The GBP/USD currency pair also continued its upward movement on Wednesday, showing no reaction to the signing of a trade agreement with Japan. As we can see, even a form of "trade truce" is no longer enough to support the U.S. dollar. It's essential to recognize that Donald Trump has no interest in a strong dollar, as a strong dollar implies low demand for American goods and services abroad. That's why Trump will do absolutely nothing to stop the dollar from falling. It's also worth remembering that the exchange rate of a national currency best reflects the economy's outlook and market sentiment.

So why didn't the dollar strengthen even after the fourth agreement was signed? The answer lies in the question itself: because in 4 months of negotiations, Trump's team has signed four deals out of a possible 75. And let's be honest—who cares about trade agreements with Vietnam or the Philippines? As for the deal with China, huge doubts remain, since media reports continue to stress that negotiations between Washington and Beijing are still ongoing. Which means there is no actual deal with China at this point. So what are we left with? Agreements with the UK, Vietnam, Japan, and the Philippines—two of which raise numerous questions.

Yes, more deals will be signed over time, but agreements with China and the European Union are still nowhere in sight. And yet those two regions are the United States' largest trading partners. Moreover, as everyone now understands, a trade agreement does not mean the elimination of tariffs. Trump will, one way or another, still make someone pay for imports. The only difference is, it won't be foreign governments—but American consumers.

And that's not all. The U.S. president has hinted that every country not yet subject to tariffs will eventually be subject to them. In other words, any country on the map will have to deal with tariffs if it wants to export goods, services, or raw materials to the U.S. No one will be spared. So what does this all add up to? Four trade deals out of 193? And even if 193 deals are eventually signed, what difference will it make if all the tariffs remain in place?

In our opinion, the U.S. dollar has gained no new reasons for optimism over the past 24 hours. How the U.S. economy will respond to sweeping tariffs and "mind-blowing deals" remains to be seen. One thing is certain: indicators like inflation don't interest Trump at all, so the so-called economic boom may end up being driven by nothing more than rising prices. However, for the U.S. president, the most important thing is to report economic growth or the signing of a new deal. The actual results don't matter. But as we've said many times before, this isn't our problem—it's America's. What matters to us is where the U.S. dollar is heading after 16 years of growth. And at this point, the answer remains clear.

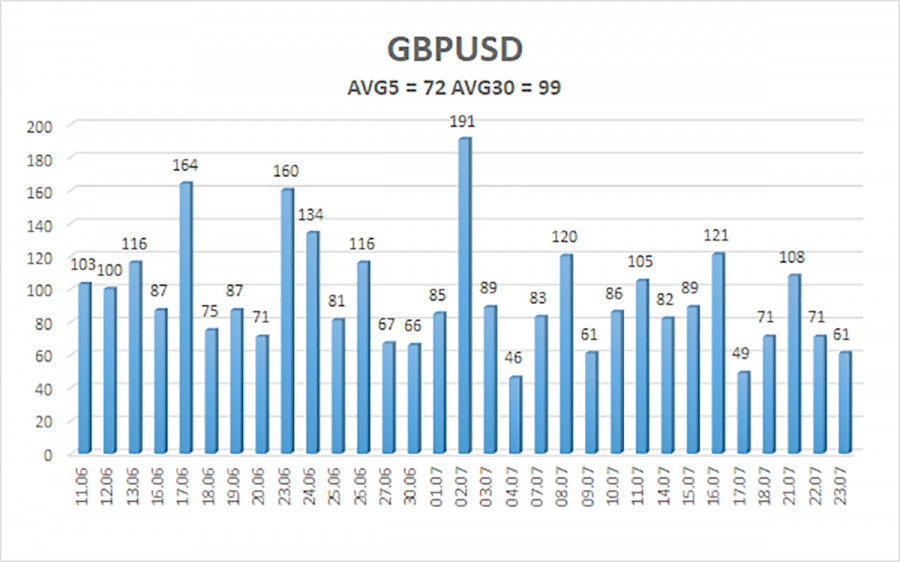

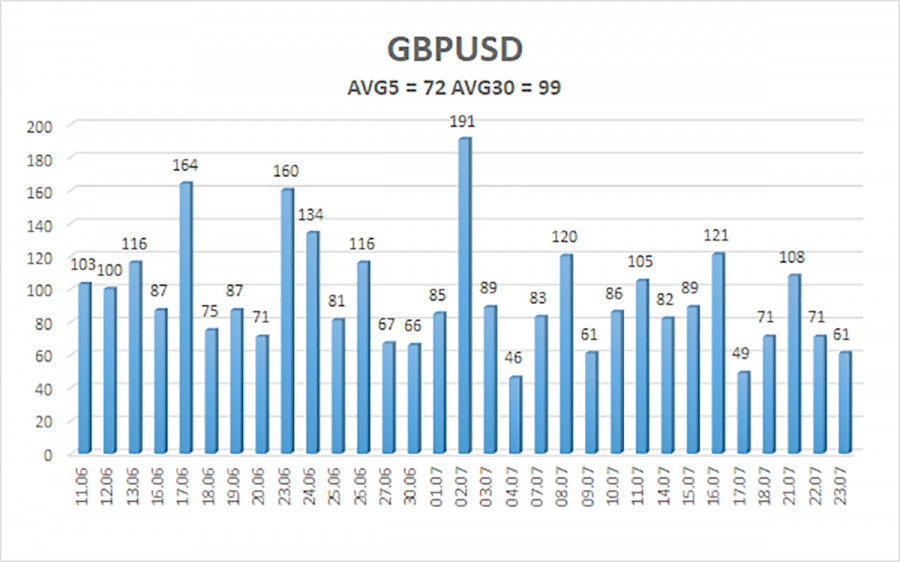

The average volatility of the GBP/USD pair over the last five trading days is 72 pips. For the pound/dollar pair, this is considered "moderate." On Thursday, July 24, we therefore expect movement within a range defined by the levels 1.3491 and 1.3635. The long-term linear regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has entered oversold territory twice, signaling a potential renewed upward trend. In addition, bullish divergences have formed.

Nearest Support Levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest Resistance Levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading Recommendations:

The GBP/USD currency pair may resume its uptrend. The pair has undergone a sufficient correction, and in the medium term, Trump's policies are likely to continue putting pressure on the dollar. Thus, long positions with targets at 1.3611 and 1.3635 remain relevant if the price stays above the moving average. If the price drops below the moving average line, small short positions may be considered with a target at 1.3428, based purely on technical grounds. Occasionally, the U.S. dollar shows corrective strength, but for an actual trend reversal, evident signs of the end of the global trade war would be needed, which now seems increasingly unlikely.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.