GBP/USD

Analysis:

The British pound chart has been experiencing an ascending wave since September last year, leading the pair's price to a strong resistance zone. Since the middle of last week, there has been a pullback in quotes, forming an intermediate correction.

Forecast:

The British pound is anticipated to experience a dominant downward movement throughout the upcoming week. It is likely to decline until it reaches the calculated support boundaries. Although a temporary upward price rebound within the resistance zone cannot be excluded in the first few days, the highest activity level is expected towards the end of the week.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

Buying is possible within the limits of intraday trading, but it carries a certain level of risk.

Selling opportunities arise when confirmed reversal signals appear within the resistance zone, and these signals can be utilized for trading purposes.

AUD/USD

Analysis:

The ongoing segment of the prominent bullish trend in the Australian dollar chart began on May 31. Following the encounter with the resistance level on a daily scale, a downward phase in the price movement has been unfolding. The current wave level of this segment indicates that a change in direction is not anticipated in the coming days.

Forecast:

The following week is expected to see a prevailing bearish movement. A decline is probable until the established support boundaries. Once this zone is reached, a reversal pattern will likely form, indicating a resumption of the bullish trend.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

There are no favorable conditions for engaging in buy transactions.

Selling can be considered for trading when upward retracements reach their end. However, the presence of support constrains the potential for downward movement.

USD/CHF

Analysis:

The downward trend of the major Swiss franc, which began in November of last year, is bringing prices back to levels not seen in twelve years. On the weekly timeframe, the pair has breached a strong support level. Before any further decline, the price must consolidate at the current position.

Forecast:

At the start of the upcoming week, the sentiment is expected to continue with sideways movement. There is a possibility of a temporary price rebound towards the resistance zone. A reversal pattern may form in this zone, indicating a resumption of the bearish trend. The most significant activity is anticipated towards the end of the week.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

Buy: There is a high level of risk involved, and the potential for gains is limited.

Sell: It is possible to consider trading after the occurrence of validated signals.

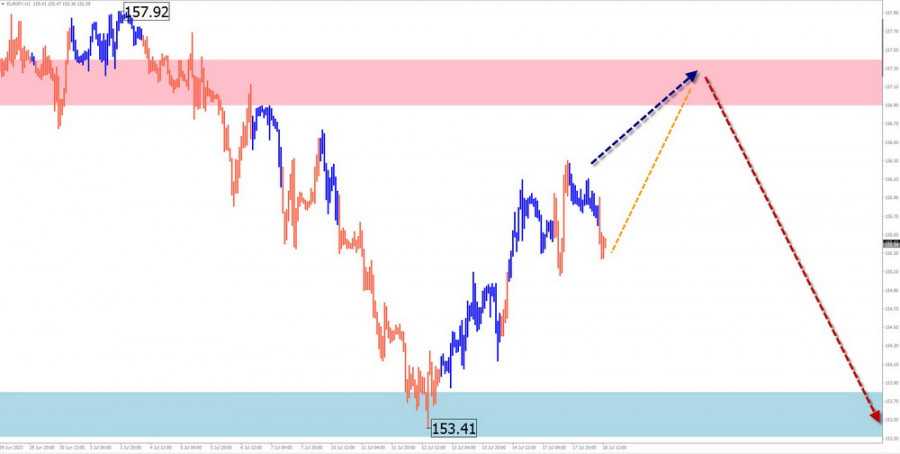

EUR/JPY

Analysis:

The euro/Japanese yen pair has been on an ascending trend for the past three years and has reached levels not seen in fifteen years. The ongoing segment of the trend began earlier this year. The quotes are confined within a wide potential reversal zone on the weekly timeframe. The counter-movement that started at the end of last month is still considered a correction.

Forecast:

Throughout the week, the overall sideways movement is expected to continue. The most likely scenario in the coming days is the completion of the upward trend around the calculated resistance. As we approach the weekend, a reversal and a resumption of downward price movement can be anticipated.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Buy: Possible within individual trading sessions. It is safer to close transactions at the first reversal signals.

Sell: Become relevant after confirmed reversal signals appear in the resistance zone.

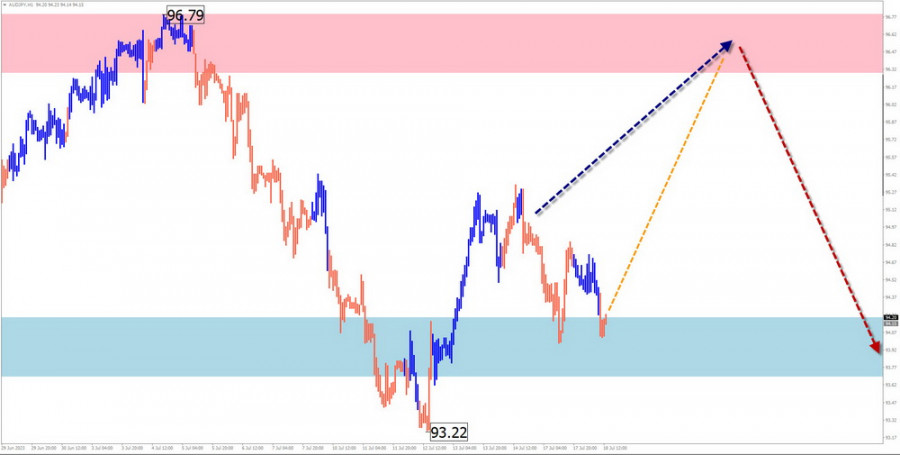

AUD/JPY

Analysis:

The ascending trend of the Australian dollar/Japanese yen pair, which has been ongoing for three years, has pushed the pair's quotes to levels not seen in fifteen years. The unfinished segment of this trend began at the start of the current year. The quotes are situated within the boundaries of a wide potential reversal zone on the weekly timeframe. The corrective movement that started at the end of the previous month remains within the confines of a correction.

Forecast:

Over the week, the overall sentiment suggests a continuation of sideways movement. The upward sentiment will likely reach its culmination around the calculated resistance level in the upcoming days. As we approach the weekend, a reversal and a resumption of the downward price movement can be anticipated.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

Buy: Possible within individual trading sessions. It is safer to close transactions at the first reversal signals.

Sell: Become relevant after confirmed reversal signals appear in the resistance zone.

US Dollar Index

Analysis:

The decline in the North American dollar index has led the quotes to a broad potential reversal zone on the weekly timeframe. The wave structure indicates an incomplete intermediate part (B), forming a shifting plane.

Forecast:

A shift towards a predominantly sideways movement in the index fluctuations is anticipated for the ongoing week. A decline toward the support zone is more probable in the coming days. Towards the end of the week, a reversal and an upward movement towards the boundary level can be expected.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

The period of the US dollar's weakening positions is nearing its conclusion. Closing all long positions in national currencies during the upcoming week and monitoring opportunities to sell them in major currency pairs is recommended.

Explanation: In simplified wave analysis (SWA), waves comprise three parts (A-B-C). Only the most recent and unfinished wave is analyzed in each timeframe. The formed structure is depicted with a solid arrow background, while dotted lines represent expected movements.

Note: The wave algorithm does not consider the duration of instrument movements in time.