Trade Review and Tips for the Euro

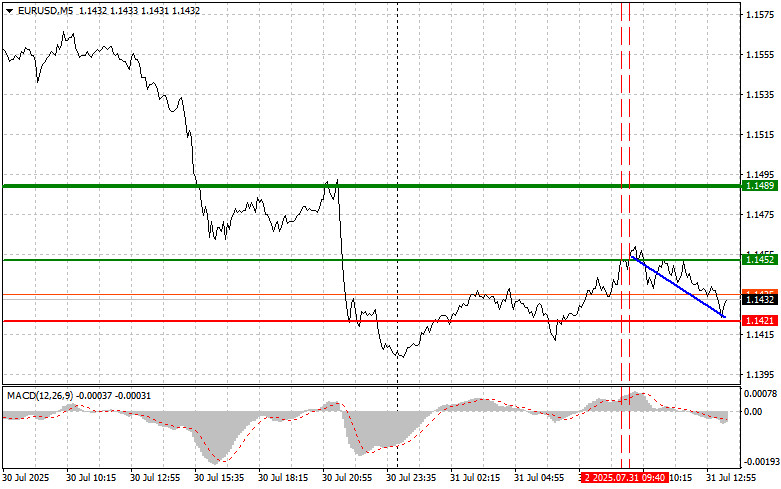

The first test of the 1.1452 price level occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy the euro. The second test of this price level occurred when the MACD was in overbought territory, confirming the implementation of Sell Scenario #2. As a result, the pair declined by 30 points.

The initial upward impulse in the euro, driven by encouraging data on falling unemployment in the eurozone and Germany, did not develop further. The rise was short-lived and limited. Even despite signs of decreasing unemployment and inflation, the risk that the European Central Bank will continue with a dovish stance continues to put pressure on the euro. On one hand, favorable macroeconomic indicators—such as falling unemployment—offer some support. On the other, fears of a potential recession and high inflation due to U.S. tariffs are capping the euro's growth potential.

In the second half of the day, markets await the release of U.S. data on initial jobless claims and the core Personal Consumption Expenditures (PCE) index. In addition, figures on changes in personal income and spending in the U.S. will be published. These are key indicators for understanding the current state of the U.S. economy and will undoubtedly influence financial market dynamics. The number of new unemployment claims will provide insight into labor market conditions, signaling potential instability or, conversely, resilience. An increase in claims may indicate an economic slowdown and job losses, while a decline points to improvement and a strengthening labor market. The core PCE index is one of the Fed's most closely watched inflation gauges, as it reflects the price dynamics of consumer goods and services. A significant rise could prompt the Fed to maintain a cautious stance, further supporting the dollar under current conditions.

As for intraday strategy, I'll be focusing more on implementing Scenarios #1 and #2.

Buy Signal

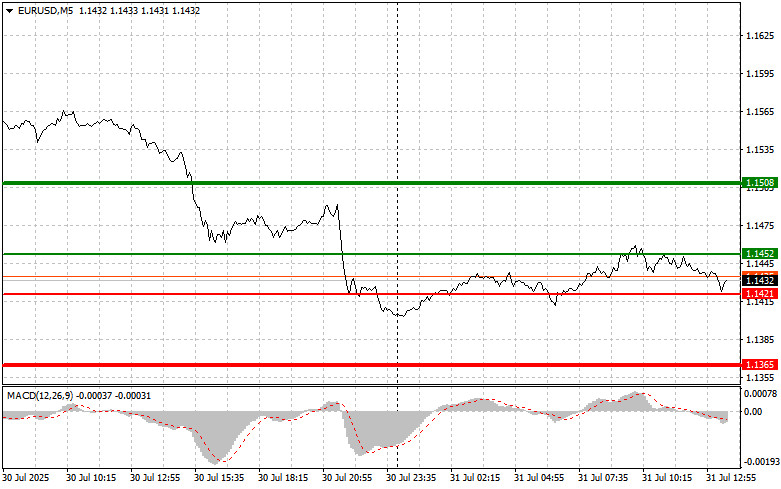

Scenario #1: Today, I plan to buy the euro at around 1.1452 (green line on the chart) with a target at 1.1508. At 1.1508, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A strong euro rally today is only likely if U.S. data comes in very weak. Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1421 level when the MACD is in oversold territory. This would limit the pair's downward potential and could lead to a market reversal to the upside. A rise toward the opposite levels of 1.1452 and 1.1508 may then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1421 level (red line on the chart), targeting 1.1365, where I will exit the market and buy in the opposite direction (expecting a 20–25 point move in the reverse direction). Downward pressure on the pair will increase if U.S. data is strong. Important! Before selling, ensure the MACD is below the zero line and just beginning to move down from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1452 level when the MACD is in overbought territory. This would limit the pair's upward potential and could lead to a reversal downward. A decline to the opposite levels of 1.1421 and 1.1365 may be expected.

Chart Legend:

- Thin green line – entry price for buying the instrument

- Thick green line – expected price to place Take Profit or manually lock in profit, as further growth beyond this level is unlikely

- Thin red line – entry price for selling the instrument

- Thick red line – expected price to place Take Profit or manually lock in profit, as further decline beyond this level is unlikely

- MACD Indicator – when entering the market, rely on overbought and oversold zones

Important: Beginner Forex traders should exercise great caution when deciding to enter the market. It's best to stay out of the market before major fundamental reports to avoid sharp price swings. If you do decide to trade during news releases, always set stop-loss orders to minimize losses. Trading without stop-losses can lead to rapid loss of your entire deposit, especially if you don't use proper money management and trade with large volumes.

And remember: successful trading requires a clear plan—like the one I've outlined above. Spontaneous decision-making based on current market conditions is a losing strategy for intraday traders.