At the end of the last regular session, U.S. stock indices closed higher. The S&P 500 rose by 0.94%, while the Nasdaq 100 gained 1.55%. The Dow Jones Industrial Average increased by 0.74%.

However, during this morning's trading session, U.S. index futures fell, and oil prices rose after President Donald Trump called for the evacuation of Tehran—statements that contrasted with earlier optimism that tensions between Israel and Iran would not escalate into a broader conflict.

The market reacted instantly, displaying volatility that reflects the uncertainty surrounding the geopolitical situation. Investors are actively assessing the potential consequences of military intervention and its impact on global oil supplies. If the evacuation of Tehran is confirmed, it could signal a significant ramp-up in preparations for a potential conflict, increasing the likelihood of disruptions in oil supplies from this key producing region. The situation requires close attention from global leaders and diplomatic institutions to prevent further escalation and stabilize the market. As long as political uncertainty persists, oil prices are likely to remain volatile, reflecting fear and anticipation of further developments in the region. The effects of these events are being felt not only in the energy sector but across the global economy, underscoring the tight link between geopolitics and finance.

S&P 500 futures fell by 0.7% following Trump's social media comments from the G7 leaders' summit in Alberta. It's unclear what he meant exactly, but just hours earlier, Trump had said that Iran wanted to make a deal. European indexes also declined, while Asian shares traded without significant changes.

The U.S. president cut short his G7 visit and stated that his return to Washington had nothing to do with a ceasefire. Gold rose, while the U.S. dollar and Treasury yields remained mostly unchanged.

Shifts in market sentiment triggered by the outbreak of hostilities between Israel and Iran continue, as traders assess the risk of escalation and broader involvement. Investor focus remains primarily on oil prices, as a commodity that had hovered near pandemic-era lows has now become an unexpected source of inflation.

Earlier, Trump claimed that Iran was interested in discussing de-escalation with Israel, even though both sides continue to exchange strikes. When asked whether the U.S. would take a more active military role, the American leader said he didn't want to discuss it.

Brent crude fluctuated between gains and losses after a 2.7% increase. It's worth noting that Middle Eastern producers ship about one-fifth of the world's daily oil supply through the Strait of Hormuz, and prices could spike sharply if Tehran attempts to disrupt shipments along that route.

Regarding trade negotiations, at the G7 summit in Alberta, Canada, Trump and Japanese Prime Minister Shigeru Ishiba failed to reach an agreement on a trade package. However, Trump did reach a deal with the U.K. Prime Minister Keir Starmer on implementing trade terms unveiled last month, which would lower U.S. tariffs on key British exports and increase the U.K.'s quotas for certain American agricultural products.

In other news, the Bank of Japan left its benchmark interest rate unchanged, as expected by economists, and decided to slow the pace of bond purchases next year as a cautionary move following increased market volatility. The yen showed little reaction.

In the coming days, Wall Street will focus on the Federal Reserve's policy decision on Wednesday, with officials expected to signal a continuation of the rate-holding stance. Investors are looking to Chair Jerome Powell for clues on what might ultimately prompt the central bank to act—and when.

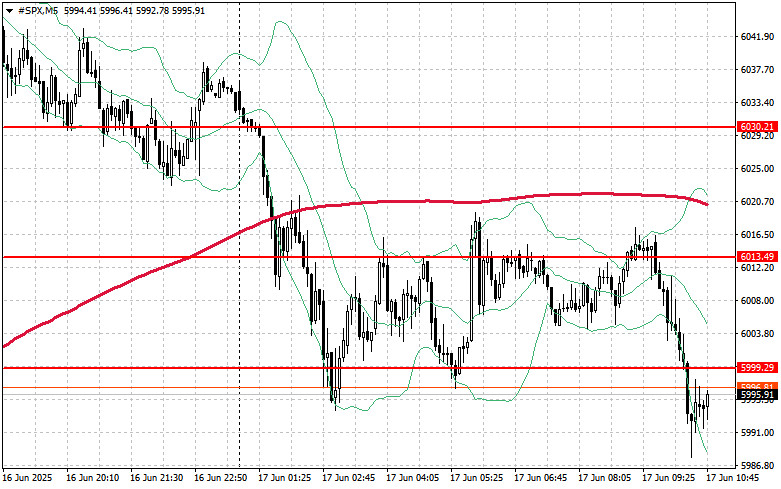

S&P 500 Technical Outlook

The primary target for buyers today will be to break through the nearest resistance at $6013. Achieving this would open the door for a move to the next level at $6030. An equally important objective for the bulls is to maintain control above $6047, which would further strengthen buyer positions. In the event of a downward move amid declining risk appetite, buyers must assert themselves around $5999. A break below this level would quickly push the instrument back to $5986 and potentially open the path toward $5975.