GBP/USD 5-Minute Analysis

The GBP/USD currency pair remained immobile for most of Thursday. Let's recall that the pair reached its three-year high this week, and even after this significant event, no correction began. The market still sees no reason for medium-term purchases of the U.S. dollar. From time to time, the dollar does correct, but these corrections only allow traders to buy at better prices. There was no macroeconomic backdrop on Wednesday from the UK or the U.S. The only fundamental event was Jerome Powell's second speech in the U.S. Congress, which brought nothing new to traders like the first.

We also expect continued growth for the British pound. In the near future, no events could halt the dollar's decline. Moreover, Donald Trump continues to get involved in various controversies and frequently misleads the market. For example, Trump announced a ceasefire between Israel and Iran, but just hours later, Tehran launched a new missile attack. Trump declared the total destruction of Iran's nuclear facilities, but the very next day, the media revealed that the sites were not seriously damaged and all enriched uranium stockpiles remained intact. Trump "resolved" the Middle East conflict, but nothing prevents it from reigniting at any moment. The main thing is that Trump managed to secure a Nobel Peace Prize for ending the conflict.

In the hourly timeframe, the pound has a key level of 1.3615, which must be breached to continue confidently moving north. Like with the euro, we believe that renewed growth is only a matter of time.

No trading signal was generated on the 5-minute chart during the day. Daily volatility was minimal, and the market completely ignored the 1.3615 level, which it had previously bounced from with precision.

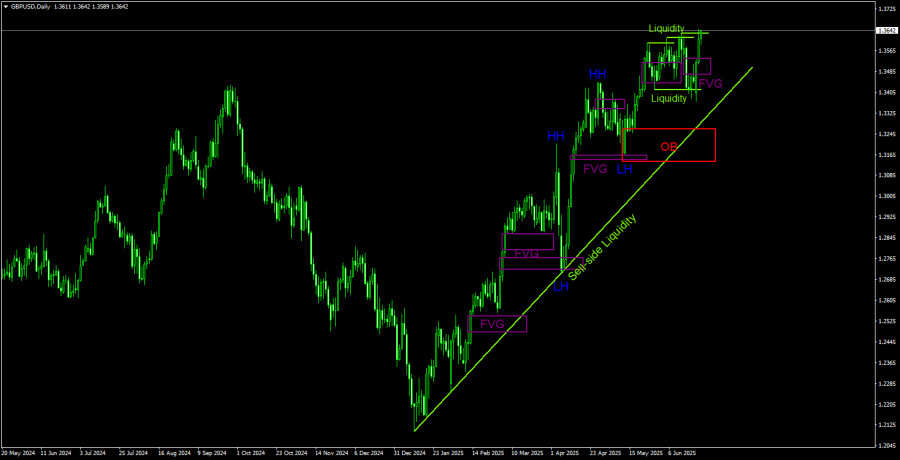

GBP/USD 1D Analysis – ICT

On the daily timeframe under the ICT system, we observe a strong uptrend that shows no signs of ending. The recent drop in the pair should not mislead traders—it was a typical liquidity grab before a new upward movement. This is now as clear as day. Thus, the pound may continue to rise unless disrupted by a triple liquidity sweep on the sell side. The bearish FVG was ignored on Tuesday and may now act as support for the bulls, turning into an IFVG. Therefore, returning to this area and a subsequent bounce could signal the next leg of upward movement.

COT Report

COT reports for the British pound show that commercial traders' sentiment has fluctuated frequently in recent years. The red and blue lines, representing net positions of commercial and non-commercial traders, often intersect and usually hover near zero. They also remain close now, indicating an approximately equal number of long and short positions. However, over the past 18 months, the net position has been trending upward.

The dollar continues to weaken due to Donald Trump's policies, so the current interest of market makers in the pound isn't particularly relevant. If the global trade war begins to de-escalate, the U.S. dollar may have a chance to strengthen. According to the latest report on the British pound, the "Non-commercial" group opened 7,400 new long contracts and closed 9,000, resulting in a weekly net increase of 16,400 contracts—a notable shift.

The pound has risen sharply lately, but it's important to remember that the primary reason is Trump's policy agenda. Once that factor is neutralized, the dollar could start to gain again—but no one knows when that will happen. The dollar is still in the early stages of Trump's presidency. What further shocks await over the next four years?

GBP/USD 1-Hour Analysis

The GBP/USD pair has broken the trendline on the hourly chart and will likely breach the 1.3615 level. For a few days, the market remained stagnant, waiting for negative or sensational news from the U.S. However, when none materialized, traders resumed buying the pound and selling the dollar. This demonstrates that news is not always necessary for the dollar to continue its decline.

For June 26, the key trading levels are 1.3125, 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537, 1.3615, 1.3741. The Senkou Span B line (1.3506) and Kijun-sen line (1.3512) may also serve as sources of signals. The recommended Stop Loss level should be moved to breakeven once the price moves 20 pips in the desired direction. Ichimoku indicator lines can shift during the day and should be accounted for when identifying signals.

On Thursday, Bank of England Governor Andrew Bailey will deliver his second speech of the week in the UK, and in the U.S., final Q1 GDP and durable goods orders will be released. We believe these events will not significantly impact traders.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.