Trade Review and GBP/USD Strategy

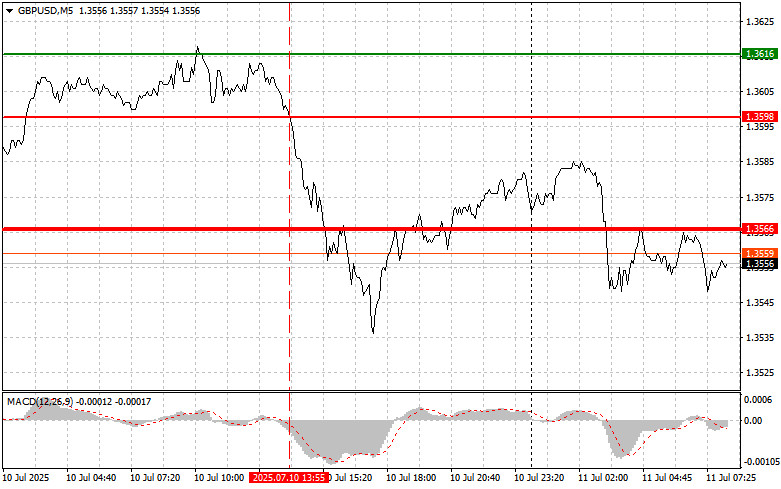

The price test of 1.3598 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downward potential. For this reason, I did not sell the pound and missed the entire downward movement.

Yesterday's lack of U.S. news and key fundamentals led to dollar strength. It is unlikely that another round of Trump's 35% tariff threats on certain countries had a direct impact on the British pound. It's worth noting that the UK has a trade agreement with the U.S., so the pound's decline is more likely due to broad-based dollar strength in the currency market.

Today, currency traders—especially those focusing on GBP/USD—should prepare for an active session. Several important macroeconomic reports from the UK are scheduled for release, which may significantly influence the pound-to-dollar exchange rate and determine short-term direction. In the first half of the day, attention will center on three key economic indicators:

- UK GDP data will be published first. This reflects the overall economic performance and total value of goods and services produced. Stronger-than-expected GDP growth may support the pound, while weaker data could pressure it.

- Industrial production figures will also be released, measuring activity in the UK's industrial sector. A rise in production signals increased demand for UK goods and services and may strengthen the pound.

- Finally, the trade balance will be published, showing the difference between exports and imports. A negative trade balance (imports exceeding exports) may weaken the pound, as it suggests the UK is spending more on foreign goods than it earns from exports.

Weak data could increase pressure on GBP/USD and drive the pair to new weekly lows.

As for intraday strategy, I will primarily rely on Buy Scenarios #1 and #2.

Buy Scenarios

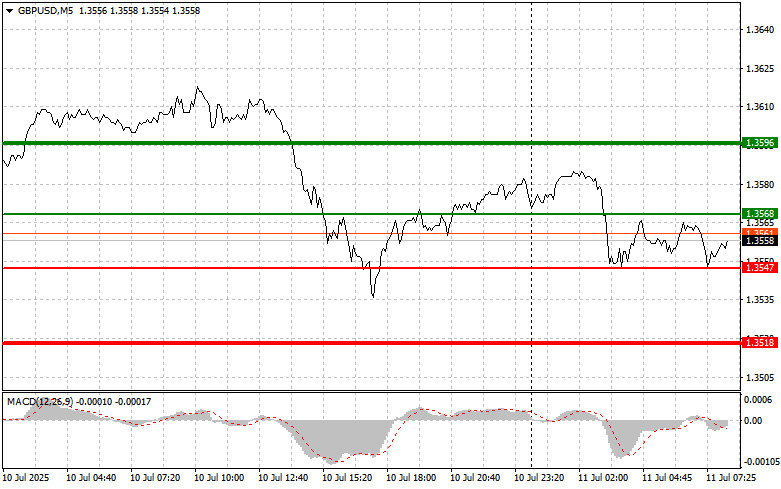

Scenario #1: I plan to buy the pound today if the price reaches the 1.3568 area (green line on the chart), targeting a rise to 1.3596 (thicker green line). Around 1.3596, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 point pullback). Pound appreciation today is only likely in case of strong data as part of a corrective move.Important: Before entering a long position, make sure the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3547 level while the MACD is in the oversold zone. This would limit the pair's downward potential and trigger an upward reversal. A rise toward 1.3568 and 1.3596 could then follow.

Sell Scenarios

Scenario #1: I plan to sell the pound after the price breaks below 1.3547 (red line on the chart), aiming for a decline to 1.3518, where I will exit the short position and consider opening a long position in the opposite direction (expecting a 20–25 point rebound). Selling the pound is appropriate on rallies within the ongoing bearish trend.Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2:I also plan to sell the pound if there are two consecutive tests of the 1.3568 level while the MACD is in the overbought zone. This would cap the pair's upward potential and likely trigger a downward reversal. A drop toward 1.3547 and 1.3518 may follow.

Chart Legend:

- Thin green line – Entry point for long positions

- Thick green line – Suggested Take Profit level or area to lock in profit, as further growth above this level is unlikely

- Thin red line – Entry point for short positions

- Thick red line – Suggested Take Profit level or area to lock in profit, as further decline below this level is unlikely

- MACD Indicator – Use overbought/oversold zones to guide entry decisions

Important Note:

Beginner Forex traders must exercise caution when entering trades. It is best to stay out of the market before major fundamental reports are released to avoid sudden price spikes. If you decide to trade during news events, always use stop-loss orders to limit potential losses. Trading without stop-losses, especially with large volumes and no money management plan, can result in rapid loss of capital.

And remember: successful trading requires a clear trading plan, like the one outlined above. Spontaneous decision-making based solely on current market conditions is generally a losing strategy for intraday traders.