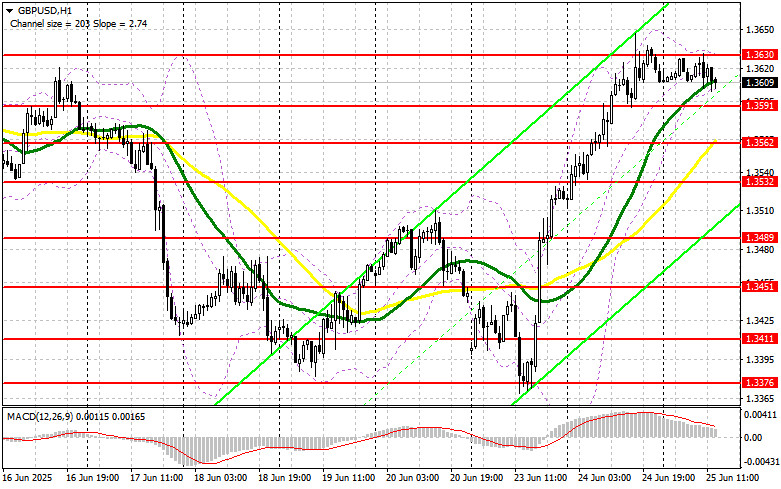

In my morning forecast, I highlighted the 1.3591 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and see what happened. The pair did decline, but never reached the test area, so no trades were executed. The technical outlook for the second half of the day remains unchanged.

To open long positions on GBP/USD:

The impassioned speech by Bank of England Deputy Governor for Monetary Policy Clare Lombardelli was completely ignored, keeping GBP/USD in balance. A similar reaction is expected to today's speech by Federal Reserve Chair Jerome Powell, who will speak in the Senate and repeat what he said yesterday to the House Financial Services Committee. Traders are unlikely to react. U.S. new home sales data might stir the market slightly, though this is also unlikely.

If GBP/USD declines, I would prefer to act near the new support at 1.3591. A false breakout there would offer a good entry point into long positions targeting a return to resistance at 1.3630. A breakout followed by a retest from top to bottom of this range will provide a new entry point for long positions, aiming to update 1.3671. The ultimate target would be the 1.3710 level, where I plan to take profit.

If GBP/USD drops and there is no bullish activity around 1.3591 in the second half of the day, pressure on the pound could intensify significantly. In that case, only a false breakout around 1.3562 would offer a suitable condition to open long positions. I plan to buy GBP/USD on a rebound from 1.3532 with an intraday correction target of 30–35 points.

To open short positions on GBP/USD:

Sellers have yet to make a meaningful move, so be cautious with short positions. If GBP/USD continues rising after weak U.S. data, only a false breakout around 1.3630 would provide a sell signal, aiming for a decline toward the 1.3591 support, where the moving averages currently favor the bulls. A breakout and retest from the bottom up of this range would trigger stop-losses and open the way to 1.3562. The final target will be the 1.3532 level, where I'll take profit.

If demand for the pound persists into the second half of the day and bears remain inactive near 1.3630, GBP/USD could stage a larger rally. In that case, it's better to wait until resistance at 1.3671 is tested. I would only open short positions there after a failed consolidation. If no downward movement occurs there either, I will look for short positions on a rebound from 1.3710, aiming for a 30–35 point intraday correction.

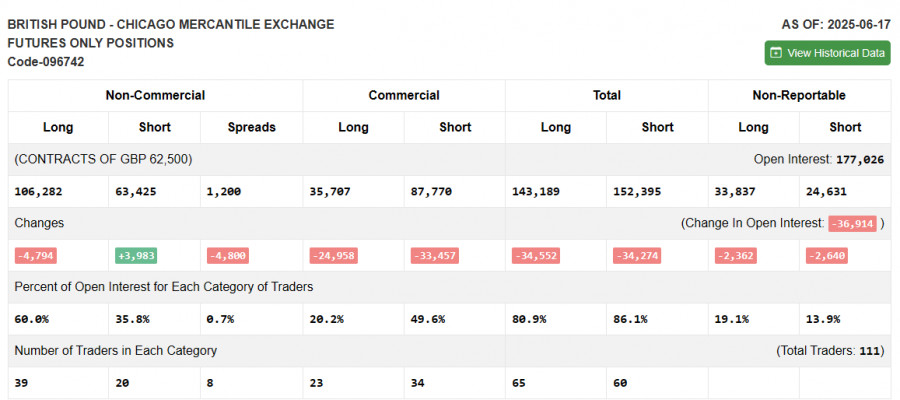

COT Report (Commitments of Traders) – June 17:

The June 17 COT report showed an increase in short positions and a decrease in long positions. The Fed's decision to maintain interest rates positively impacted the U.S. dollar, though the primary factor behind its strength remained tensions in the Middle East.

U.S. GDP growth data will soon be published, which could influence the Fed's next moves. A decisive factor in the dollar's future dynamics will be Jerome Powell's interpretation of inflation conditions and his outlook for possible rate cuts in the fall.

According to the latest COT report, long non-commercial positions decreased by 4,794 to 106,282, while short non-commercial positions rose by 3,983 to 63,425. As a result, the gap between long and short positions narrowed by 4,800.

Indicator Signals:

Moving AveragesTrading is taking place above the 30- and 50-day moving averages, indicating the pair's continued upward momentum.

Note: The periods and prices of the moving averages are based on the H1 (hourly) chart and differ from the standard definitions used on the D1 (daily) chart.

Bollinger BandsIn the event of a decline, the lower band near 1.3590 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing out volatility and market noise.

- Period 50 – marked in yellow on the chart

- Period 30 – marked in green

- MACD (Moving Average Convergence/Divergence):

- Fast EMA: period 12

- Slow EMA: period 26

- Signal SMA: period 9

- Bollinger Bands:

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions held by non-commercial traders.