Trade Analysis and Tips for Trading the British Pound

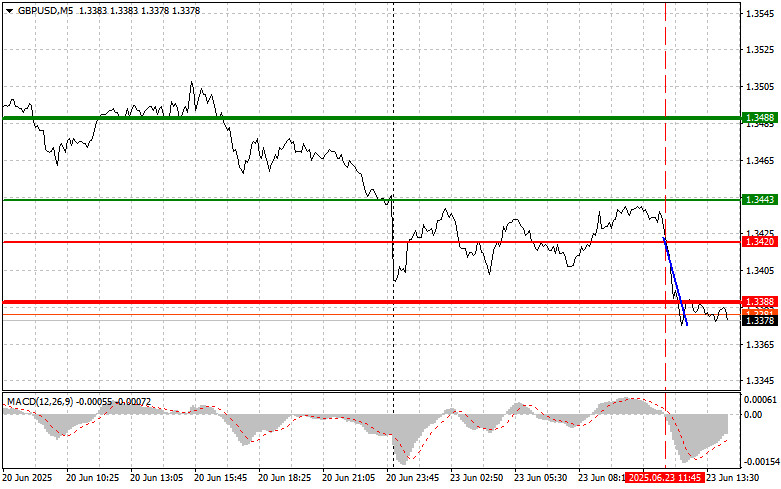

The price test at 1.3420 in the first half of the day coincided with the MACD indicator just starting to move downward from the zero mark, confirming the correctness of the market entry point. The sell trade yielded about 30 points in profit.

Fairly strong PMI data from the UK only provided temporary support for the pound. Economic realities, despite brief optimism, proved stronger, reminding investors of more fundamental problems facing the British economy. First and foremost, inflation—although declining—remains high, eroding consumers' purchasing power and putting pressure on businesses. Because of this, the Bank of England is in no rush to cut interest rates. Second, geopolitical consequences of the military conflict in the Middle East could impact trade relations among several countries. Third, there is global economic uncertainty driven by geopolitical risks and slowing global economic growth.

Although we await U.S. PMI and existing home sales data in the second half of the day, all attention will likely shift to the further escalation of the Middle East conflict. As is well known, geopolitical tension has a powerful influence on financial markets, and the current situation is no exception. Investors are nervously watching every update and piece of news, trying to assess potential risks and adjust their strategies. However, beyond short-term volatility, the long-term consequences of the Middle East conflict may prove far more serious—possibly involving realignments in geopolitical alliances, shifts in capital flows, and even a new round of the arms race.

Remarks by FOMC members Michelle Bowman and John Williams will also draw attention. Investors will closely monitor their rhetoric for hints regarding the future path of interest rates. The market expects the Fed to maintain current rates, but any signals about prospects for the fall will be key.

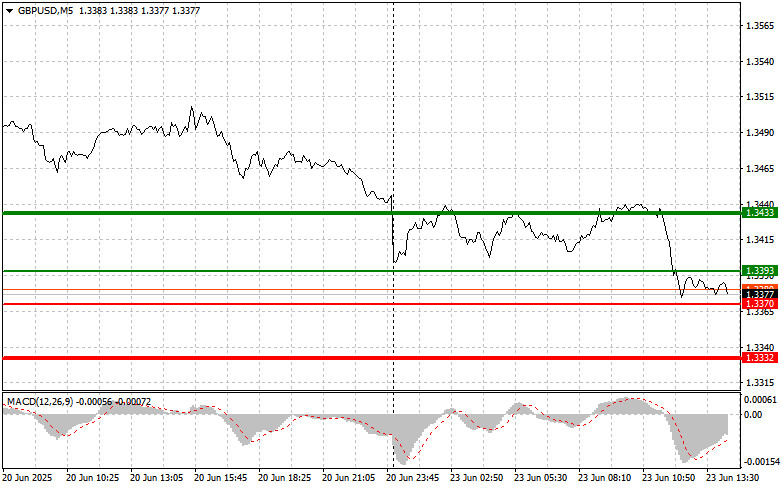

As for the intraday strategy, I will focus mainly on scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound after reaching the entry point around 1.3393 (green line on the chart), aiming for a rise to 1.3433 (thicker green line on the chart). Around 1.3433, I will exit long positions and open short positions in the opposite direction (expecting a 30–35 point pullback). Today's pound growth is expected only within the context of a correction.Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3370 level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to a market reversal upward. A rise toward 1.3393 and 1.3433 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after the level of 1.3370 is updated (red line on the chart), which will lead to a quick drop in the pair. The sellers' main target will be the level of 1.3332, where I will exit short positions and open buys in the opposite direction (expecting a 20–25 point upward correction). Sellers are likely to take action if strong statistics are released.Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3393 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward 1.3370 and 1.3332 can be expected.

Chart Key:

- Thin green line – the entry price for buying the instrument

- Thick green line – the suggested price to place Take Profit or manually fix profits, as further growth above this level is unlikely

- Thin red line – the entry price for selling the instrument

- Thick red line – the suggested price to place Take Profit or manually fix profits, as further decline below this level is unlikely

- MACD Indicator – it's important to follow overbought and oversold zones when entering the market

Important Note for Beginner Traders:

Beginner Forex traders must exercise great caution when deciding to enter the market. It's best to stay out of the market before the release of important fundamental reports to avoid sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you're not using money management and trading with large volumes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Making spontaneous decisions based on the current market situation is an inherently losing strategy for intraday traders.