bank will now pause its easing cycle have strengthened the euro. A strong Eurozone GDP report also supports continued euro appreciation, explaining why short positions declined more than longs.

The report shows non-commercial long positions fell by 1,540 to 202,786, while short positions dropped by 4,830 to 120,022. As a result, the gap between longs and shorts increased by 7,295.

Indicator Signals:

Moving AveragesTrading is taking place near the 30- and 50-period moving averages, signaling market uncertainty.

Note: The author uses H1 (hourly) chart data, which differs from the classical daily moving averages on D1.

Bollinger BandsIn the event of a decline, the lower boundary of the indicator near 1.1408 will serve as support.

Indicator Descriptions:

- Moving Average (smooths volatility and noise to define the current trend). Period – 50. Marked in yellow on the chart.

- Moving Average (trend identification). Period – 30. Marked in green.

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12, Slow EMA – 26, Signal SMA – 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as retail traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open interest held by non-commercial traders.

- Short non-commercial positions: Total short open interest held by non-commercial traders.

- Net non-commercial position: The difference between long and short positions held by non-commercial traders.