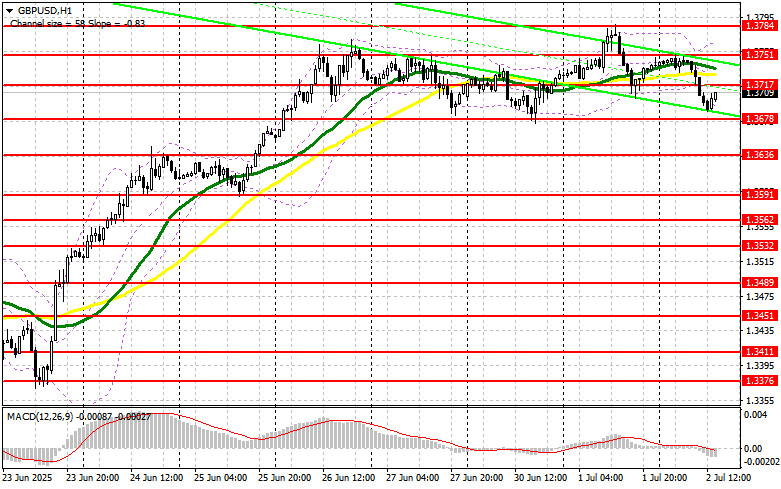

In my morning forecast, I focused on the 1.3713 level and planned to make trading decisions from there. Let's look at the 5-minute chart and examine what happened. Although the 1.3713 level was broken, I didn't see a confirming retest to initiate short positions, so I stayed out of the market in the first half of the day. The technical outlook has been revised for the second half.

To open long positions on GBP/USD:

The absence of UK macro data worked in favor of pound sellers, whose activity has persisted since yesterday's speech by Bank of England Governor Andrew Bailey. Strong U.S. ADP employment data during the American session could push GBP/USD even lower. In this case, I plan to buy only around the major support level of 1.3678. A false breakout there will provide a good entry point for long positions, aiming for a rebound toward the 1.3717 resistance, which was formed in the first half of the day. A breakout and retest from above will confirm a long entry point with the prospect of retesting 1.3751. The ultimate target will be 1.3784, where I plan to take profit.If GBP/USD drops and there is no bullish activity around 1.3678, the pressure on the pound may increase significantly. In that case, only a false breakout around 1.3636 will be a valid condition for opening long positions. I also plan to buy GBP/USD immediately on a rebound from 1.3591, targeting an intraday correction of 30–35 points.

To open short positions on GBP/USD:

Sellers remain active, and a key objective now is to defend the 1.3717 resistance level, which will likely be tested following the ADP report. Only a false breakout at this level will give a signal to open short positions, aiming for a decline toward 1.3678. A breakout and upward retest of this range will likely trigger stop-loss orders and push the pair toward 1.3636. The furthest target is 1.3591, where I plan to take profit. If demand for the pound returns in the second half of the day and bears do not act around 1.3717 — where the moving averages are slightly above — a stronger upward move in GBP/USD cannot be ruled out. In that case, it's better to wait until the 1.3751 resistance is tested before considering short positions. I'll sell there only after a failed consolidation. If there's no downward movement there either, I'll look for short entries near 1.3784, but only for an intraday correction of 30–35 points.

Commitment of Traders (COT) Report (as of June 24):

The latest COT report showed an increase in short positions and a decrease in long positions. The British pound continues to show strong upward momentum, supported by recent UK GDP and inflation data. At the same time, expectations that the Federal Reserve may cut interest rates earlier than previously forecast continue to weigh on the U.S. dollar. A series of U.S. labor market reports is expected soon, which will determine the further direction of the GBP/USD pair.According to the latest COT report, non-commercial long positions fell by 6,434 to 99,848, while short positions rose by 2,028 to 65,453. As a result, the net long position decreased by 222.

Indicator Signals:

Moving AveragesTrading is occurring below the 30- and 50-day moving averages, indicating potential downward pressure on the pair.Note: The moving average periods and prices are based on the author's analysis on the H1 chart and may differ from standard daily averages on the D1 chart.

Bollinger BandsIf the pair declines, the lower boundary of the indicator around 1.3685 will serve as support.

Indicator Descriptions:

- Moving Average: Identifies the current trend by smoothing out volatility and noise. Period – 50 (yellow on the chart); Period – 30 (green on the chart).

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12; Slow EMA – 26; Signal line (SMA) – 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific criteria.

- Non-commercial long positions: Total long open interest held by non-commercial traders.

- Non-commercial short positions: Total short open interest held by non-commercial traders.

- Net non-commercial position: The difference between non-commercial long and short positions.