The EUR/USD currency pair traded very calmly throughout Thursday, until unemployment and labor market reports were released in the United States. However, we will discuss those reports in other articles. In this one, we'll take a broader look at the current situation of the EUR/USD pair.

There's not much to discuss, as from a global perspective, the U.S. dollar has been in decline for five consecutive months. Let us recall that at the very beginning of the year, the dollar was trading at its highest levels in three years, and overall, very close to 23-year highs. However, with Donald Trump's rise to power, the dollar has now traded at its lowest levels in four years. If the euro rises to 1.2550, it would mark the weakest value for the dollar in the past 11 years. So in just five months, Trump has turned the entire world and financial system upside down.

Previously, commercial banks, central banks, and various funds sought to accumulate dollar reserves, viewing the U.S. dollar as a "safe" and stable currency. There is now a clear trend toward divesting from the U.S. dollar. Where people once stored dollars under their pillows, they now hold euros, pounds, francs — anything but dollars. It's also important to note that the shift away from the dollar isn't solely due to Trump's arrival or the currency's newfound instability. The dollar is being discarded because it is losing value at an alarming rate. Who wants to have a dollar "safety cushion" and watch it lose value day after day?

While the dollar continues to plunge into the abyss, Trump has just barely managed to sign his third "grand" trade deal. We don't mean to sound sarcastic, but with five days remaining until July 9, only 3 out of 75 countries on Trump's "blacklist" have signed deals with the U.S. Let's take a closer look at the "lucky" ones.

The first to sign was the United Kingdom, which, from the start, expressed willingness to come to an amicable agreement with Trump. However, as of seven days ago, the deal had been agreed upon but not signed. Most likely, this is a formality, so we'll count it as a completed agreement.

The second "lucky" party was China, but there are many questions surrounding this deal. No details were disclosed in the media. The parties stated that a deal was signed, but the details of what it entails remain unknown. Will there be further negotiations? That's also unclear. What is clear is that tariffs from the U.S. side will stay in place for both the UK and China. For the UK, it's a "discounted" 10%; for China, up to 55% depending on the product category. So what exactly is the purpose of these trade agreements or supposed truces?

The third deal was signed by Vietnam, which received "just" a 20% tariff on goods and 40% on "transshipment" from Trump. Most likely, "transshipment" refers to imports from third countries. In any case, the tariffs remain in effect, so in reality, there is no trade truce. That's why the dollar isn't growing — and won't be. The market has no use for a truce that doesn't exist.

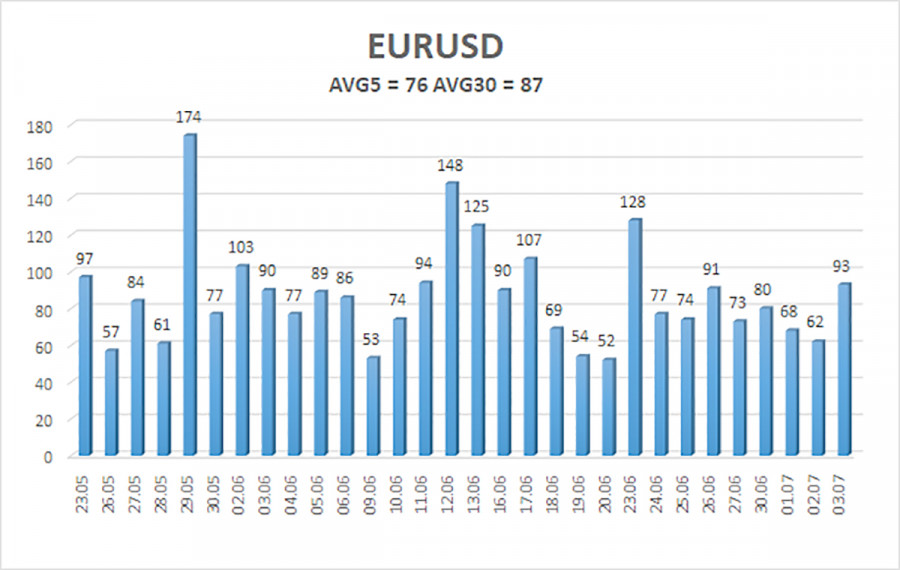

The average volatility of the EUR/USD pair over the last five trading days as of July 4 is 76 pips, which is considered moderate. We expect the pair to move between 1.1681 and 1.1833 on Friday. The long-term regression channel points upward, indicating a sustained upward trend. The CCI indicator had entered the overbought zone and is now forming bearish divergences — but in an uptrend, these usually only indicate the possibility of a correction.

Nearest Support Levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1841

R2 – 1.1963

Trading Recommendations:

The EUR/USD pair remains on an upward trend. The U.S. dollar remains heavily influenced by Trump's policies, both foreign and domestic. Additionally, the market is interpreting or outright ignoring many economic data releases to the detriment of the dollar. We continue to see a complete reluctance from the market to buy the dollar under any circumstances. If the price is below the moving average, small short positions with a target of 1.1597 can be considered, although a significant decline is not expected under current conditions. Above the moving average, long positions remain relevant with targets at 1.1833 and 1.1841, continuing the uptrend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.