The EUR/USD currency pair continued to trade very calmly on Thursday, even when the results of the ECB meeting became known. It should be noted that there was no intrigue in this event. Long before June 5, it was clear that the European regulator was planning to cut the key rates for the eighth time. This was stated by almost all members of the monetary committee. Thus, there was no surprise in this decision.

As for the fact of the eighth rate cut itself, it had exactly the same impact on the market as all previous easing steps in 2025. Why specifically in 2025? Because it was in 2025 that Donald Trump became President of the United States, after which the prolonged decline of the American currency began. And at the moment, nothing can stop it except for the de-escalation or end of the Global Trade War. The market simply ignores all other factors, especially those in favor of the dollar.

It should be recalled that a central bank rate cut is a strong "bearish" factor for its currency. Accordingly, on the ECB rate cut, the euro should fall. Even if this decision is known in advance, the euro should show a "pre-emptive" decline. But look at the chart.

The euro has been rising for more than two weeks — and we are only talking about the latest uptrend. This week we saw a microscopic strengthening of the U.S. dollar after the JOLTs report showed a slightly higher figure than expected, but by Thursday the market ignored a much more important event favoring the dollar.

Thus, the ECB can cut rates five more times. As long as Donald Trump continues to blame the world for perceived injustices, escalate tariffs, make reckless decisions that unsettle economists, and promote his "One Big Beautiful Bill" promising an additional $4 trillion in national debt, there is no scenario in which the dollar can strengthen.

We still believe that if it weren't for Donald Trump's policies, the EUR/USD exchange rate would be somewhere near parity. Even now, the U.S. economy is not facing super-serious problems. Yes, a number of macroeconomic indicators are slowing and worsening, but this wouldn't have happened without Donald Trump. Trump brewed this mess, and he must deal with it. However, the U.S. leader has no desire to clean up this mess. On the contrary, he is much more eager to see a weak dollar to boost the country's exports. However, relying on a weak dollar alone will not go far, and the events of the past four months have created a strong reluctance among many countries, consumers, and businesses to have anything to do with the U.S. currency, economy, and goods.

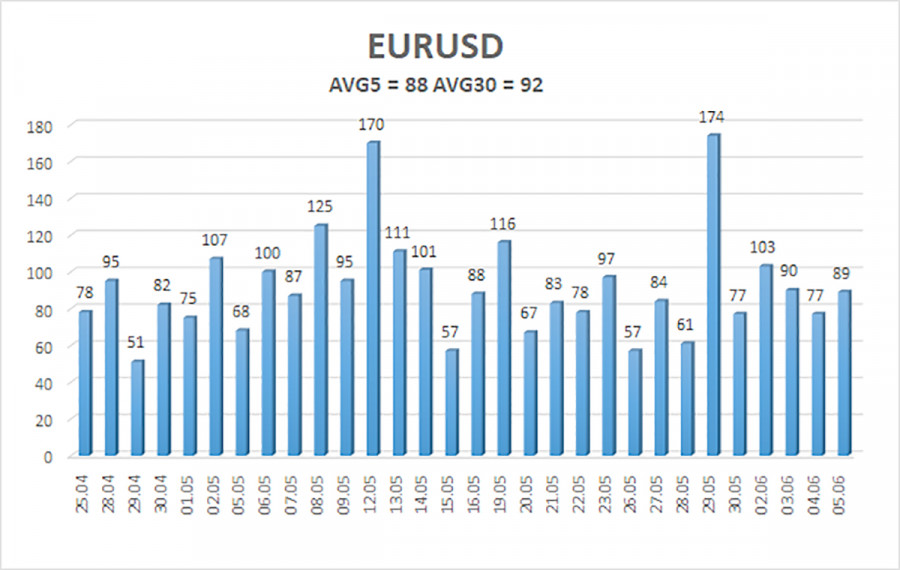

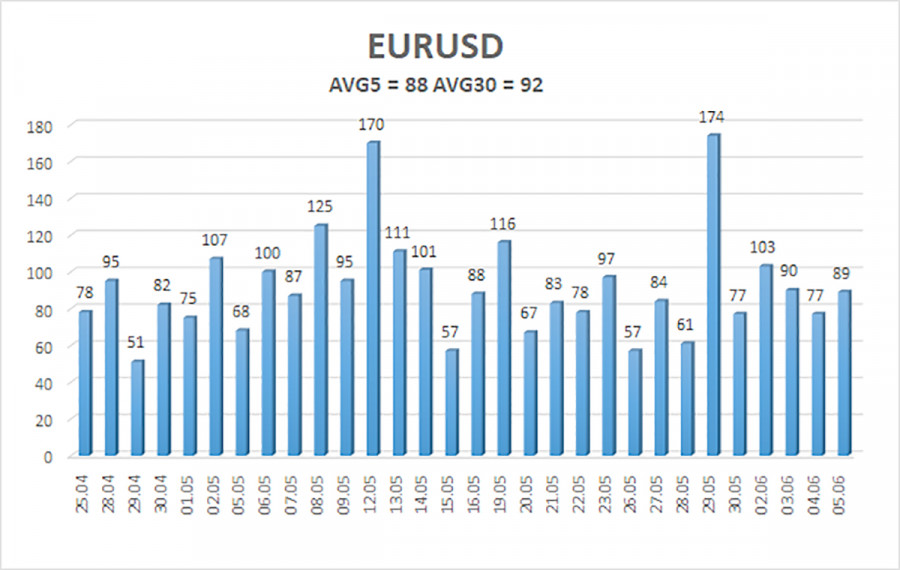

The average volatility of the EUR/USD currency pair over the last 5 trading days as of June 5 is 88 points and is characterized as "average." We expect the pair to move between the levels of 1.1351 and 1.1527 on Friday. The senior linear regression channel is directed upward, still indicating an upward trend. The CCI indicator dipped into the oversold area and a "bullish" divergence was formed, which triggered the resumption of the uptrend.

Nearest support levels:

- S1 – 1.1414

- S2 – 1.1353

- S3 – 1.1292

Nearest resistance levels:

- R1 – 1.1475

- R2 – 1.1536

- R3 – 1.1597

Trading Recommendations:The EUR/USD pair is trying to resume the uptrend. In recent months, we have consistently said that we expect only a decline in the euro in the medium term because the dollar still has no reason to fall, except for Donald Trump's policies, which are likely to have destructive and long-term consequences for the U.S. economy. However, we still note the market's complete unwillingness to buy the dollar even when there are reasons to do so, and the complete disregard of positive factors for the dollar. When the price is below the moving average, shorts are relevant with targets at 1.1292 and 1.1230, but strong declines should not be expected under current circumstances. Above the moving average line, long positions can be considered with targets at 1.1475 and 1.1527.

Illustration Explanations:

- Linear regression channels help determine the current trend. If both are pointing in the same direction, the trend is strong.

- The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which to trade.

- Murray levels — target levels for movements and corrections.

- Volatility levels (red lines) — the probable price channel in which the pair will spend the next day based on current volatility readings.

- The CCI indicator — entering the oversold area (below -250) or overbought area (above +250) signals that a trend reversal is near.