Best Buy shares fell after the company cut its full-year sales and earnings forecasts. Boeing, on the other hand, gained ground as its CEO announced plans to ramp up production of the 737 MAX. Meanwhile, Japan's Nikkei lagged as the yen strengthened on safe-haven demand.

Index performance: The Dow rose 0.3%, the S&P 500 added 0.4%, and the Nasdaq climbed 0.4%.

.

Wall Street edges higher: Nvidia sets the tone, markets eye Trump tariffs

US equity indices advanced on Thursday, boosted by a sharp rally in Nvidia shares following a robust quarterly earnings report. Against this backdrop, investors also digested a surprise court ruling that reinstated key tariffs imposed by former President Donald Trump.

Legal whiplash and market reaction

An appellate court overturned a recent trade court decision that would have suspended the tariffs immediately. The ruling caused volatility throughout the session. Despite early strength, major indices closed well below their intraday highs.

Salesforce ends on downbeat note

Shares of enterprise software firm Salesforce dropped 3.3%, even after the company raised its revenue and earnings guidance. The decline suggests that positive expectations were already priced in, or that other elements of the report acted as red flags for investors.

Chip boom and China factor

Nvidia shares rose 3.2% after the company reported strong demand for its artificial intelligence chips, with buyers racing to place orders ahead of new export restrictions on shipments to China. However, Nvidia warned that those restrictions could result in a sales decline of up to $8 billion this quarter.

'Magnificent Seven' wrap up earnings season

With Nvidia's results, the so-called "Magnificent Seven," the leading high-cap tech giants, have now all reported quarterly earnings. Despite the broadly upbeat tone, Nvidia shares are up only 3.6% year-to-date.

Indices post gains as Wall Street holds cautious optimism

US stock indices ended Thursday's session in positive territory, continuing to show resilience despite mixed signals from both the economic and political front.

Trading session recap:

- Dow Jones gained 117.03 points (+0.28%) to close at 42,215.73;

- S&P 500 rose 23.62 points (+0.40%) to 5,912.17;

- Nasdaq Composite added 74.93 points (+0.39%) to finish at 19,175.87.

Tariff echoes: market feels weight of geopolitics

Rising trade tensions, triggered by Donald Trump's April 2 statement announcing plans to impose universal import tariffs, have placed noticeable pressure on markets. Still, the S&P 500 managed to recover following its April correction, supported by easing tensions and unexpectedly strong corporate earnings reports.

The index remains below its February peak, but it is up 0.5% year-to-date, an indication of a cautious return of investor confidence.

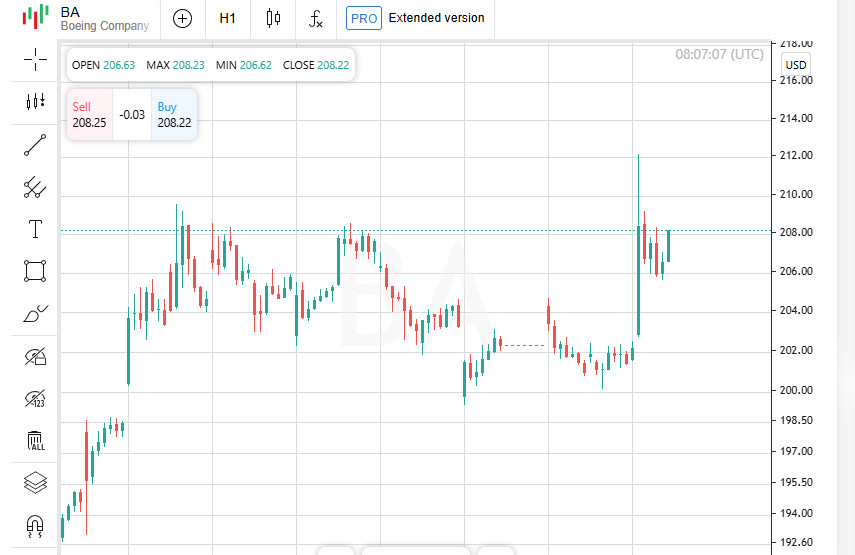

Boeing takes off

Boeing shares climbed 3.3% after CEO Kelly Ortberg announced plans to ramp up production of 737 MAX jets. The company aims to reach a monthly output of 42 planes in the coming months and expand to 47 per month by early 2026. Investors welcomed the update as a sign of stabilization and production growth.

Best Buy dips on weakening consumer demand

Shares of electronics retailer Best Buy fell 7.3% after the company lowered its full-year guidance. Management warned that new US tariffs could weaken consumer appetite for big-ticket items, a trend already reflected in same-store sales and earnings expectations.

Asian markets slip, yen strengthens

Asian equity markets came under pressure on Friday as investors locked in profits after a volatile week marked by abrupt legal swings in US trade policy. The sell-off coincided with a rally in the Japanese yen, a classic safe-haven asset, dealing a sharp blow to the export-heavy Nikkei 225, which pulled back after nearly a 2% gain the previous day.

Yen strength weighs on Japanese market

Japan's Nikkei fell 1.1% in response to the yen's rapid appreciation. The currency climbed 2% from recent lows, reaching 143.45 per dollar. A stronger yen erodes exporters' competitiveness and diminishes the value of overseas revenues, triggering the index's retreat.

Asian markets in the red

On Friday, losses extended across other Asian markets:

- Hong Kong's Hang Seng dropped 1.6%, with Apple suppliers hit amid shifting tariff policy;

- China's CSI 300, tracking mainland blue chips, edged down 0.3%;

- South Korea's KOSPI declined 0.9%;

- The MSCI Asia-Pacific Index excluding Japan slid 0.6%.

US and Europe: calm before next move?

S&P 500 futures dipped 0.1%, following Thursday's rally driven by Nvidia's strong earnings report, a reaction already priced in across Asia. Eurozone STOXX 50 futures also posted modest losses.

Bonds and oil: flat with slight downward bias

The US 10-year Treasury yield held steady at 4.42%, after falling 5.5 basis points the day before.

Global oil prices slipped slightly:

- Brent crude dipped 0.3% to settle at $63.95 per barrel;

- WTI (West Texas Intermediate) eased 0.3% to $60.75.