US Markets Close Higher as Chip Stocks Lead the Rally

U.S. stock indexes finished Tuesday's session in positive territory, driven by strong gains in chipmakers like NVIDIA. Investors welcomed the momentum, anticipating potential clarity on Washington's tariff policies and the prospect of renewed trade dialogue with key global partners.

Spotlight on Trump and Xi

Both President Donald Trump and China's leader Xi Jinping are expected to deliver remarks later this week, according to a Monday statement from the White House. This comes shortly after Trump accused China of breaching the Geneva agreement — a move he claims justifies the lifting of tariffs and other trade restrictions. Beijing firmly rejected the accusation, calling it unfounded and reaffirming its commitment to defending national interests.

White House Pushes for Trade Proposals by Wednesday

A draft letter circulated among negotiating partners reveals that the Trump administration is urging countries to submit their best trade offers by Wednesday. The move is part of a broader strategy to fast-track discussions and finalize agreements within a tight five-week window.

Markets Rebounded Strongly in May

The easing of harsh trade rhetoric from the White House last month reignited investor appetite for risk. As a result, the benchmark S&P 500 and tech-heavy Nasdaq posted their strongest monthly percentage gains since November 2023, signaling renewed confidence in the markets.

Wall Street Closes Higher with Tech Stocks in the Lead

Tuesday's Market Summary:

- Dow Jones Industrial Average climbed 214.16 points (+0.51%) to 42,519.64;

- S&P 500 rose by 34.43 points (+0.58%), closing at 5,970.37;

- Nasdaq Composite gained 156.34 points (+0.81%), ending the session at 19,398.96.

Tech Sector Powers Ahead

The tech sector once again took center stage, with the S&P technology index (SPLRCT) advancing by 1.5%. Nvidia led the charge, with its shares surging 2.9% amid continued investor enthusiasm over AI developments.

Meanwhile, Broadcom hit a fresh all-time high after announcing it has begun shipping its newest networking chip, designed to supercharge artificial intelligence performance. The company's stock jumped 3.2% in response.

Labor Market Shows Mixed Signals

According to the U.S. Department of Labor, job openings saw an uptick in April, yet the increase in layoffs points to a cooling labor market. Economists view this as a potential consequence of lingering tariff concerns and broader economic uncertainty.

Manufacturing Orders Stumble

Census Bureau data revealed that U.S. factory orders dropped 3.7% in April — a sharp reversal from March's unrevised 3.4% jump. The fall suggests that the one-time boost from pre-tariff stockpiling has run its course.

Eyes on Friday's Jobs Report

Markets are now focused on Friday's upcoming employment data. The report is expected to offer a clearer picture of how escalating trade tensions are impacting the world's largest economy.

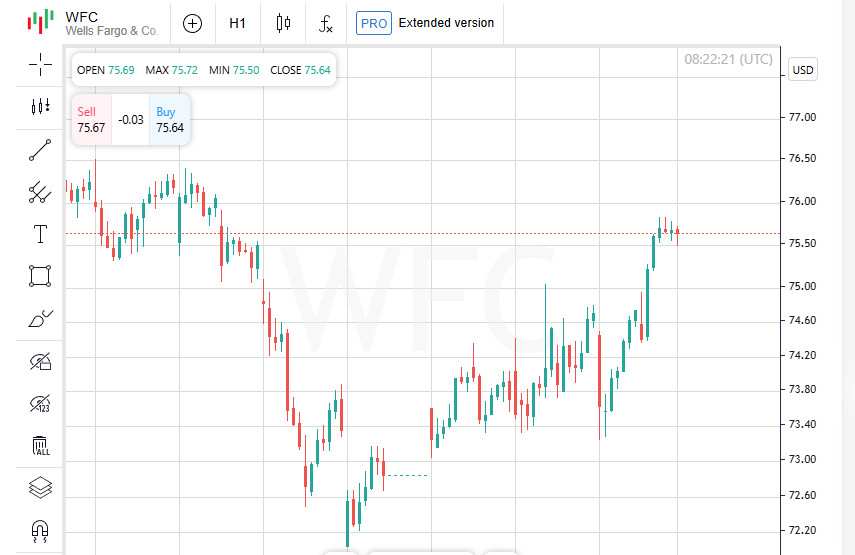

Wells Fargo Gains in Extended Trading

Wells Fargo shares closed up 1.2%, but extended trading saw the stock rise an additional 2%, reflecting post-market investor optimism.

Kenvue Stumbles as Retailers Slash Inventories

Shares of Kenvue tumbled by 6%, leading the losses on the S&P 500. The consumer health company revealed at a Deutsche Bank conference that retailers in both the U.S. and China are aggressively clearing out stock. The uncertainty surrounding potential tariffs has led distributors to pull back on inventory levels, putting pressure on the supply chain.

Dollar General Surges After Strong Forecast

Discount retailer Dollar General saw its stock leap 15.8% after the company raised its full-year sales outlook. Quarterly results exceeded expectations, signaling solid demand even in a choppy economic environment. Investors responded enthusiastically to the upbeat revision.

Pinterest Gets a Boost from JPMorgan Upgrade

Pinterest shares climbed 3.8% after JPMorgan upgraded the stock from "Neutral" to "Overweight." The change sparked increased buying, reflecting renewed confidence in the platform's monetization potential.

Reddit Faces Outage, Stock Dips

Reddit stock edged down 1.1% after technical issues disrupted access for more than 29,000 users, according to outage monitoring site Downdetector.com. The incident raised concerns over the platform's reliability.

Airbus Shares Take Flight Amid China Deal Rumors

European stocks posted modest gains Wednesday, supported by a 3.4% rise in Airbus shares. Bloomberg News reported that Chinese airlines may place a large aircraft order as early as next month — a development that energized investors despite broader trade worries.

STOXX 600 Extends Rally as Tariff Fears Ease

The pan-European STOXX 600 index inched up 0.3% by 07:07 GMT, extending its rebound by roughly 15% since early April lows. The positive mood was further buoyed by President Donald Trump's decision to pause broad-based tariffs and secure a trade deal with the United Kingdom.

PMI Data to Offer Insight on Tariff Impact in Europe

Later today, the release of Purchasing Managers' Index (PMI) data for the UK, eurozone, Germany, and France is expected to shed light on how escalating trade tensions have shaped economic performance across the region in May. The readings may provide early signs of whether tariffs are starting to drag on business sentiment and output.

ECB Poised to Cut Rates in Policy Pivot

Investors are closely watching Thursday's European Central Bank meeting, where officials are widely expected to cut interest rates by 25 basis points. If confirmed, this would mark the ECB's first step toward monetary easing — a strategic shift aimed at shielding the eurozone economy from global uncertainty.

U.S. Jobs Report in the Spotlight

On Friday, attention will shift across the Atlantic to the highly anticipated U.S. employment report. The data could prove pivotal in shaping the Federal Reserve's next policy moves, especially as markets try to gauge the balance between slowing growth and inflation risks.

Tech and Mining Lead Gains in Europe

Most sectors in European equity markets posted gains, with technology (SX8P) and mining (SXPP) stocks leading the advance. The upbeat performance suggests renewed appetite for risk among investors seeking value in cyclical industries.

Remy Cointreau Walks Back 2030 Sales Ambitions

Shares of Remy Cointreau dropped 2.6% after the French spirits group scrapped its long-term sales growth target for 2030. The company cited a combination of persistent U.S. underperformance, global tariff pressures, and broader market volatility as key risks undermining its outlook for the coming years.