The EUR/USD currency pair continued to trade very calmly on Wednesday.

The pair maintained a slight downward bias, as we've noted in all of our recent articles. However, the current market movement is nothing more than a standard technical correction and is not driven by any meaningful factors.

Imagine a situation where negative news comes out of the U.S. every day, while positive news flows from the Eurozone. Do you think the U.S. dollar would fall daily under such conditions? No. The market will still occasionally correct, take profits, try to anticipate trend reversals, and take long-term speculative positions. This means that even when the fundamental and macroeconomic backdrop clearly favors one currency (as it does now), the pair cannot move in only one direction indefinitely.

Therefore, there is no need to look for specific reasons behind the U.S. dollar's temporary strengthening. Many analysts consistently make the same error by attributing even minor price movements to fundamental events, changes in sentiment, or macroeconomic data. Sometimes, these explanations lack credibility. For instance, some now argue that the dollar is rising in anticipation of a trade agreement with the EU. But why didn't it rise after the deal with the UK? Why are the newly announced tariffs on copper, pharmaceuticals, and semiconductors being overlooked? Why is the market disregarding the increased duties on 15 countries included in Trump's list? It appears the market is reacting to the potential EU deal—despite Brussels still having three weeks to negotiate—while ignoring the other recent tariff announcements.

Once again, this movement is a pure technical correction. Of course, everything can change on the currency market in an instant. A vivid example of this is January of this year, when a 16-year trend was abruptly reversed simply because Donald Trump became president. The dollar had been strengthening for 16 years, but the policies of the "greatest president in U.S. history" caused it to collapse against all major currencies in just five months.

Donald Trump decided that tariffs on steel and aluminum weren't enough—now he wants to tax copper imports as well. It's worth noting that copper is a highly valuable metal, so tariffs could potentially be very beneficial for the U.S. budget. And the budget needs support, as Trump's new law is expected to increase the national debt by 3 trillion dollars. If the budget were running a surplus, how could the debt still grow? Clearly, the budget is in deficit—and will remain so. The same goes for the trade balance, as the White House has so far managed to sign only two trade deals: with the UK and Vietnam. As for the deal with China, we've already expressed doubts—and Trump confirmed them yesterday. He stated that negotiations with Beijing are still ongoing. How can there be a "signed" deal if talks are still in progress?

Thus, the dollar is rising solely on technical grounds. It is not falling on the news of new tariffs because they have not been implemented yet. The new duties will take effect on August 1, and for products like pharmaceuticals, copper, semiconductors, and other items Trump wants to generate revenue from, it is still unknown when those tariffs will be enforced.

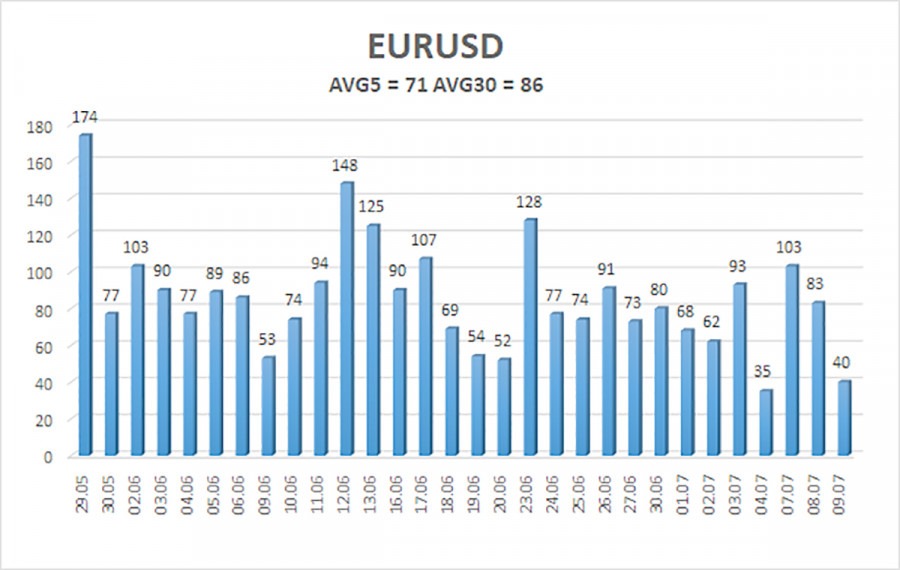

Average EUR/USD Volatility (5 Days as of July 10):

71 points – characterized as moderate.

Expected range for Thursday: between 1.1639 and 1.1781.

The senior linear regression channel remains upward-sloping, indicating a continued uptrend. The CCI indicator entered the overbought zone and formed several bearish divergences, which triggered the current downward correction.

Nearest Support Levels:

- S1: 1.1597

- S2: 1.1475

- S3: 1.1353

Nearest Resistance Levels:

- R1: 1.1719

- R2: 1.1841

- R3: 1.1963

Trading Recommendations:

The EUR/USD pair continues its upward trend. Donald Trump's policies—both foreign and domestic—remain the primary force affecting the U.S. dollar. The market still shows a clear reluctance to buy the dollar under any circumstances. If the price is below the moving average, short positions with a target of 1.1639 may be considered, though a strong decline is unlikely under current conditions. Above the moving average, long positions remain valid with a target of 1.1841, in line with the prevailing trend.

Illustration Notes:

- Linear Regression Channels help define the current trend. If both channels point in the same direction, the trend is considered strong.

- Moving Average (20,0, smoothed) defines the short-term trend and the preferred trading direction.

- Murray Levels serve as target levels for price movements and corrections.

- Volatility Levels (red lines) represent the expected price range for the next 24 hours based on current volatility.

- CCI Indicator – entering the oversold zone (below -250) or overbought zone (above +250) indicates a potential trend reversal.