Trade Review and Tips for Trading the Euro

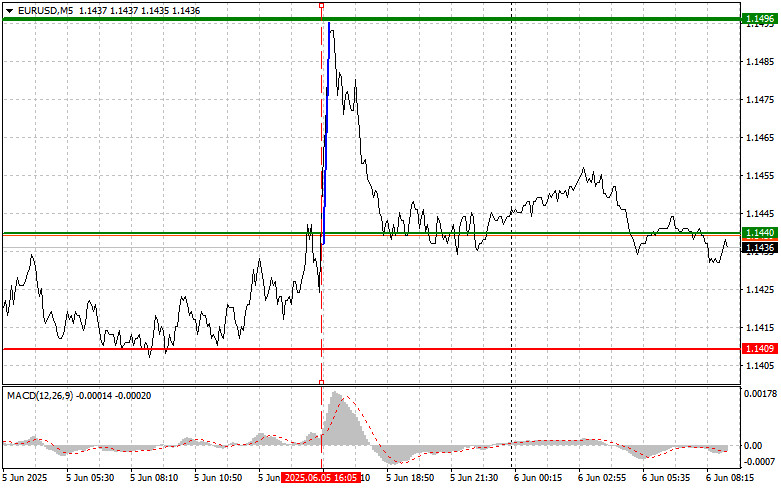

The price test at 1.1440 coincided with the moment when the MACD indicator had just started moving upward from the zero mark, confirming the correct entry point for buying the euro and resulting in the pair rising by more than 50 points.

The European Central Bank's pause in the current interest rate reduction cycle has pushed euro quotes upward. This unexpected move by the ECB is likely driven by a sharp decline in inflation, which, according to recent data, has returned to the ECB's target level. On the other hand, the ECB may wish to analyze the results of the measures already taken before deciding on further rate cuts. Overall, the ECB's decision and its consequences have triggered mixed feelings in financial markets. Expert opinions on the future trajectory of the euro are divided. Some believe the euro's rise will be short-lived, while others are confident that the upward trend will continue. Time will tell how justified the ECB's decision is and what impact it will have on the eurozone economy and the global economic system.

Today, investors' focus is on Germany and the eurozone GDP data. Information on industrial production dynamics will serve as a key indicator of the manufacturing sector's health, which is crucial for overall economic growth prospects. The report on Germany's foreign trade balance is also of significant interest. A positive trade balance has traditionally been an advantage for the German economy, but recently there has been a trend of decline.

The revised estimate of the first-quarter GDP will provide a clearer picture of the region's economic development. Preliminary data pointed to growth, but traders will closely examine the GDP structure to determine the contribution of various economic sectors and identify potential risks. Changes in employment levels will also be an important indicator of labor market conditions and prospects for increased consumer spending. Positive developments in the labor market can support economic growth, although heightened inflationary pressures could offset this positive effect.

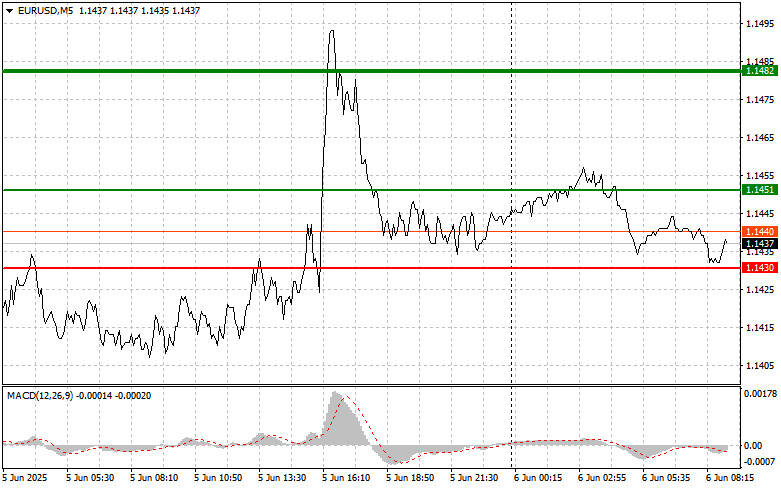

As for the intraday strategy, I will mainly rely on the implementation of Scenarios #1 and #2.

Buy Scenarios

Scenario #1: Today, buying the euro is possible upon reaching the price area around 1.1451 (green line on the chart) with a target of rising to 1.1482. At 1.1482, I plan to exit the market and also sell the euro in the opposite direction, aiming for a movement of 30–35 points from the entry point. Counting on euro growth is only reasonable after positive statistical data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1430 price area when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and could trigger a reversal upward. Growth to the opposite levels of 1.1451 and 1.1482 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the euro after reaching the 1.1430 level (red line on the chart). The target will be 1.1399, where I plan to exit the market and immediately buy in the opposite direction (aiming for a movement of 20–25 points back from the level). Selling pressure on the pair will return in case of weak data. Important! Before selling, ensure that the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1451 price area when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and could trigger a reversal downward. A decline to the opposite levels of 1.1430 and 1.1399 can be expected.

What's on the chart:

- Thin green line – entry price for buying the trading instrument.

- Thick green line – estimated price for setting Take Profit or manually closing the trade, as growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – estimated price for setting Take Profit or manually closing the trade, as a further decline below this level is unlikely.

- MACD Indicator – It is important to use overbought and oversold zones as a guide when entering the market.

Important: Beginner traders in the Forex market should make decisions very carefully when entering the market. It's best to stay out of the market before the release of important fundamental reports to avoid getting caught in sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Spontaneous decision-making based on the current market situation is inherently a losing strategy for intraday traders.