The EUR/USD currency pair continued its downward movement on Tuesday, driven by the same factors as on Monday—as we warned in advance. On Monday, it was revealed that the European Union had agreed to Donald Trump's downright exploitative terms within a trade agreement. We must admit, we had believed until the very end that the EU was a force capable, if not of stopping Trump, then at least of mounting serious resistance to the American president's protectionism. However, Trump remained unwavering and ultimately won—deservedly so. Because in today's world, it's not justice that wins, but strength.

Now, a well-fed and peaceful Europe will be investing in the American economy instead of its own. It will buy expensive American energy instead of sourcing it from cheaper and more beneficial suppliers. European goods will face a 15% tariff, while American goods won't face any barriers. Such is this so-called "historic deal."

We're confident no one is wondering anymore why the euro is falling. For a long time, we repeated the same point—there were few chances for the dollar to grow in the medium or long term because Trump's policies were unpopular globally. However, results matter in economics and politics, and Trump has delivered. He doesn't care about inflation in the U.S.—he cares about economic growth and how much revenue the federal budget collects. And he is steadily working toward those goals.

On Tuesday, new information surfaced: the U.S.-EU deal has been agreed upon but not yet signed. Now, Ursula von der Leyen will have to convince the European Parliament to ratify the agreement. In Europe, the "super deal" has drawn heavy criticism—only the lazy haven't denounced it. Still, we're nearly certain that the alternative—30% tariffs—would have been far worse for the Eurozone. Think about it: if 30% tariffs were the lesser evil, why wouldn't the EU have agreed to them instead? We're confident that the head of the European Commission secured the best-possible outcome for Europe under the circumstances. It's just that many in Europe expected an advantageous deal in the literal sense, but got instead the "least-bad" option.

As such, we have little doubt that the European Parliament will ratify the deal once von der Leyen presents a detailed, written explanation of how much the EU stands to lose under the 30% tariff scenario. After all, trade between the EU and the U.S. accounts for a third of all global trade, and America remains the largest and wealthiest market in the world.

Looking at the daily timeframe, it's clear the dollar still has room to rise. Currently, when we consider the dollar's decline over the past six months, it hasn't even corrected by 23.6% according to the Fibonacci retracement. With the current fundamental backdrop, the euro simply has to drop to the 1.1440 level. And the correction will likely be deeper than that. Of course, we don't believe the 16-year "dollar trend" will resume, because even under Trump, the dollar doesn't have many strong cards to play. Trump may have signed a highly favorable deal with Europe, but that doesn't mean global confidence in the U.S. or the dollar has grown.

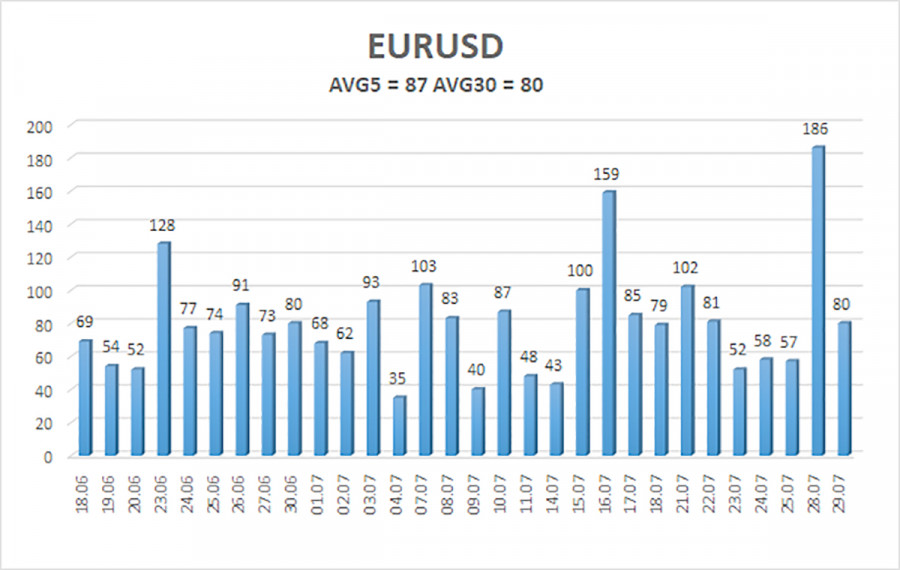

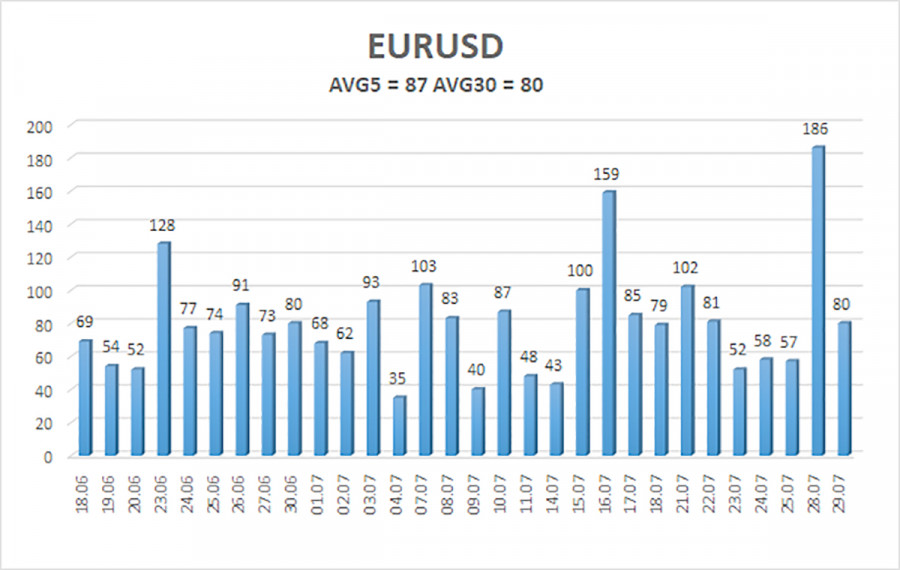

The average volatility of the EUR/USD pair over the past five trading days as of July 30 is 87 pips, classified as "moderate." We expect the pair to move between 1.1472 and 1.1646 on Wednesday. The long-term linear regression channel is still pointing upward, indicating a prevailing uptrend. The CCI indicator has again entered oversold territory, suggesting a possible resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1536

S2 – 1.1475

S3 – 1.1414

Nearest Resistance Levels:

R1 – 1.1597

R2 – 1.1658

R3 – 1.1719

Trading Recommendations:

The EUR/USD pair has begun a new leg of corrective movement. The U.S. dollar remains heavily influenced by Trump's domestic and foreign policies. While the dollar strengthened at the beginning of the week, we still do not see a case for medium-term buying.

When the price is below the moving average, short positions remain relevant with targets at 1.1536 and 1.1475. If the price rises above the moving average, long positions with targets at 1.1719 and 1.1780 would align with the ongoing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.