The EUR/USD currency pair traded very calmly throughout Monday, as the market continued to ignore Trump's tariff hikes. If the euro remains flat while the British pound is actively falling, can we conclude that Trump's tariffs are to blame? If the dollar had been falling for five months due to the global trade war initiated by Trump, can we now say that the dollar is rising because of the same tariffs? In our view, the answer to both questions is no. So what's happening in the currency market?

We are witnessing a typical, plain correction. We've said many times that a technical correction doesn't require any fundamental reasons — that's precisely why it's called technical. Last week, the market largely overlooked the tariff hikes on copper, pharmaceuticals, and against 22 countries worldwide. This week began with the market ignoring new tariffs against Mexico and the European Union. But does this mean the market will forget about them entirely?

We believe the market is currently engaged in profit-taking from previously opened long positions and, possibly, the formation of new long positions. This is not a fast process, as major players and market makers cannot simply buy billions in currency by clicking a button in a trading terminal. They need to place orders, set price limits, and wait for offers with sufficient volume. This takes time. Therefore, we are inclined to think that the market is preparing for another rally in the euro and a further decline in the dollar.

What do the new tariffs mean for the EU and Mexico? Essentially, nothing — they change very little. First, the tariffs won't take effect until August 1. Second, who in the market can still be surprised by new or increased tariffs? Officials in the White House continue to announce new trade deals in unison, but the total number of signed deals has mysteriously remained unchanged for a long time, at just three. Moreover, it's still entirely unclear whether a deal with China has even been finalized. There has been very little information on this; the sides merely stated that some sort of agreement had been signed. But it may only concern specific product categories and not be comprehensive. We believe that as of now, Trump has signed only 2 out of a possible 75 trade agreements.

Is there any reason for dollar bulls to celebrate — who, by the way, are becoming fewer with each passing month? Is there any real expectation that even 10 of the 75 deals will be concluded? And even if all 75 are signed, is there any reason for optimism if agreements with Britain and Vietnam still preserve high tariffs?

In our opinion, the dollar can only hope for a technical correction at this point. A typical, plain one. And even that hasn't been able to lift the dollar "back from the dead" over the past two days. The move has effectively stalled around the 1.1666 level, which we've mentioned several times. There is no truly positive news for the dollar.

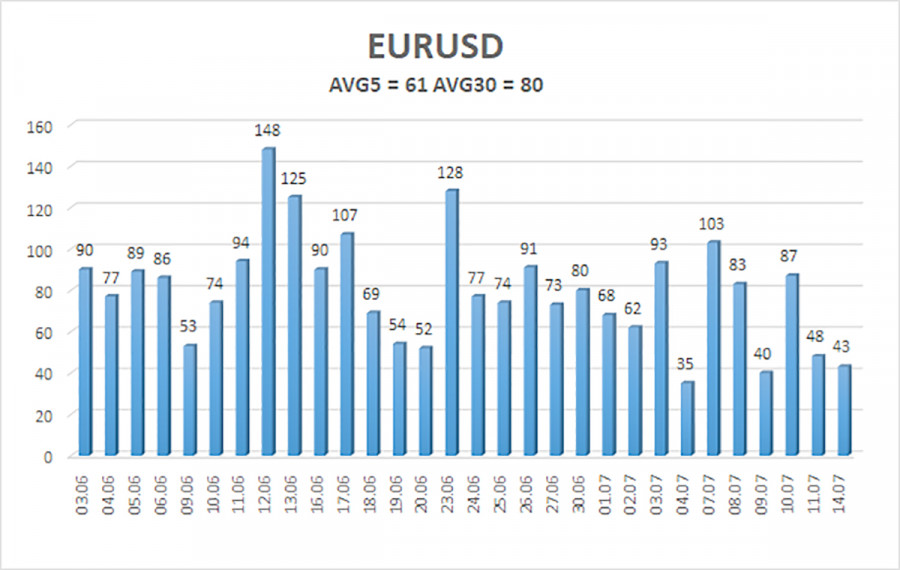

The average volatility of the EUR/USD pair over the last five trading days as of July 15 is 61 pips, which is classified as "moderate." We expect the pair to trade between 1.1604 and 1.1726 on Tuesday. The long-term regression channel is pointing upward, which continues to signal an uptrend. The CCI indicator had entered the overbought zone and formed several bearish divergences, which triggered the current downward correction.

Nearest Support Levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair continues its upward trend but is currently in a corrective phase. Donald Trump's domestic and foreign policy continues to exert strong pressure on the U.S. dollar. We still observe a complete reluctance by the market to buy the dollar under any circumstances.

If the price is below the moving average, small short positions may be considered with targets at 1.1604 and 1.1597, though a major drop is unlikely in the current environment. If the price remains above the moving average, long positions with targets at 1.1780 and 1.1841 remain valid in line with the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.