Analysis of Trades and Trading Tips for the Euro

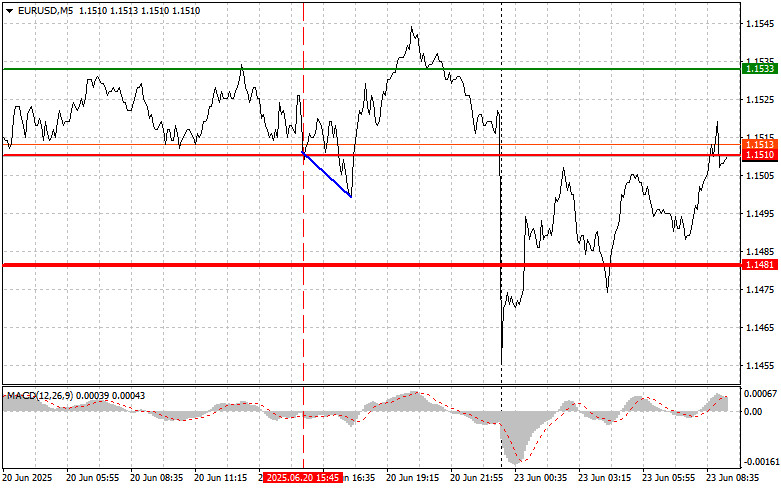

The test of the 1.1510 price mark coincided with when the MACD indicator had just begun to move downward from the zero mark, confirming a valid entry point for selling the euro. However, the pair never saw a significant decline.

The U.S. strike on Iran's nuclear facilities went largely unnoticed, and the initial drop in the euro against the dollar was quickly recovered. Markets are showing unexpected resilience during periods of geopolitical tension, as such events may have already been partially priced in. Investors may have viewed the attack as limited in scope and insufficient to disrupt global economic ties significantly.

Today, pressure on the pair may come from eurozone manufacturing PMI data in the first half of the day. The market is highly sensitive to such indicators, interpreting them as leading signals of the economy's health. A drop in the manufacturing PMI may point to a slowdown in growth, a decline in new orders, and worsening prospects for European manufacturers. This could prompt a flight to safety and strengthen the U.S. dollar as a safe-haven currency. However, it's essential to consider other key macroeconomic indicators as well. The eurozone services PMI is equally vital in shaping the broader economic outlook. If the services sector shows steady growth, it may offset the negative impact of the manufacturing slowdown and support the euro.

Furthermore, close attention will also be paid to the composite eurozone PMI, a weighted average of the manufacturing and services indices. This indicator provides the most comprehensive view of the health of the eurozone economy. If it remains above the 50-point threshold, it would suggest continued—albeit moderate—growth, which could limit the euro's downside potential.

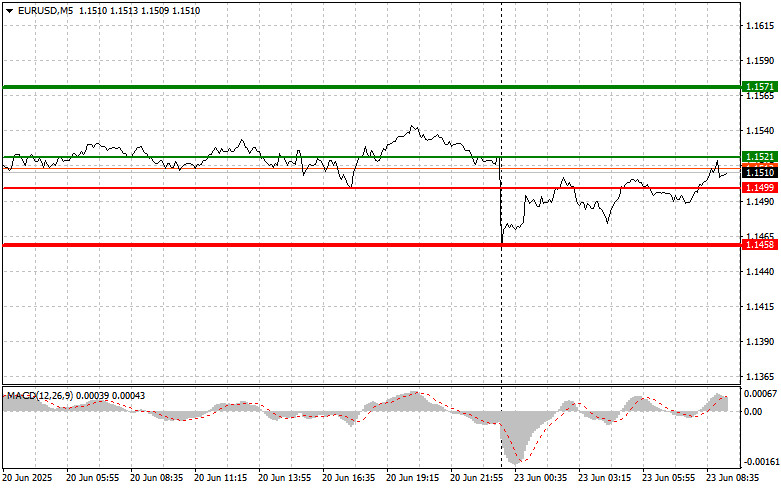

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: Buy the euro today if the price reaches 1.1521 (green line on the chart), targeting growth toward 1.1571. I plan to exit the market at 1.1571 and open a short position in the opposite direction, aiming for a 30–35 pip pullback. Euro growth today depends on strong reports.

Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I will also consider buying the euro if there are two consecutive tests of the 1.1499 price level while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and lead to a market reversal to the upside. Targets would be the opposite levels at 1.1521 and 1.1571.

Sell Scenario

Scenario #1: I plan to sell the euro after it reaches the 1.1499 level (red line on the chart). The target will be 1.1458, where I intend to exit and open a long position in the opposite direction (expecting a 20–25 pip move upward from that level). Pressure on the pair will return if today's data disappoints.

Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I will also consider selling the euro if there are two consecutive tests of the 1.1521 level while the MACD indicator is in the overbought zone. This would cap the pair's upward potential and lead to a market reversal downward. The expected targets in this case are 1.1499 and 1.1458.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.