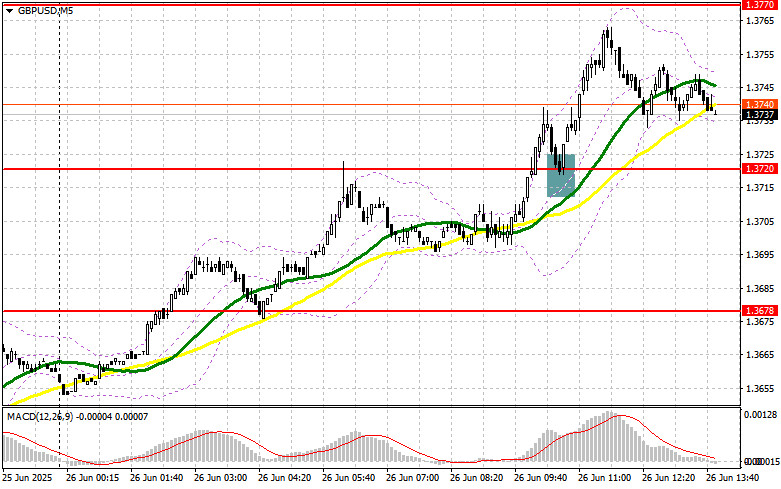

In my morning forecast, I focused on the 1.3720 level and planned to base my market entry decisions around it. Let's look at the 5-minute chart and analyze what happened. A breakout and subsequent retest of 1.3720 offered an excellent entry point for long positions on the pound, resulting in a rise of over 40 points. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD:

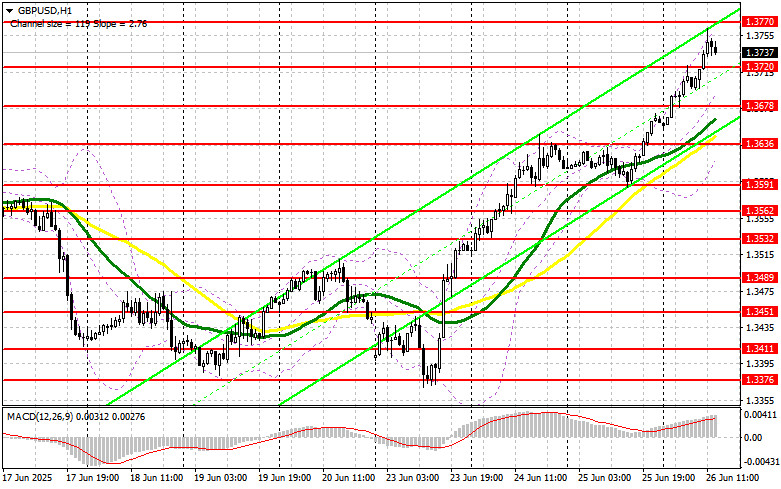

The pound extended its rally, fueled by yesterday's momentum following criticism of Jerome Powell. However, during the U.S. session today, things may change quickly due to upcoming GDP and labor market data. The calendar includes Q1 GDP figures, weekly jobless claims, durable goods orders, and the trade balance for goods—key indicators that could shape the broader picture.

Weak U.S. data will weigh on the dollar, while strong readings could put pressure on the overbought pound. If GBP/USD declines, I would prefer to act near the new support at 1.3720. A false breakout there would present a good entry point for long positions, aiming for a return to the 1.3770 resistance level. A breakout and retest of this range from above would confirm a new entry point for long positions with the prospect of retesting 1.3818. The ultimate target would be the 1.3864 level, where I plan to take profit.

If GBP/USD drops and there is no buying activity around 1.3720 in the second half of the day, bearish pressure could intensify. In this case, only a false breakout near 1.3678 would serve as a basis for long positions. I would consider buying GBP/USD on a rebound from the 1.3636 support, targeting a 30–35 point intraday correction.

To open short positions on GBP/USD:

Sellers became active after another monthly high was reached, but this still looks more like a correction than genuine bearish pressure from major players. If GBP/USD continues rising following weak U.S. data, only a false breakout around 1.3770 would offer a signal to enter short positions, targeting a decline toward 1.3720.

A breakout and retest of that range from below would trigger stop-losses, opening the way toward 1.3678, where the moving averages are located. The ultimate downward target is 1.3636, where I would take profit.

If demand for the pound persists in the second half of the day and sellers fail to act near 1.3770, a sharper rise in GBP/USD cannot be ruled out. In this case, it's better to postpone short positions until the 1.3818 resistance is tested. I would only open short positions there if a false breakout is confirmed. If the pair fails to turn lower there, I would look for short entries from the 1.3864 level, but only for a 30–35 point intraday correction.

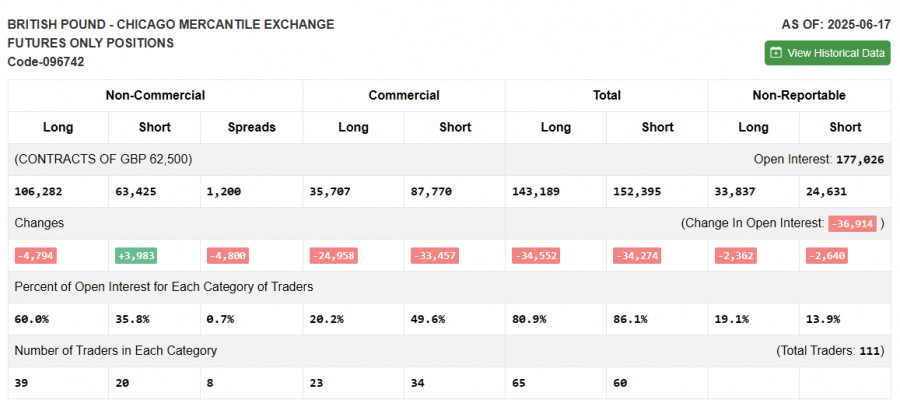

COT Report (Commitments of Traders) – June 17

The latest COT report showed an increase in short positions and a reduction in long ones. The Fed's decision to keep rates unchanged had a supportive effect on the dollar, but geopolitical tensions in the Middle East remained the key factor behind its strength. Soon, U.S. growth data will be released, which could influence the Fed's future policy stance.

The market will also closely watch how Jerome Powell interprets inflation trends and whether he signals possible rate cuts in the fall. The latest COT data show that long non-commercial positions decreased by 4,794 to 106,282, while short positions rose by 3,983 to 63,425. As a result, the gap between long and short positions narrowed by 4,800.

Indicator Signals:

Moving AveragesTrading is taking place above the 30- and 50-day moving averages, which suggests continued growth for the pair.Note: The author uses H1 (hourly) chart settings, which differ from traditional daily (D1) moving average interpretations.

Bollinger BandsIn case of a decline, the lower band around 1.3590 will act as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise. Period – 50 (yellow line).

- Moving Average (MA): Period – 30 (green line).

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12; Slow EMA – 26; SMA – 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between long and short non-commercial positions.