The GBP/USD currency pair continued its upward movement on Thursday, trading overall calmly and without any rush. There was no news for either the British pound or the U.S. dollar on Thursday. Donald Trump, with great effort, refrained from introducing new tariffs or raising existing ones, and no macroeconomic publications were scheduled for that day. Nevertheless, the market continued to buy pounds with dollars. And this is something to keep in mind in the near future: the dollar may make minimal corrections, may stand still for a couple of days, but it will still keep falling. Simply because the situation with the trade war isn't getting any better by the day.

A few weeks ago, some signs of de-escalation appeared, which slightly helped the dollar and brought some optimism to market participants. But that optimism quickly vanished into thin air. "It flew away and didn't promise to come back." Recall that initially Trump wanted to raise tariffs on all goods from the European Union but changed his mind the very next day, inspiring hope for an imminent trade deal with Brussels. However, it is now clear that the negotiations are again bogged down, and there is very little time left until July 9 to sign such a comprehensive agreement.

Then China and the U.S. agreed to lower tariffs by 115% for 90 days, which also seemed to many a sign of de-escalation. However, a couple more weeks passed, and Trump again accused Beijing of all mortal sins, with no positive news on the negotiations' progress. Moreover, Trump is still waiting for a personal call from Xi Jinping, but he may wait forever. If the Chinese leader wanted to call Trump and discuss the current situation, he would have done so long ago. But Xi Jinping shows no desire to talk to Trump.

Later, it became known that the governors of 12 Democratic U.S. states filed a collective lawsuit in the International Trade Court requesting to overturn all of Trump's tariffs. The court reviewed the lawsuit, flipped through the legislation, and decided to satisfy the plaintiffs' request, since there was no clause "declare a state of emergency – and do whatever you want" in the emergency law. The court ruled that global tariffs could only be introduced with Congressional approval. And Congress learns about new tariffs from the news or White House broadcasts.

But a little later, the U.S. Court of Appeals overturned the International Trade Court's decision, so the situation again gave hope, but in fact, things did not improve. The "cherry on top" was the June 4 decision to raise tariffs on steel and aluminum imports to 50%, indefinitely. Trump decided that domestic producers of these two metals were insufficiently protected, and 25% tariffs allowed many foreign companies to circumvent restrictions. But 50% tariffs will put an end to this outrage. After all the above, does anyone still wonder why the dollar keeps falling?

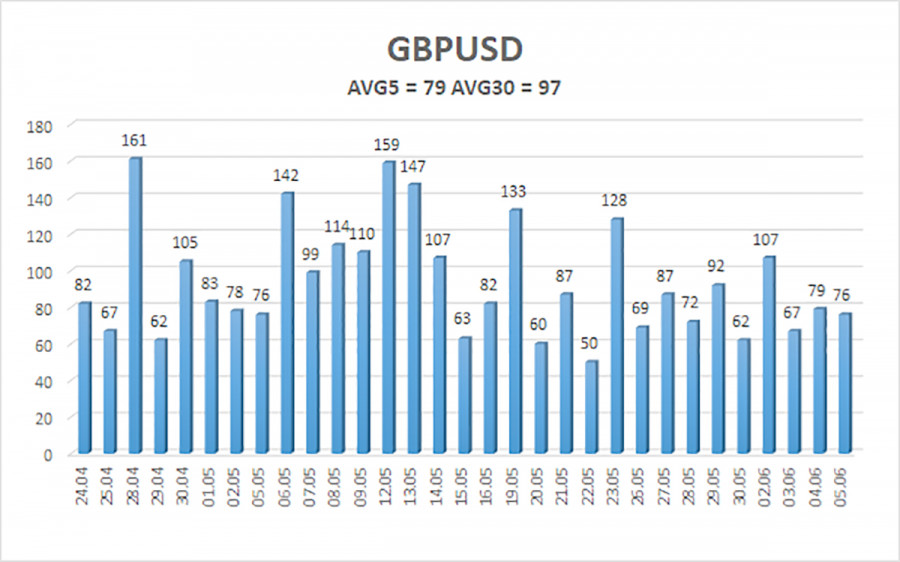

The average volatility of the GBP/USD pair over the last 5 trading days is 79 points. For the pound/dollar pair, this figure is considered "average." On Friday, June 6, we expect the movement within the range bounded by 1.3500 and 1.3658. The senior linear regression channel is directed upward, indicating a clear uptrend. The CCI indicator has not recently entered extreme zones.

Nearest support levels:

- S1 – 1.3550

- S2 – 1.3428

- S3 – 1.3306

Nearest resistance levels:

- R1 – 1.3672

- R2 – 1.3794

- R3 – 1.3916

Trading Recommendations:The GBP/USD currency pair maintains an uptrend and continues to rise. And there is plenty of news supporting such a movement. The de-escalation of the trade conflict both started and ended quickly, while the market's aversion to the dollar remains. Every new decision or event related to Trump is perceived negatively by the market. Thus, long positions are possible with targets at 1.3658 and 1.3672 when the price is above the moving average. A consolidation below the moving average line would allow considering shorts with targets at 1.3428 and 1.3306, but who is expecting strong dollar growth now? From time to time, the U.S. currency may show minor corrections. For a stronger rise, real signs of de-escalation in the Global Trade War are needed.

Illustration Explanations:

- Linear regression channels help determine the current trend. If both point in the same direction, the trend is strong.

- The moving average line (settings 20.0, smoothed) determines the short-term trend and direction in which trading should be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) represent the probable price channel the pair will spend the next day within based on current volatility indicators.

- The CCI indicator — entering the oversold area (below -250) or the overbought area (above +250) signals that a trend reversal in the opposite direction is approaching.