EUR/USD

Analysis:

The dominant upward wave that began in February continues on the chart of the major euro pair. Two weeks ago, quotes started pulling back from the lower boundary of a strong resistance zone. Once the downward phase is fully completed, price growth is expected to resume.

Forecast:

A sideways trajectory is expected to continue in the coming week. The pair is likely to trend downward toward the support zone in the early days, followed by a reversal and renewed upward movement. A change in direction could result in increased volatility.

Potential Reversal Zones

Resistance: 1.1810 / 1.1860

Support: 1.1620 / 1.1570

Recommendations:

- Selling: Low potential; possible on intraday basis with reduced volume sizes.

- Buying: Could be profitable if reversal signals emerge near the support zone.

USD/JPY

Analysis:

The daily chart of the Japanese yen pair shows an upward wave model forming since August of last year. Its current active phase began in mid-April. Over the past two months, a corrective (B) wave in the form of a flattening structure has been developing. This correction appears incomplete at the time of analysis.

Forecast:

A flat movement is expected at the start of the week. Reversal conditions may emerge near the calculated support zone, resuming upward momentum. A brief dip below the support zone is possible. Volatility may increase toward the end of the week.

Potential Reversal Zones

Resistance: 149.20 / 149.70

Support: 146.90 / 146.40

Recommendations:

- Selling: Risky and may result in losses.

- Buying: Could be profitable if reversal signals appear near support.

GBP/JPY

Analysis:

The GBP/JPY pair has been trending upward since April, in line with the trend on the higher time frame. Price has reached the lower boundary of the weekly reversal zone. A countertrend move began last week, which, as of the analysis, still qualifies as a correction within the larger wave.

Forecast:

A continuation of the downward move is expected early in the week, likely ending near the support level. Afterward, the pair may reverse and resume its upward trajectory. A breakout beyond the expected weekly range is unlikely.

Potential Reversal Zones

Resistance: 200.00 / 200.50

Support: 197.50 / 197.00

Recommendations:

- Selling: May yield profits in individual sessions with reduced volume sizes; exit trades upon early reversal signals.

- Buying: Become relevant after reversal signals near the calculated support zone.

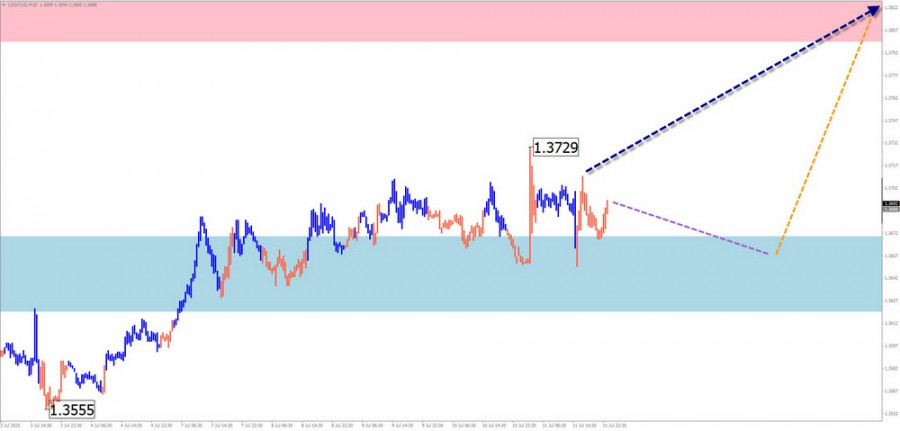

USD/CAD

Analysis:

Since mid-April, the Canadian dollar has been moving in a downward wave pattern. Since late May, a counter-move has developed in the form of a flattening correction, which lacks its final leg. Recently, the pair has moved sideways.

Forecast:

The pair is expected to continue sideways along the calculated support at the beginning of the week. A reversal and renewed bullish movement may follow in the second half of the week. Volatility could increase amid key news releases.

Potential Reversal Zones

Resistance: 1.3800 / 1.3850

Support: 1.3670 / 1.3620

Recommendations:

- Buying: May be profitable in individual sessions with reduced volume sizes; exit upon early reversal signals.

- Selling: No potential this week.

