Trade Review and Tips for Trading the British Pound

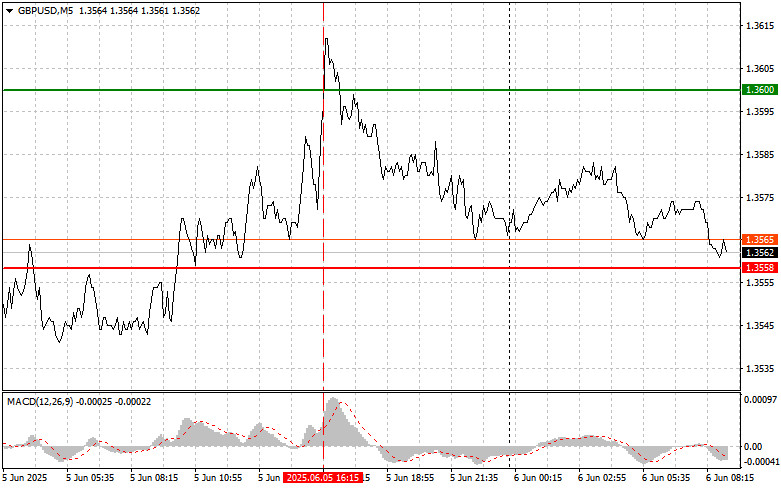

The price test at 1.3600 in the second half of the day coincided with the moment when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the pound.

Yesterday, the pound attempted to move alongside the euro following the ECB's decision to pause the interest rate reduction cycle, but the move turned out to be rather muted. This synchronicity, although brief, highlights the close connection between European financial markets and the pound's sensitivity to decisions made in the eurozone. The market's initial positive reaction to the ECB's decision, reflected in the strengthening of both currencies, shows the general expectation of a more cautious monetary policy going forward. However, the pound's subsequent rollback after reaching a weekly high indicates the presence of internal factors exerting pressure on the British currency. These may include concerns about the UK's economic growth prospects, uncertainty regarding trade relations with the U.S., or expectations concerning the future policy of the Bank of England.

Today, only the Halifax House Price Index is scheduled for release in the UK, which is not of major interest to traders. Moreover, this eventful week will conclude tomorrow with the publication of key U.S. labor market data, leaving little room for secondary indicators.

The Halifax House Price Index reflects the state of the UK housing market, but its impact on the broader economic outlook is limited. Traders typically focus on broader macroeconomic indicators such as inflation, GDP, and employment levels, which directly influence the Bank of England's interest rate decisions.

As for the intraday strategy, I will mainly rely on the implementation of Scenarios #1 and #2.

Buy Scenarios

Scenario #1: Today, I plan to buy the pound upon reaching the entry point around 1.3576 (green line on the chart) with a target at 1.3630 (thicker green line on the chart). Around 1.3630, I plan to exit purchases and open short positions in the opposite direction (targeting a movement of 30–35 points in the opposite direction). Counting on strong growth of the pound is only reasonable after strong data. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3546 level when the MACD indicator is in the oversold zone. This would limit the pair's downward potential and could trigger a reversal upward. A rise to the opposite levels of 1.3576 and 1.3630 can be expected.

Sell Scenarios

Scenario #1: Today, I plan to sell the pound after breaking below 1.3546 (red line on the chart), which would likely lead to a rapid decline of the pair. The main target for sellers will be 1.3504, where I plan to exit short positions and immediately consider buying in the opposite direction (aiming for a 20–25 point reversal). Selling the pound is possible after a failed attempt to break above the daily high. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3576 when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and could trigger a reversal downward. A decline to the opposite levels of 1.3546 and 1.3504 can be expected.

What's on the chart:

- Thin green line – the entry price for buying the trading instrument.

- Thick green line – the estimated price for setting a Take Profit or manually closing profits, as further growth above this level is unlikely.

- Thin red line – the entry price for selling the trading instrument.

- Thick red line – the estimated price for setting a Take Profit or manually closing profits, as further decline below this level is unlikely.

- MACD Indicator – it's important to use the overbought and oversold zones when entering the market.

Important: Beginner traders in the Forex market should make entry decisions very carefully. It's best to stay out of the market before major fundamental reports are released to avoid being caught in sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Spontaneous decision-making based on the current market situation is inherently a losing strategy for an intraday trader.