.GBP/USD

Analysis:

The upward wave that began in January of this year has entered a corrective phase. Since the end of last month, quotes have been pulling back from the lower boundary of a strong potential reversal zone. The calculated support lies at the upper boundary of the 4-hour time frame's support zone.

Forecast:

Sideways movement is expected throughout the week. The early part of the week may see a downward trend toward support. Afterward, a reversal and an upward move are possible. Volatility may rise significantly toward the weekend.

Potential Reversal Zones

Resistance: 1.3610 / 1.3660Support: 1.3400 / 1.3350

Recommendations:

- Selling: Intraday trades are possible but carry high risk.

- Buying: May be considered after confirmed reversal signals near support.

AUD/USD

Analysis:

The unfinished bullish wave from early April continues to dominate the trend on the Australian dollar chart. Since June 23, the final leg of this wave has been forming. As of the analysis, the pair is near the lower boundary of a broad potential reversal zone on the daily time frame.

Forecast:

A bullish trend is expected in the coming days, with potential pressure on the upper boundary of the resistance zone. After reaching this area, a reversal may occur, followed by a bearish phase.

Potential Reversal Zones

Resistance: 0.6600 / 0.6650Support: 0.6470 / 0.6420

Recommendations:

- Buying: Risky with limited potential.

- Selling: May be used with fractional volumes after confirmed trend reversal signals; downside is limited by support.

USD/CHF

Analysis:

The downward trend that began early this year continues to guide the USD/CHF pair. A corrective (B) wave has formed in recent months, developing as a flattening structure. The final leg is still missing. Price has been moving sideways near the upper boundary of the weekly support zone.

Forecast:

Sideways movement is expected at the beginning of the week. A brief decline toward the support zone is possible. Afterward, a reversal and a bullish trend may begin. The highest market activity is likely near the end of the week.

Potential Reversal Zones

Resistance: 0.8040 / 0.8090Support: 0.7880 / 0.7830

Recommendations:

- Selling: High-risk with limited potential.

- Buying: May be considered after confirmed reversal signals near support.

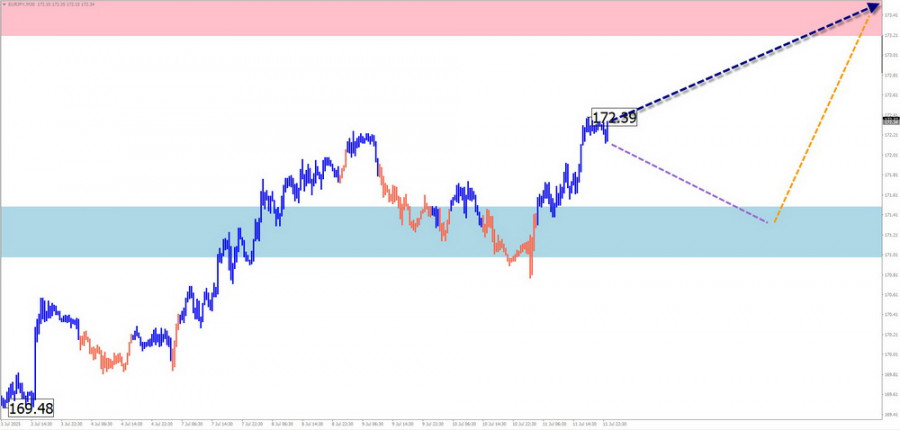

EUR/JPY

Analysis:

An upward wave zigzag has been developing since August of last year. The unfinished segment of the wave has been active since mid-May. Last week, the pair approached a potential reversal zone on the hourly chart. The resulting pullback remains within the bounds of a temporary correction.

Forecast:

Sideways movement is expected to continue. In the next few days, the pair may decline toward support. A reversal and renewed upward movement are possible closer to the weekend.

Potential Reversal Zones

Resistance: 173.20 / 173.70

Support: 171.50 / 171.00

Recommendations:

- Selling: May be used in short-term sessions with small volumes; exit positions at the first signs of a reversal.

- Buying: Will become relevant after confirmed signals near support.

AUD/JPY

Analysis:

The ongoing upward wave of the AUD/JPY pair, which began on August 5 of last year, is forming as a flattening structure. The pair is currently in a cluster of potential reversal levels across different time frames. The final leg of the wave has yet to form.

Forecast:

A sideways movement is expected early in the week along the calculated support zone. This may be followed by a resumption of upward movement toward resistance. Volatility may increase closer to the weekend.

Potential Reversal Zones

Resistance: 100.00 / 100.50Support: 95.90 / 95.40

Recommendations:

- Selling: Possible during specific sessions; best to close trades upon initial signs of reversal.

- Buying: Become relevant after confirmed signals near support.

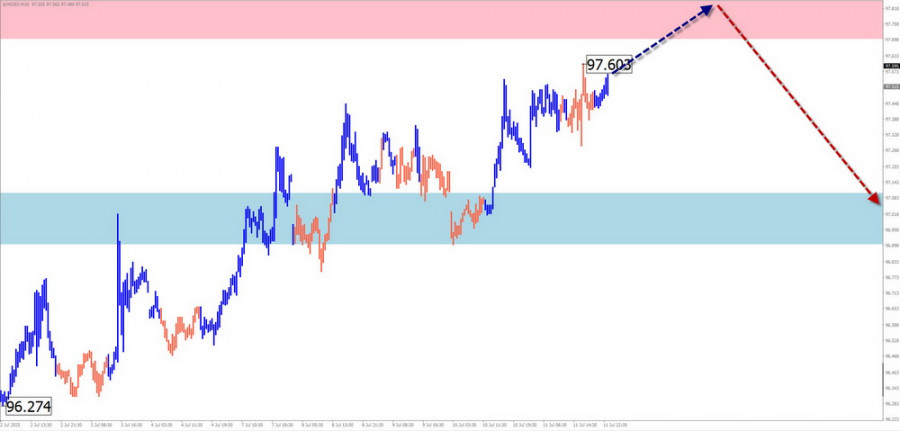

US Dollar Index

Analysis:

The correction of the main bearish wave has brought the US Dollar Index to a broad potential reversal zone on the 4-hour chart. As of the analysis, the wave structure appears unfinished. The calculated resistance runs along the upper boundary of the reversal zone.

Forecast:

A change in direction is expected this week. Once the upward phase ends near resistance, the index may reverse and resume a downward move. The highest volatility and activity are likely near the end of the week.

Potential Reversal Zones

Resistance: 97.90 / 98.10Support: 97.10 / 96.90

Recommendations:The period of US dollar strength is nearing its end. During the upcoming week, it is advisable to close short positions on national currencies and begin monitoring opportunities to buy them in major pairs.

Note: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). Each time frame analyzes the most recent unfinished wave. Dotted lines represent expected movements.

Caution: The wave algorithm does not account for the duration of price movements over time.