It is becoming increasingly difficult for gold to maintain balance and move towards new highs. Gold is facing numerous obstacles along the way, primarily the current monetary policy of the US Federal Reserve and macroeconomic data from the United States. The markets pay close attention to these factors as they determine the direction of the dollar, which directly affects the dynamics of gold.

In the middle of the week, the yellow metal is trading at a moderate pace, with little changes over the past few days. Gold had previously experienced a slight decline but managed to stay afloat. This week, the yellow metal made a comeback. On Tuesday evening, July 4th, the price of August futures for gold on the New York Commodities Exchange increased by 0.29% to $1,935 per troy ounce.

However, gold struggled to maintain an uptrend. As a result, the precious metal slipped back to lower levels. On Wednesday morning, XAU/USD was trading at $1,925, trying to hold within the current range.

Upcoming macroeconomic data from the United States and the decision of the Federal Reserve regarding the key interest rate hold significant importance for the future dynamics of gold. The markets are focused on the publication of the FOMC June minutes scheduled for Wednesday, July 5th. Last month, the regulator kept the key interest rate unchanged, breaking the long cycle of monetary tightening. According to analysts, the Fed will continue to raise the rate this month. The majority of experts (88.7%) hold this position, anticipating a 25 basis point increase from the current level of 5%-5.25%.

It is worth noting that gold is highly sensitive to changes in the Federal Reserve's monetary policy as it directly influences the value of the dollar. Traditionally, the tightening of monetary conditions supports the US currency, making gold less affordable for purchasing in other currencies.

In addition to the current macroeconomic statistics, reports on the American jobs market will be released on Thursday and Friday. It is important to highlight that the Federal Reserve takes these data into account when making decisions on the key interest rate. On Thursday, July 6th, information on the number of initial jobless claims in the United States is expected. Preliminary estimates suggest an increase of 6,000 claims, reaching 245,000. On Friday, July 7th, the market will evaluate the data on the unemployment rate. The indicator is projected to decrease to 3.6% from the previous 3.7%. Meanwhile, the number of nonfarm payrolls in the US economy is expected to increase by 225,000 in June after surging by 339,000 in May.

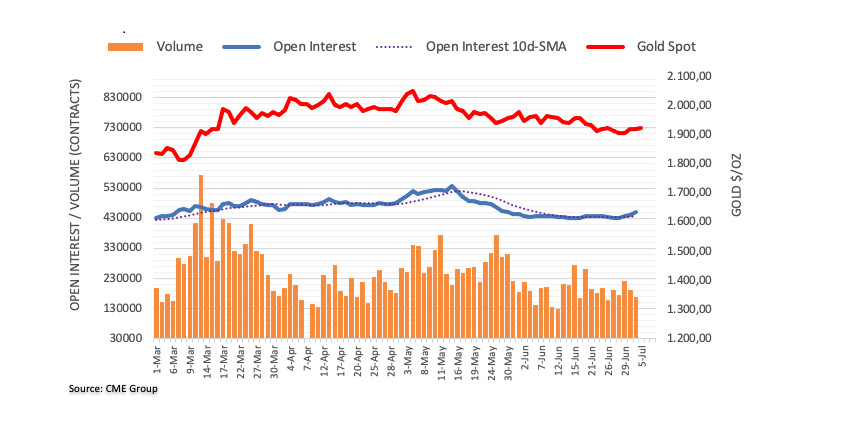

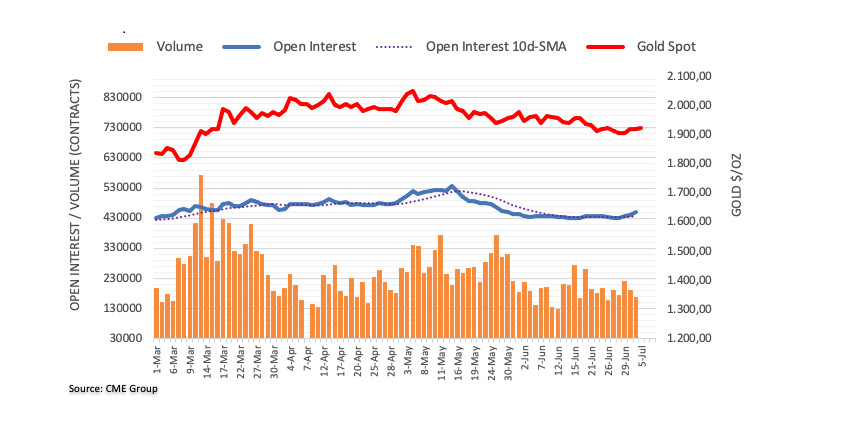

Against this backdrop, the yellow metal remains under pressure, which has persisted for several weeks. However, in the first half of 2023, gold prices, including futures and spot quotes, increased by 5%. Nevertheless, experts see the current support level at $1,900 as unreliable. The reason for the decline in the price of the precious metal, according to analysts at Commerzbank, is a decrease in investor interest, evidenced by the reduction in the share of gold ETFs since early June. The mass outflow of investors into the dollar and other assets has caused a decline in gold prices, as emphasized by the bank.

According to preliminary forecasts, gold is capable of continuing its growth, albeit at a moderate pace. At the moment, gold has moved away from the lows of last week (near $1,900), but it is far from a confident rally. According to analysts at CME Group, this trend, along with a high level of open interest, indicates continued growth in the near term. However, further upward movement of the precious metal will face resistance at the 100-day SMA, which was around $1,945 earlier this week.

According to currency strategists at TD Securities, despite overall positive trends, XAU/USD has little chance of a significant rally. In the short term, a sharp increase in gold prices is unlikely, but in the long term, it is quite possible. The reason is the Federal Reserve's stance on further raising the key interest rate. Currently, the futures market factors in a high probability of an additional 25 basis point rate hike in late July into the price of gold. This negatively affects the upside potential of gold.

Economists at ANZ Bank also share this view. The specialists note good prospects for the XAU/USD pair in the medium and long-term planning horizons and some deterioration in the near future. "The likelihood of the Federal Reserve pausing at the next meeting has increased, but strong economic activity will allow the regulator to maintain a hawkish stance. In the short term, this contributes to a consolidation of gold prices," emphasized ANZ Bank.

According to analysts, a tailwind for the precious metal will be the resumption of the downward trend in the US dollar. In such a situation, gold will gain additional support.

Currency strategists at ANZ Bank are confident that in the second half of 2023, the Federal Reserve will conclude its rate hiking cycle. "This is a factor of structural support for gold in the medium and long-term perspectives. Gradual weakening of the greenback will provide substantial support for the yellow metal."