Markets Brush Off Tariff Threats as S&P 500 Rises

Despite fresh trade threats from President Donald Trump, U.S. markets closed higher on Monday, reflecting continued investor confidence in the progress of trade talks between the U.S. and its key economic partners.

Trump Doubles Down on Tariffs

On Friday night, Trump announced plans to raise tariffs on imported steel and aluminum from 25% to 50%, with the change set to take effect on Wednesday. The statement came just hours after he accused China of backtracking on previously agreed terms.

Beijing Pushes Back Firmly

In response, China labeled Trump's accusations as "groundless" and reaffirmed its commitment to defending its trade interests. Officials insisted that no consensus was breached during negotiations in Geneva.

U.S. Sets the Clock

According to a draft letter reviewed by journalists, the U.S. administration has urged its trade partners to submit final proposals by Wednesday. Washington appears determined to fast-track discussions, aiming to wrap up negotiations within five weeks.

Steel Stocks Surge, Automakers Slide

Shares of American steelmakers soared on the news. Cleveland-Cliffs led the charge, jumping 23%, while Nucor and Steel Dynamics also saw significant gains. In contrast, automakers took a hit — Ford dropped nearly 3.9%, with General Motors showing similar losses.

Storm Ahead? Markets Remain Hopeful

Analysts caution that escalating tariffs could reignite global trade tensions and dampen recent market optimism driven by a more conciliatory U.S. trade tone. For now, however, investors appear to believe that dialogue will ultimately prevail.

Markets Rally in May as Trade Tensions Ease and Earnings Impress

U.S. stock markets capped off May on a high note, with the S&P 500 delivering its strongest monthly performance since November 2023. A relaxation in trade threats and upbeat earnings reports fueled investor confidence.

Tariff Pressure Lightens — Investors Exhale

The U.S. softened its stance on tariffs toward China and backed away from confrontational rhetoric with the European Union. These diplomatic shifts, paired with improving corporate fundamentals and signs of economic resilience, helped sustain market momentum.

Indexes March Higher

The Dow Jones Industrial Average climbed 35.41 points (+0.08%) to close at 42,305.48. The S&P 500 gained 24.25 points (+0.41%) to reach 5,935.94, while the Nasdaq Composite rose 128.85 points (+0.67%) to settle at 19,242.61.

May marked the S&P's best monthly gain in 18 months, reinforcing investor optimism after a stretch of economic uncertainty.

Energy Stocks Shine as OPEC+ Holds Steady

Shares in energy firms advanced after OPEC+ announced it would maintain July production at levels seen over the past two months. The move helped stabilize sentiment in the commodity space.

Tech Titans on the Move

Tech giants continued to attract investor capital. Nvidia rose 1.7%, while Meta (banned in Russia) jumped 3.6% amid ongoing enthusiasm for AI and digital platforms.

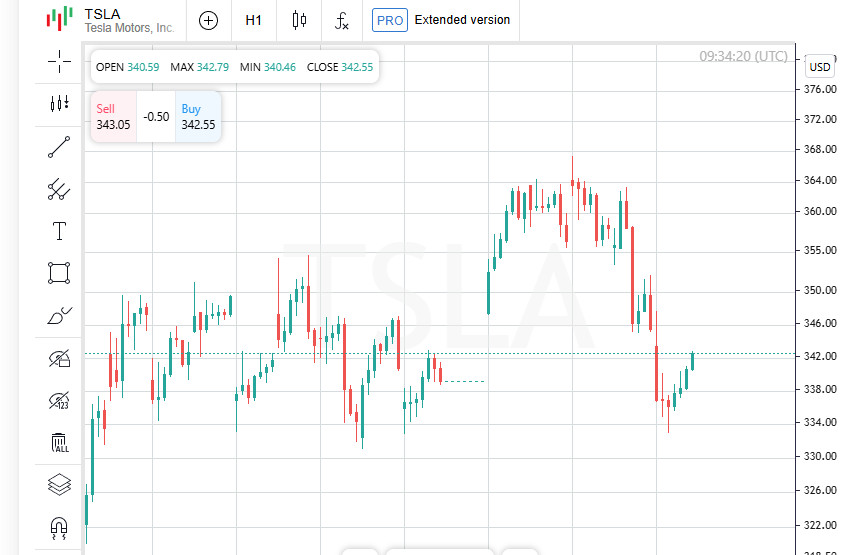

Tesla Stumbles in Europe

Tesla bucked the trend, sliding 1.1% after weaker-than-expected monthly sales in Portugal, Denmark, and Sweden. The drop raised concerns about the company's European market traction.

