Trade Analysis and Tips for the British Pound

The price test at 1.3381 occurred when the MACD indicator had just begun moving downward from the zero line, confirming a correct entry point for selling the pound—though the pair did not experience a major drop.

The increase in unemployment claims in the United Kingdom, along with a rise in the unemployment rate itself, negatively impacted the pound sterling. The growing number of unemployed signals a slowdown in economic growth, which in turn undermines investor confidence in the pound's outlook. However, despite clear downward pressure, the pound showed some resilience, possibly due to supporting factors such as expectations for further policy easing by the Bank of England. While many anticipate more decisive action from the central bank, no such intentions have been officially communicated so far.

The market's attention will now turn to U.S. data, particularly initial jobless claims, June retail sales, and the Philadelphia Fed Manufacturing Index. These indicators serve as a litmus test for the current state of the U.S. economy. A decline in jobless claims will be viewed as a positive sign, indicating labor market strength and solid economic growth. Conversely, a rise may suggest an economic slowdown and a potential increase in unemployment.

Retail sales data will reflect consumer activity—the key driver of the U.S. economy. An increase signals sustained consumer demand, which supports economic expansion. A decline, however, could indicate falling consumer confidence and slower growth. The Philadelphia Fed Index, reflecting business activity in the manufacturing sector, will complete the broader picture. A value above zero suggests ongoing expansion, while a negative value may indicate slowing growth.

As for the intraday strategy, I will rely mostly on Scenarios #1 and #2.

Buy Signal

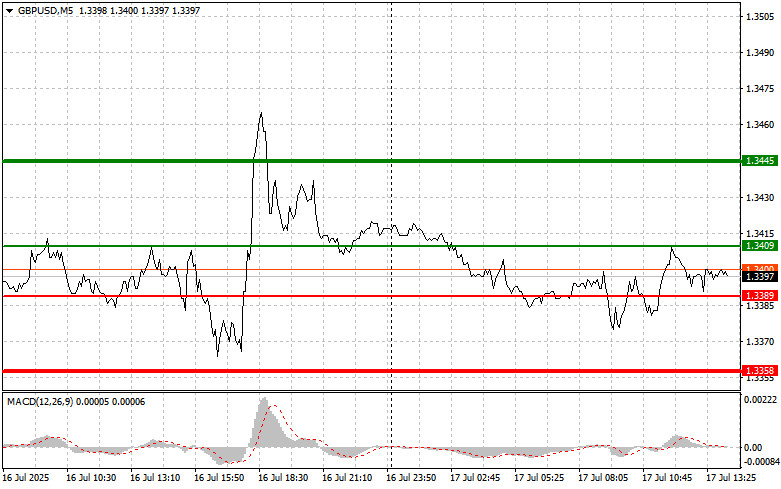

Scenario #1: I plan to buy the pound today around the 1.3410 level (green line on the chart) with the goal of rising to 1.3445 (thicker green line). Around 1.3445, I plan to exit long positions and open short positions, aiming for a 30–35 point reversal. A stronger rally is likely only if U.S. data disappoints. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3389 level, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth toward 1.3410 and 1.3445 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound after a breakout below the 1.3389 level (red line on the chart), which may lead to a quick decline. The key target will be 1.3358, where I plan to exit short positions and immediately open long positions, aiming for a 20–25 point pullback. Selling pressure may increase if U.S. data is strong. Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3410 level, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal. A decline toward 1.3389 and 1.3358 can be expected.

Chart Notes:

- Thin green line – entry level for buying the trading instrument

- Thick green line – expected level for setting Take Profit or manually securing profit, as further growth beyond this point is unlikely

- Thin red line – entry level for selling the trading instrument

- Thick red line – expected level for setting Take Profit or manually securing profit, as further decline beyond this point is unlikely

- MACD Indicator – when entering trades, it is essential to consider overbought and oversold zones

Important: Beginner Forex traders should be extremely cautious when entering the market. It is best to stay out of the market before the release of major fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Trading without stop-losses can quickly lead to a full account loss, especially if you ignore money management and trade large positions.

And remember: successful trading requires a clear trading plan—like the one I've outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for any intraday trader.