Trade Analysis and Tips for the Euro

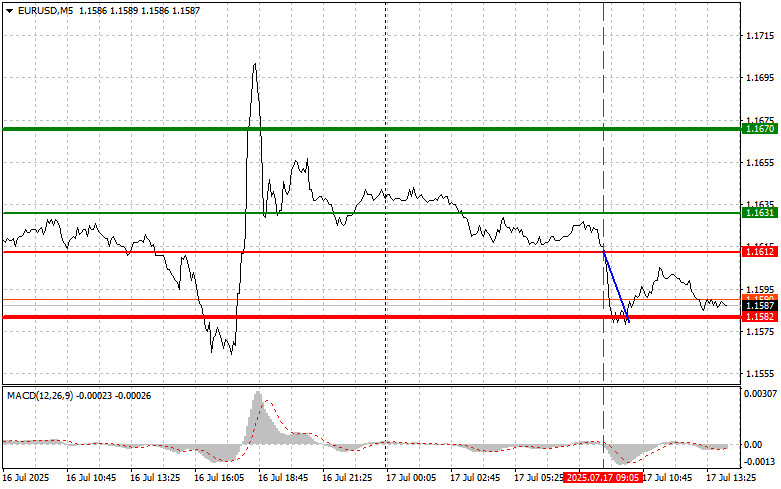

The price test at 1.1612 coincided with the MACD indicator just beginning to move down from the zero line, which confirmed a valid entry point for selling the euro and resulted in a drop of more than 30 points. Buying on a rebound from 1.1582 yielded a profit of 15 points.

June inflation data from the eurozone confirmed analysts' expectations, leaving euro buyers with little hope in the first half of the day. An inflation estimate of 2% is more than satisfactory for the ECB, so further rate cuts may now be in question. Core inflation, excluding volatile components, also remains close to the ECB's target at 2.3%. The euro's next move will depend on ECB statements and expectations regarding future policy decisions. The probability of further rate cuts remains significant, which will put pressure on the euro in the medium term.

In the afternoon, we expect a significant batch of U.S. economic data. Special attention will be paid to initial jobless claims and retail sales dynamics. The number of initial jobless claims acts as a kind of thermometer for the labor market. A decline indicates employment stability and can be seen as a positive economic signal, whereas an increase may signal an economic slowdown and a potential rise in unemployment.

Retail sales, in turn, reflect the level of consumer activity—the main driver of the U.S. economy. An increase indicates growing consumer demand, supporting economic growth. A decline may reflect lower consumer confidence and potentially slower economic expansion. Overall, favorable data may strengthen the dollar, while weaker results could put downward pressure on it. Keep in mind that market reactions will depend not only on the actual data but also on how they compare to forecasts.

As for the intraday strategy, I will mostly rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, buying the euro is possible around the 1.1600 level (green line on the chart) with the target of rising to 1.1651. At 1.1651, I plan to exit the market and also sell the euro in the opposite direction, expecting a 30–35 point pullback from the entry point. A strong rally in the euro today is only likely if U.S. data disappoints. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1575 level, at a time when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a reversal upward. Growth can then be expected to the opposing levels of 1.1600 and 1.1651.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1575 level (red line on the chart), targeting 1.1524, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20–25 point rebound). Pressure on the pair may return today if U.S. data is strong. Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to move down.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1600 level, while the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a market reversal downward. A drop to 1.1575 and 1.1524 can then be expected.

Chart Notes:

- Thin green line – entry price for long positions;

- Thick green line – estimated take-profit level where further growth is unlikely;

- Thin red line – entry price for short positions;

- Thick red line – estimated take-profit level where further decline is unlikely;

- MACD Indicator – when entering trades, it is crucial to consider overbought and oversold zones.

Important: Beginner Forex traders should be extremely cautious when deciding to enter the market. It's best to stay out of the market before major fundamental reports to avoid sharp volatility. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Trading without stop-losses can quickly deplete your entire deposit, especially if you disregard money management and trade large volumes.

Remember, successful trading requires a clear trading plan—like the one presented above. Making spontaneous decisions based on the current market situation is a losing strategy for any intraday trader.