Trade Review and GBP/USD Strategy

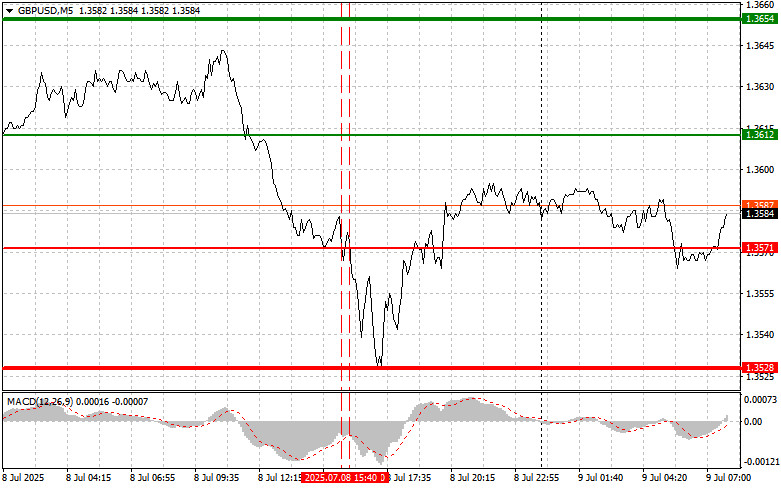

The test of the 1.3571 level occurred when the MACD indicator had already moved significantly below the zero line, limiting the pair's downward potential. A second test of 1.3571 shortly afterward took place while MACD was in the oversold zone, confirming Buy Scenario #2. However, the pair failed to rise, resulting in a loss.

The U.S. dollar has started to regain strength. Yesterday, the U.S. president announced a 50% tariff on all copper products and signaled his readiness to introduce substantial import tariffs on pharmaceuticals—something many U.S. trade partners fear. These statements prompted an immediate reaction in global markets. Metal and pharmaceutical companies with exports to the U.S. came under pressure. GBP/USD also declined, not due to pound weakness, but because of increased demand for the U.S. dollar.

Today, the Bank of England's Financial Stability Report is expected in the first half of the day, along with the Financial Policy Committee's summary and meeting minutes. These events could support the pound, though any strengthening is likely to be short-lived. The market has already priced in the Bank of England's current stance, and a significant shift in sentiment would require an unexpectedly hawkish tone. However, given concerns about the UK's economic growth outlook, such a scenario seems unlikely. Investors will closely study the Financial Stability Report to assess risks linked to potential U.S. trade tariffs and their impact on inflation.

As for intraday strategy, I will focus primarily on executing Buy and Sell Scenarios #1 and #2.

Buy Scenarios

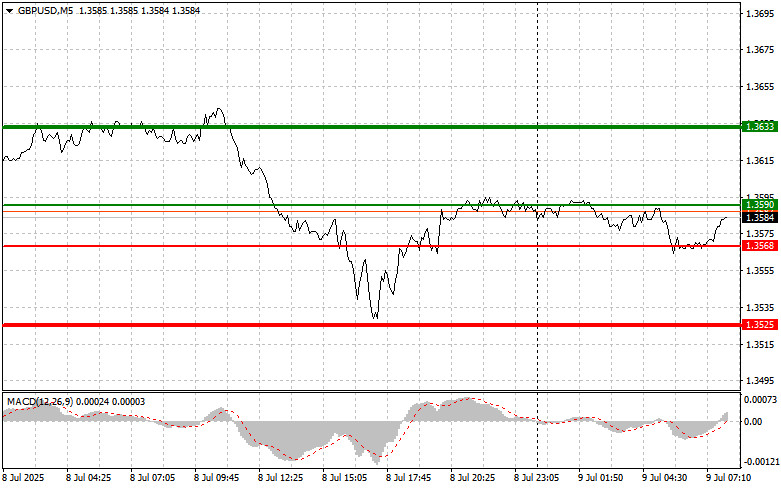

Scenario #1: I plan to buy the pound today if the price reaches the 1.3590 level (green line on the chart), aiming for a rise to 1.3633 (thicker green line). Around 1.3633, I will exit long positions and open a short position in the opposite direction (targeting a move of 30–35 points from the level). Any upward move today should be viewed as a corrective bounce.Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if the price tests 1.3568 twice in a row while MACD is in the oversold zone. This would signal a limited downside and a likely reversal to the upside. The targets in this case are 1.3590 and 1.3633.

Sell Scenarios

Scenario #1: I plan to sell the pound after the price breaks below 1.3568 (red line on the chart), which would likely trigger a sharp decline. The primary target is 1.3525, where I plan to exit short positions and open a long position in the opposite direction (expecting a 20–25 point retracement). Selling the pound during a rally remains in line with the prevailing bearish trend.Important: Before selling, ensure that MACD is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the pound if the price tests 1.3590 twice in a row while MACD is in the overbought zone. This would limit the pair's upward potential and trigger a market reversal to the downside. Targets in this case are 1.3568 and 1.3525.

What's on the chart:

- Thin green line – entry price for buying the instrument.

- Thick green line – estimated price where Take Profit orders can be placed or profits manually fixed, as further growth above this level is unlikely.

- Thin red line – entry price for selling the instrument.

- Thick red line – estimated price where Take Profit orders can be placed or profits manually fixed, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones.

Important:Beginner forex traders should make trade entry decisions with great caution. It is best to avoid the market before key fundamental reports are released to prevent getting caught in sharp price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without them, especially if trading large volumes without proper money management, you risk losing your entire deposit quickly.

And remember: successful trading requires a clear plan—like the one outlined above. Making spontaneous decisions based on current market conditions is inherently a losing strategy for intraday traders.