Analysis of Trades and Trading Tips for the Euro

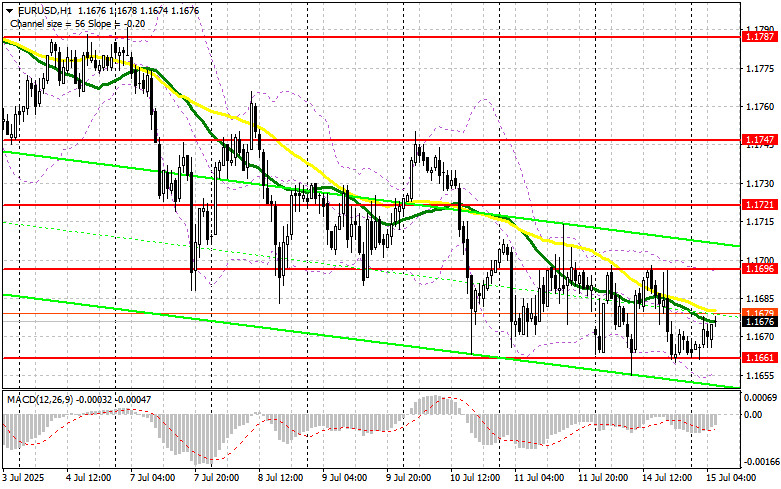

The test of the 1.1684 level occurred at the moment when the MACD indicator had just started to move downward from the zero line, confirming a valid entry point for selling the euro. As a result, the pair dropped by more than 30 pips.

Since no significant economic data was published from the U.S. yesterday, the EUR/USD exchange rate remained within its range. However, this pause did not eliminate the prevailing market uncertainty. Perhaps today's data on Germany's business climate index and current economic conditions, along with the eurozone's ZEW economic sentiment index, will shed light on the pair's future direction.

The ZEW index, being a leading indicator, reflects analysts' and investors' expectations regarding the outlook for economic development. A reading above zero signals optimism, while negative values indicate prevailing pessimism. Meanwhile, changes in eurozone industrial production provide insight into the actual condition of the manufacturing sector, one of the key drivers of the economy. If the published figures exceed market expectations, this could strengthen the euro, as investors may interpret it as a sign of the eurozone's resilience and its ability to withstand external challenges. Conversely, worse-than-expected results may negatively impact the euro, raising concerns about slowing economic growth and a possible recession.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: Today, I plan to buy the euro upon reaching the 1.1687 level (green line on the chart), aiming for a rise toward 1.1716. At the 1.1716 level, I intend to exit the market and open a short position in the opposite direction, targeting a 30–35 pip move from the entry point. Any expected growth in the euro today is only within the context of a correction.

Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today if the 1.1671 level is tested twice in a row while the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to a reversal to the upside. A rise toward the opposite levels of 1.1687 and 1.1716 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after it reaches the 1.1671 level (red line on the chart). The target will be 1.1645, where I plan to exit the market and immediately open a buy position in the opposite direction (anticipating a 20–25 pip move from that level). Selling pressure on the pair may return at any moment today.

Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro today if the 1.1687 level is tested twice in a row while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and lead to a downward reversal. A decline toward the opposite levels of 1.1671 and 1.1645 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.