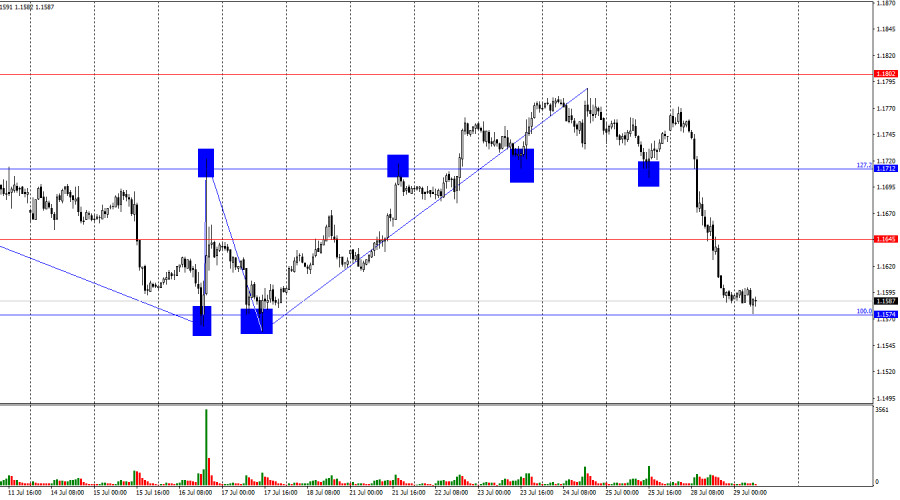

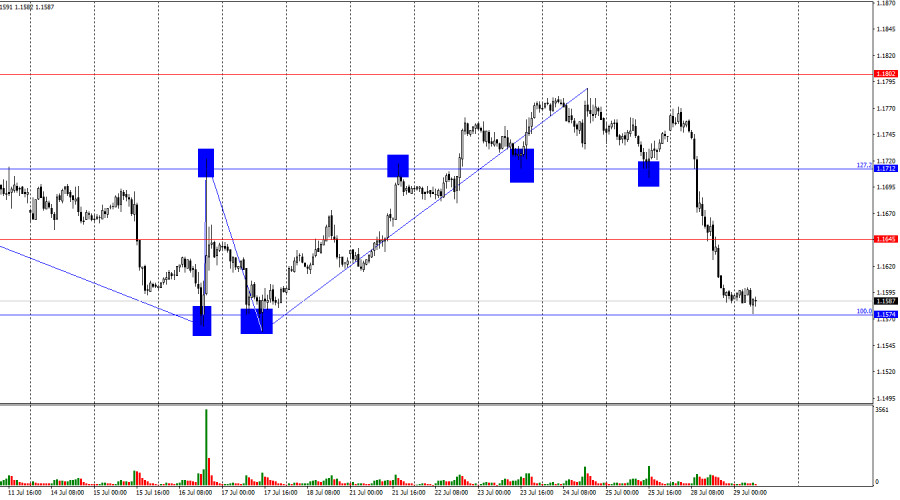

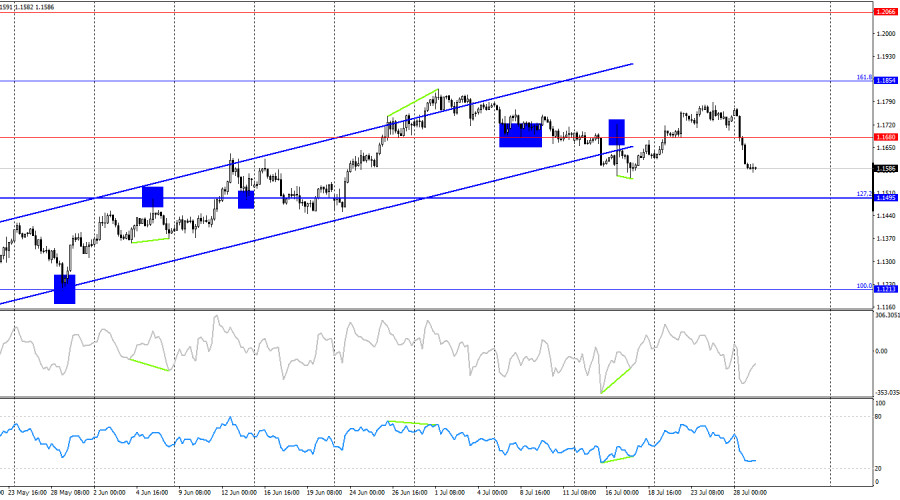

On Monday, the EUR/USD pair reversed in favor of the U.S. dollar and experienced a sharp decline toward the 100.0% Fibonacci retracement level at 1.1574. Without a doubt, such a drop would not have occurred without the impact of the news background. The trade agreement between the European Union and the United States was interpreted by traders in a clear and decisive way. A rebound from the 1.1574 level today would favor the euro and open the way for a move toward 1.1645. A consolidation below 1.1574 would increase the likelihood of a further decline toward the next retracement level at 76.4% – 1.1454.

The wave situation on the hourly chart remains simple and clear. The most recent completed upward wave broke above the peak of the previous wave, and the latest downward wave did not break the previous low. Therefore, despite the extended correction and Monday's drop, the trend is still considered bullish. Donald Trump has signed several advantageous trade deals, which may temporarily support the bears. However, most of the U.S.'s trading partners have yet to reach any agreements with Washington.

