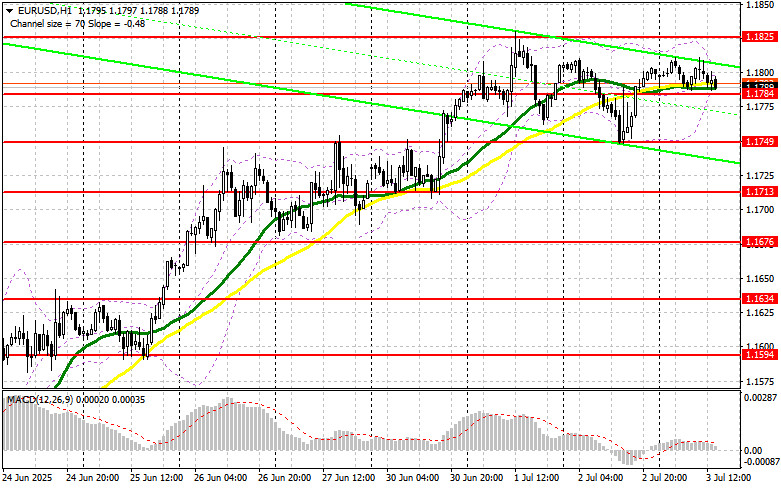

In my morning forecast, I highlighted the 1.1784 level as the key reference point for market entry. Let's take a look at the 5-minute chart and analyze what happened there. The price did decline toward the 1.1784 level, but never reached the level itself—so no trades were executed. The technical outlook for the second half of the day remains unchanged.

To open long positions on EUR/USD:

The euro showed no reaction to the positive PMI data for the eurozone services sector. This indicates that traders are focused on the upcoming U.S. labor market data, expected later today. Given yesterday's weak ADP report, the change in U.S. non-farm employment for June will play a crucial role. A rise in the U.S. unemployment rate would likely lead to a sharp dollar sell-off and support for risk assets.

In the event of strong data and a decline in the pair, buyers will once again focus on the 1.1784 support level, which was not tested earlier in the day. A false breakout at this level would be a signal to buy EUR/USD in anticipation of a return to bullish momentum and a retest of the monthly high at 1.1825. A breakout and retest of this range from above would confirm a valid entry point, with the next target at 1.1866. The final target will be the 1.1903 level, where I will take profits.

If EUR/USD declines and shows no activity around 1.1784, pressure on the pair will increase, potentially leading to a deeper drop to 1.1749. I will only consider long positions after a false breakout forms at that level. Alternatively, I plan to open long positions on a bounce from 1.1713, targeting a 30–35 point intraday correction.

To open short positions on EUR/USD:

Sellers are currently in wait-and-see mode, which is understandable given the uncertainty surrounding the U.S. labor market. If the U.S. data disappoints—as it did yesterday—the euro could resume its rally, so it's wise not to rush into selling. I'll act only after a false breakout at the 1.1825 monthly high. This would be a signal to open short positions, aiming for a decline to the 1.1749 support. A breakout and consolidation below this range would be a favorable scenario for selling, with a move toward 1.1713. The final target will be the 1.1676 area, where I plan to take profit.

If EUR/USD rises further in the second half of the day and bears remain inactive around 1.1825, buyers could push for continued bullish momentum and a breakout of 1.1866. I will only consider selling after a failed consolidation at that level. Alternatively, I plan to open short positions on a bounce from 1.1903, targeting a 30–35 point downward correction.

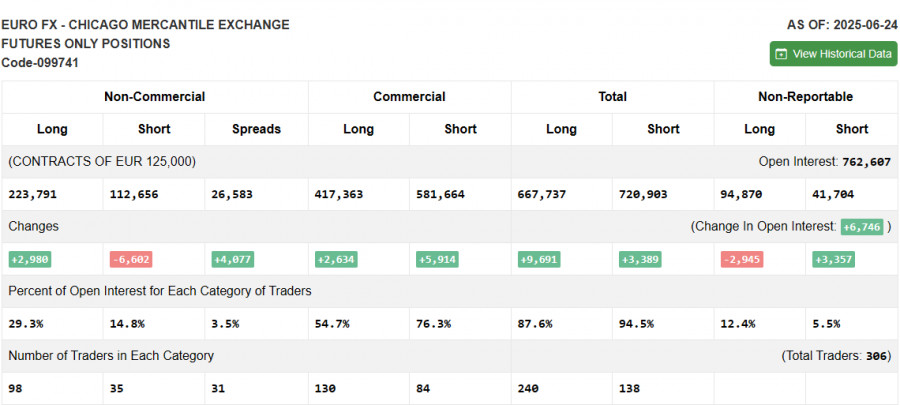

Commitment of Traders (COT) Report (June 24):

The latest COT report showed an increase in long positions and a reduction in short positions. The euro continues to attract demand, while the U.S. dollar loses ground. Recent U.S. inflation and GDP data led market participants to revise their expectations toward earlier rate cuts by the Federal Reserve, putting downward pressure on the dollar.

According to the COT report, long non-commercial positions rose by 2,980 to 223,791, while short non-commercial positions declined by 6,602 to 119,258. As a result, the gap between long and short positions widened by 4,077.

Indicator Signals:

Moving AveragesTrading is taking place around the 30- and 50-period moving averages, indicating challenges for the euro's upward momentum.Note: The author uses the H1 chart for moving averages, which may differ from the classic daily (D1) chart definitions.

Bollinger BandsIn case of a decline, the lower band around 1.1784 will act as support.

Indicator Descriptions:

- Moving Average (MA): Smooths out volatility and noise to indicate the current trend.

- 50-period (yellow on the chart)

- 30-period (green on the chart)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA: 12-period

- Slow EMA: 26-period

- Signal line (SMA): 9-period

- Bollinger Bands:

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open interest held by non-commercial traders.

- Short non-commercial positions: Total short open interest held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.