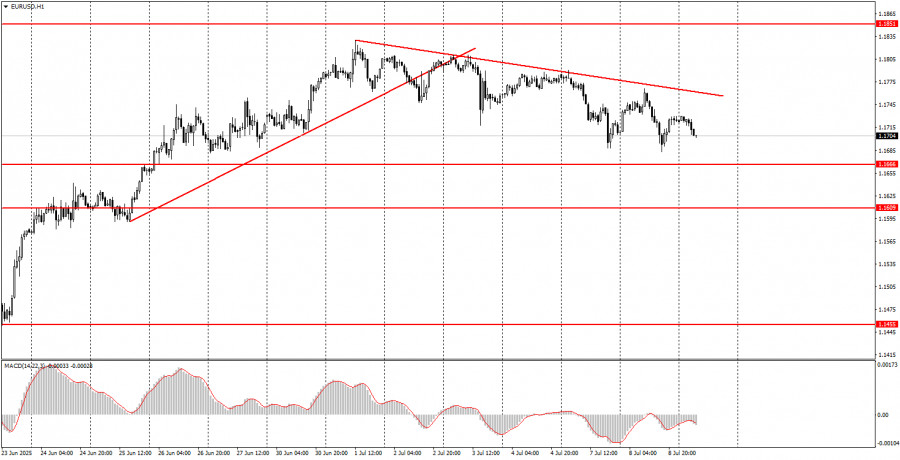

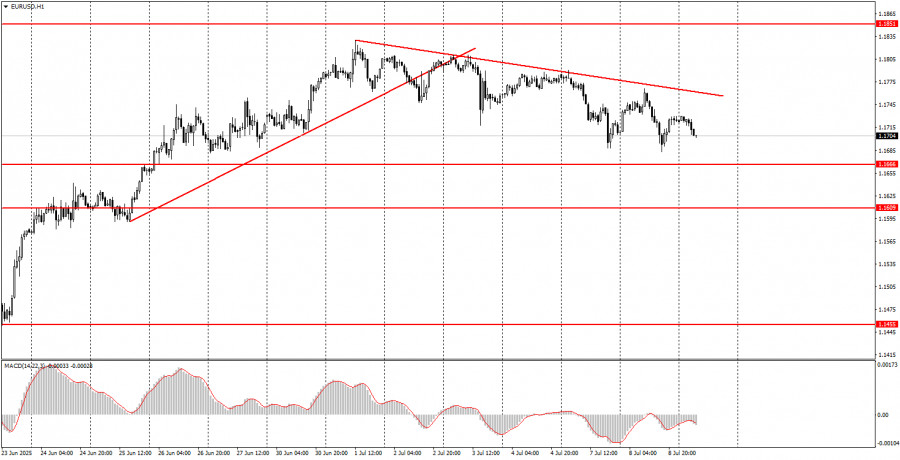

Tuesday Trade Breakdown: 1H Chart for EUR/USD

On Tuesday, the EUR/USD currency pair continued its mild downward movement in line with the prevailing trend. After a fairly strong upward move, the market began a correction. The nature of the current decline fully aligns with the characteristics of a technical correction. Under these conditions, we expect a moderate technical strengthening of the U.S. dollar, after which the upward trend is likely to resume. At the moment, a downward trendline has formed, which can help beginner traders identify the end of the downward correction. It's also worth noting that last week the dollar had valid reasons to rise, but the market ignored them. This week, by contrast, there are several factors weighing on the dollar, yet it is rising—leading us to conclude that the current movement is technical in nature. Recall that this week Donald Trump already raised tariffs for a number of countries, while there has been virtually no macroeconomic backdrop in the first three trading days of the week.

5M Chart for EUR/USD

On the 5-minute timeframe, two trade signals were generated on Tuesday. The pair first broke above the 1.1740–1.1745 level, but this buy signal turned out to be false. Unfortunately, the price failed to move even 15 points in the expected direction. The following sell signal, however, was valid, and the price declined by nearly 50 points after it was formed. Beginners could have easily captured 20–30 points from this trade. The position could have been closed at any point.

Trading on Wednesday:

On the hourly timeframe, the EUR/USD pair began a correction, but the five-month uptrend remains intact. The fact that Donald Trump is President of the United States is still a sufficient reason for the dollar to weaken regularly. Of course, the dollar will go through occasional corrections—as we are seeing now—but given the current fundamental backdrop, there is still little reason to expect strong gains from the U.S. currency. This week, the price may decline sluggishly, but breaking above the downward trendline would signal a new upward movement.

On Wednesday, the EUR/USD pair may continue its slow and gradual decline. No major events are scheduled for the third trading day of the week, so the technical correction may continue.

On the 5-minute chart, the relevant levels to watch are: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1561–1.1571, 1.1609, 1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908.

No macroeconomic publications or speeches are scheduled in the EU or the U.S. for Wednesday. Donald Trump has announced new tariffs for several countries on his list, but the market has not yet reacted to this escalation of the trade war.

Basic Trading System Rules:

- Signal strength is based on how long it takes for the signal to form (bounce or breakout from a level). The quicker it forms, the stronger the signal.

- If two or more false signals occur around the same level, all subsequent signals from that level should be ignored.

- During flat (sideways) markets, a pair may generate many false signals or none at all. It is best to stop trading at the first signs of a range-bound market.

- Trades should be opened during the time window from the start of the European session until the middle of the U.S. session. All trades should be manually closed after that.

- On the hourly timeframe, MACD indicator signals should be traded only if there is strong volatility and a trend confirmed by a trendline or trend channel.

- If two levels are too close together (5 to 20 points), treat them as a support or resistance zone.

- After a trade moves 15 points in the correct direction, move the Stop Loss to breakeven.

Chart Notes:

- Support and Resistance Levels – These are price targets for buying or selling. Take Profit levels can be placed near them.

- Red Lines – Trend channels or trendlines indicating the current market direction and preferred trading bias.

- MACD Indicator (14, 22, 3) – Histogram and signal line used as an additional source of trade signals.

- Major Speeches and Reports (always listed in the news calendar) can strongly affect the pair's movement. Trade with caution or exit the market during these events to avoid sharp reversals against the previous trend.

A reminder for beginner traders: not every trade will be profitable. Developing a clear strategy and practicing proper money management are key to long-term success in forex trading.