On Monday, the market focused on just one event: the trade agreement between the EU and the U.S., which many had anticipated but few truly believed would happen. However, once traders learned the details of the deal, much of the initial optimism faded. The agreement was signed—that is a fact—but the terms are controversial. In short, the European Union committed to buying U.S. energy products, investing in the U.S., and accepting tariffs of up to 15%. At the same time, the U.S. made no binding commitments. For the EU, this deal appears more like a list of obligations that must be fulfilled over the coming years. As such, the euro's decline and the bears' pressure were entirely justified. Their pressure may continue today, as the EU–U.S. trade agreement is not a routine event and will have long-term consequences for both economies.

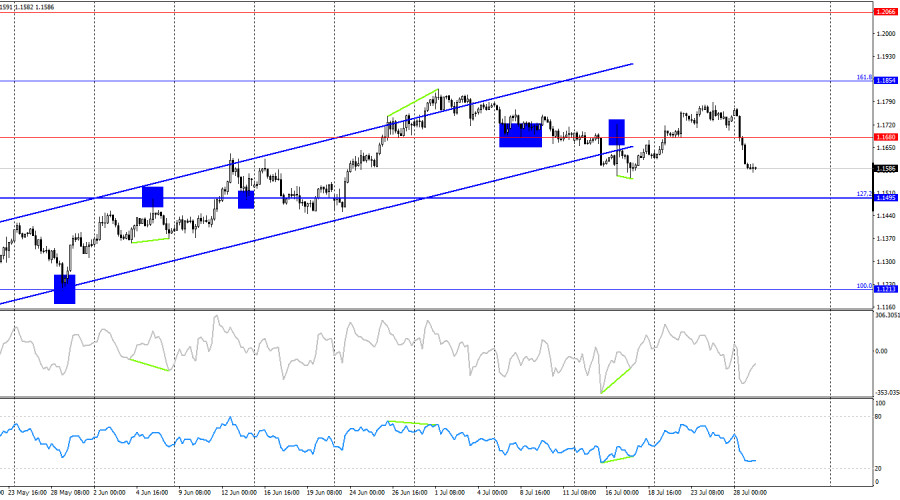

On the 4-hour chart, the pair confirmed a reversal in favor of the U.S. dollar and closed below the 1.1680 level. Earlier, the euro had exited the ascending trend channel. However, I am not rushing to conclude that a full-fledged bearish trend has started. The pair exited the channel not because of strong bearish pressure, but due to a prolonged correction. The EU–U.S. trade agreement strengthened the bears, but a consistently bearish news background is needed for the decline to continue toward the 127.2% Fibonacci level at 1.1495.

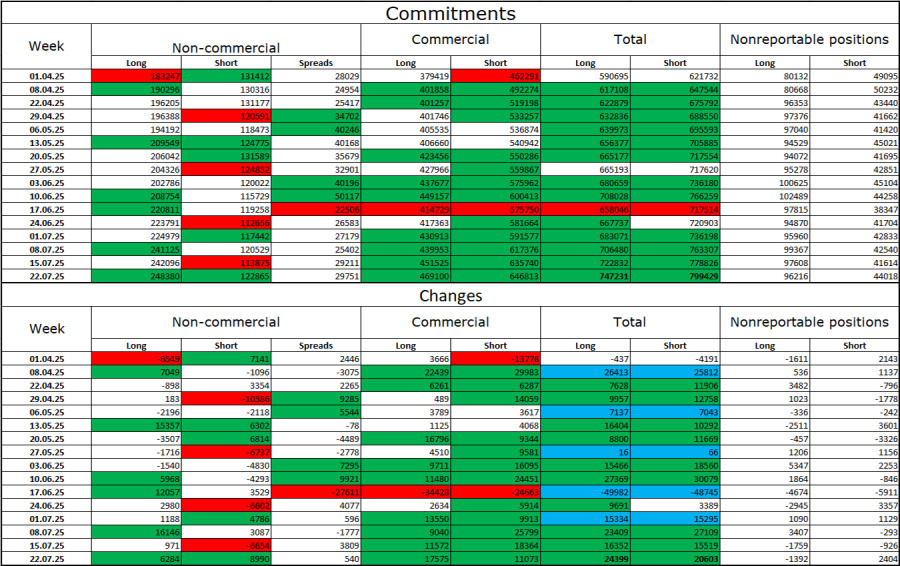

Commitments of Traders (COT) Report

During the most recent reporting week, professional traders opened 6,284 long positions and 8,990 short positions. Sentiment in the "Non-commercial" group remains bullish, largely due to Donald Trump, and continues to strengthen. The total number of long contracts held by speculators now stands at 248,000, compared to 122,000 short positions—a ratio of more than 2:1.

Also note the number of green cells in the upper table, which reflect strong growth in positions on the euro. In most cases, interest in the euro continues to grow, while interest in the dollar declines.

For 24 consecutive weeks, large traders have been reducing short positions and increasing long ones. Donald Trump's policies remain the most influential factor for traders, as they are seen as potential triggers for a U.S. economic recession and a range of other structural, long-term issues. Despite the signing of several key trade deals, I still see no significant change in the sentiment of major market participants.

Economic Calendar for the U.S. and EU

United States – JOLTS Job Openings (14:00 UTC)

The economic calendar for July 29 contains just one noteworthy release. The influence of the news background on market sentiment on Tuesday may be limited. However, new agreements signed by Trump may give additional momentum to the bears.

EUR/USD Forecast and Trading Tips

Selling opportunities arose after a close below 1.1712, with a target of 1.1645. That target was reached, and the next target at 1.1574 was also hit. New sell positions may be considered if the pair closes below 1.1574, with a target of 1.1454.

Buy positions may be opened today if the price rebounds from 1.1574, with targets at 1.1645 and 1.1712.

Fibonacci grids are drawn from 1.1574 to 1.1066 on the hourly chart and from 1.1214 to 1.0179 on the 4-hour chart.