The GBP/USD currency pair remained nearly flat throughout Friday, as the U.S. trading session was essentially inactive on that day. There were no macroeconomic publications, and the market chose to postpone its response to the fundamental backdrop. However, the coming week is likely to bring plenty of developments, particularly regarding Trump's tariffs or his confrontation with Musk. We maintain our view that such large-scale events are shaping the broader fundamental landscape, which continues to exert steady pressure on the U.S. dollar. In other words, this backdrop has created a persistent market bias toward selling the dollar—not just in reaction to negative news, but as a prevailing trend. As a result, the market often follows a pattern of sideways movement followed by a decline in the dollar, without the need for specific news to prompt the next drop.

Last week, the dollar once again had a chance to strengthen, but it rose only for a single day—and not even in response to any major event. On Wednesday, during Keir Starmer's address in the UK Parliament, Chancellor of the Exchequer Rachel Reeves broke down in tears following harsh criticism of the new government. This incident immediately sparked a wave of speculation. We believe such a development was not a sufficient reason for a 200-point drop in the pound. Rather, it seems the market used the event as an opportunity to take partial profits on long positions and begin forming new GBP/USD longs.

Meanwhile, the U.S. macroeconomic data—unlike the UK political drama—clearly pointed to dollar buying. All key reports exceeded forecasts, and more importantly, both unemployment and NonFarm Payrolls figures have been consistently outperforming expectations for three consecutive months. This suggests that the U.S. labor market remains strong. However, this is only a surface-level conclusion.

A strong labor market allows the Fed to maintain the key interest rate at its current level of 4.5%. The market could thus postpone expectations of a rate cut for another six months. Jerome Powell has repeatedly emphasized that only labor market weakness would justify monetary policy easing. Otherwise, the Federal Reserve will wait to see the full effects of new import tariffs on the U.S. economy. Therefore, no rate cuts should be expected at the next two or three Fed meetings—despite markets having anticipated them since fall 2022.

Nonetheless, the Fed's "hawkish" stance continues to have little effect on the dollar. In 2025, the dollar will be consistently declining, even though the Fed has not cut rates once. When monetary easing eventually resumes, it will likely become yet another reason for markets to sell the dollar—though they are already doing so without that catalyst.

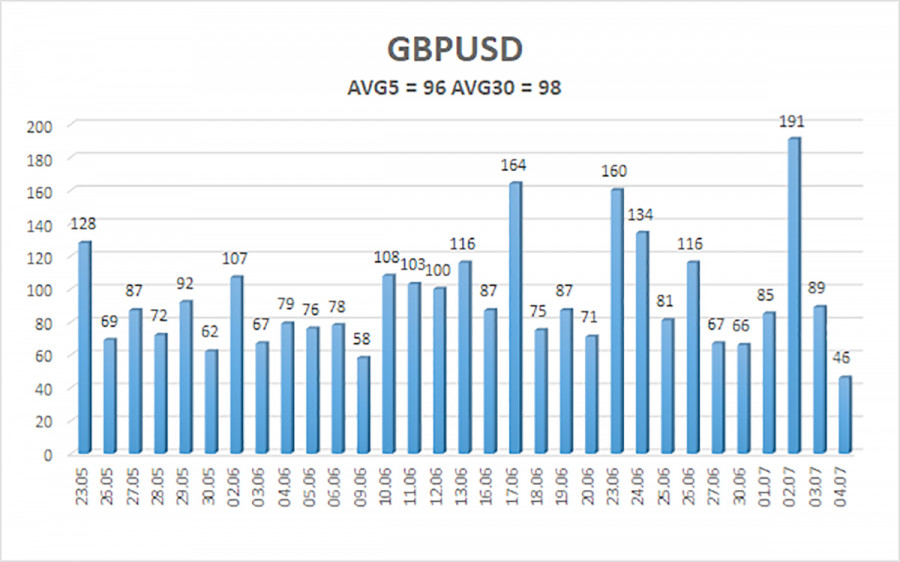

GBP/USD Volatility and Key Levels

The average volatility for GBP/USD over the last five trading days stands at 96 points, which is considered "moderate" for this pair. On Monday, July 7, we expect the pair to move within the range of 1.3552 to 1.3744. The senior linear regression channel continues to point upward, indicating a sustained uptrend. The CCI indicator has once again entered oversold territory, which suggests a potential resumption of the bullish trend.

Nearest Support Levels:

- S1 – 1.3611

- S2 – 1.3550

- S3 – 1.3489

Nearest Resistance Levels:

- R1 – 1.3672

- R2 – 1.3733

- R3 – 1.3794

Trading Recommendations:

The GBP/USD pair remains in a weak downward correction that could end soon. In the medium term, Donald Trump's policies will likely continue to weigh on the dollar. As a result, long positions targeting 1.3733 and 1.3744 remain valid while the price stays above the moving average. If the price falls below the moving average, short positions with targets at 1.3611 and 1.3552 can be considered—but we still do not anticipate strong dollar gains. The U.S. currency may show occasional corrections, but any sustained upward move would require clear signs that the global trade war is over.

Explanations to the illustrations:

- Linear Regression Channels – Help identify the current trend. If both channels point in the same direction, the trend is strong.

- Moving Average Line (20,0, smoothed) – Indicates the short-term trend and the direction in which to trade.

- Murray Levels – Target zones for price movements and corrections.

- Volatility Levels (red lines) – Expected price range for the day based on current volatility.

- CCI Indicator – Readings below -250 (oversold) or above +250 (overbought) signal a possible trend reversal.