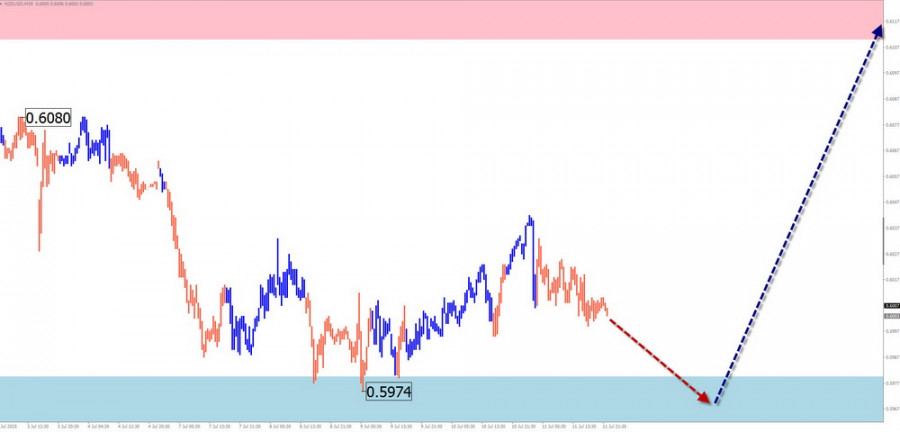

NZD/USD

Brief Analysis:

An upward wave zigzag has been forming on the New Zealand dollar chart since April. After a three-month flat correction, the bullish leg that began on June 23 initiated a new upward wave. A retracement is currently developing and is not yet complete.

Weekly Forecast:

Sideways movement is expected early in the week, with a possible decline to calculated support. A reversal is then expected, followed by a rise toward the resistance zone. A brief decline below support cannot be ruled out. Volatility is likely to peak at the end of the week.

Potential Reversal Zones

Resistance: 0.6110 / 0.6160

Support: 0.5980 / 0.5930

Recommendations:

- Selling: May become the main trade direction after confirmed reversal signals.

- Buying: Can be used in fractional volumes for individual sessions; potential is limited by resistance.

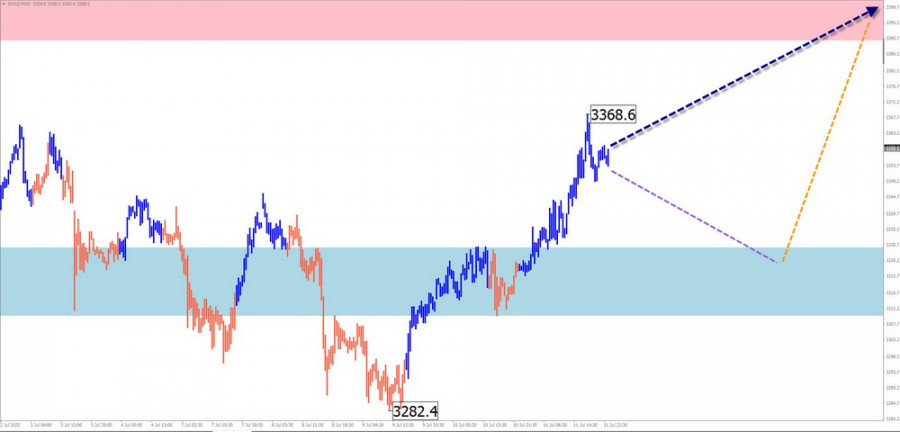

GOLD

Analysis:

The latest unfinished wave structure for gold has been forming since April. Within this bearish wave, the final leg (C) began in late June. The most recent section of the wave started on July 9. Price is currently within a cluster of resistance levels on different time frames.

Forecast:

The overall upward movement may continue this week until price fully reaches the calculated resistance. A brief decline toward the support zone is possible in the next couple of days. The resistance zone marks the upper boundary of the expected weekly price range.

Potential Reversal Zones

Resistance: 3390.0 / 3410.0

Support: 3330.0 / 3310.0

Recommendations:

- Buying: May be the main trade direction if confirmed signals appear based on your trading system.

- Selling: Risky and potentially unprofitable; best to stay out of the market until reversal signals are evident.

Note: In simplified wave analysis (SWA), all waves consist of three parts (A-B-C). Each time frame analyzes the most recent unfinished wave. Dotted lines indicate expected price movements.

Disclaimer: The wave algorithm does not account for the duration of price movements over time.