Manufacturing Contraction Signals Supply Stress

A report from the Institute for Supply Management (ISM) revealed that U.S. manufacturing contracted for the third consecutive month in May. Supply chains have slowed, partly due to tariff-related disruptions, hinting at potential shortages in certain goods.

Fed Eyes Data Closely Amid Inflation and Labor Resilience

Dallas Federal Reserve President Lorie Logan emphasized that the central bank remains in a cautious mode as inflation stays above target and labor market conditions remain strong. She noted that the Fed is scrutinizing a broad set of indicators before deciding on next steps.

Markets Bet on Rate Cuts

According to data from LSEG, traders are pricing in at least two interest rate cuts of 25 basis points by year-end. This outlook reflects growing market sentiment that the Fed may eventually move toward easing — despite persistent inflationary pressures.

All Eyes on Friday's Jobs Report

Investors are awaiting Friday's U.S. nonfarm payrolls report, which is expected to offer a critical insight into how well the job market is holding up amid growing trade-related uncertainty.

European Stocks Slide as Trade Fears Weigh on Sentiment

Across the Atlantic, European markets ended lower on Tuesday, with economically sensitive sectors like banking and mining taking the brunt of investor pessimism. Hopes for a swift resolution to trade tensions continue to fade.

STOXX 600 Dips Again

The pan-European STOXX 600 index erased earlier gains, falling 0.5% by 08:30 GMT. Monday's losses deepened as the banking sector dropped 1.4%, while mining stocks declined by 2.3%.

OECD Cuts Global Growth Forecast

The Paris-based Organisation for Economic Co-operation and Development (OECD) slashed its global economic outlook. It warned that ongoing trade disputes are inflicting greater damage on the U.S. economy than previously estimated.

Markets Brace for ECB and Inflation Data

This bout of market anxiety comes just ahead of two key events: the eurozone's preliminary inflation reading and a European Central Bank policy meeting later this week, both of which could shape the region's monetary path moving forward.

Trade Uncertainty and European Political Upheaval Rattle Markets

Concerns over how President Donald Trump's tariffs will move forward continued to weigh on sentiment after facing legal hurdles last week. The White House has now requested a federal appeals court to pause a second ruling that challenged the legality of its trade measures.

U.S. Presses for Deals — Leaders May Speak Soon

Despite the courtroom drama, Washington is pushing for progress. The administration urged trade partners to submit improved proposals by Wednesday. There's growing speculation that both Trump and China's president could make public remarks this week — a possible signal that negotiations are nearing a new phase, even amid heightened tension.

Safe-Haven Sectors Rise

With market volatility on the rise, investors pivoted toward defensive sectors. Utilities and telecom companies led the charge, pushing the sector index (.SXKP) into positive territory for the day.

Dutch Government on the Brink

Adding to the global political tension, Dutch far-right leader Geert Wilders announced that his party PVV would exit the ruling coalition. The move could collapse the current right-wing government and force early elections, injecting fresh uncertainty into EU politics.

The AEX index in Amsterdam dropped 0.6%, largely mirroring declines seen across broader regional markets.

Corporate Movers: Mixed Fortunes

British water company Pennon Group fell 2.1% after reporting a full-year pre-tax loss. In contrast, UBS gained 2% as Jefferies upgraded the stock from "hold" to "buy." Swiss lender Julius Baer, however, slipped 1.9% after announcing a new cost-cutting initiative targeting CHF 130 million in savings by 2028.

Cofinimmo Shares Climb on Healthcare Real Estate Merger

Belgian real estate investment firm Cofinimmo saw its stock rise 2.9% after announcing a merger with Aedifica, a property company focused on healthcare and assisted living facilities.

Strategic Expansion into Healthcare

Both firms operate in complementary segments, and the merger is expected to strengthen their combined presence in the fast-growing healthcare real estate market. Investors view the move as a smart play for long-term growth and operational synergy.