EUR/USD 5-Minute Analysis

The EUR/USD currency pair showed absolutely no movement throughout Wednesday. Volatility was minimal. What's most interesting is that the flat occurred at the highest levels seen in three years. As we can see, traders still show no desire to buy the dollar. When there is no news, they wait for something to happen so they can resume selling the U.S. currency.

And on Wednesday, there was no news at all. Jerome Powell gave another speech in the U.S. Congress, but unsurprisingly, the Federal Reserve Chair remained loyal to his 2025 rhetoric and repeated his Tuesday speech word for word. Additionally, media reports emerged questioning the destruction of Iran's nuclear facilities and the loss of its nuclear power status. More precisely, there is currently no evidence that American bombs did anything more than create an expensive fireworks display above the nuclear sites—there is no proof they penetrated deep into the ground to actually destroy the facilities. However, this no longer matters much, as the conflict between Iran and the U.S./Israel has been temporarily resolved.

From a technical standpoint on the hourly timeframe, the uptrend remains intact. Over the past two days, the price has failed to break through the 1.1615 level confidently, yet there's still a strong sense that further growth of the pair is inevitable.

In the 5-minute timeframe, the price generated two sell signals near the 1.1615 level and one buy signal on Wednesday. However, it never managed to move more than 15 pips in the desired direction for traders. Given the current volatility, it was extremely difficult to expect any profit.

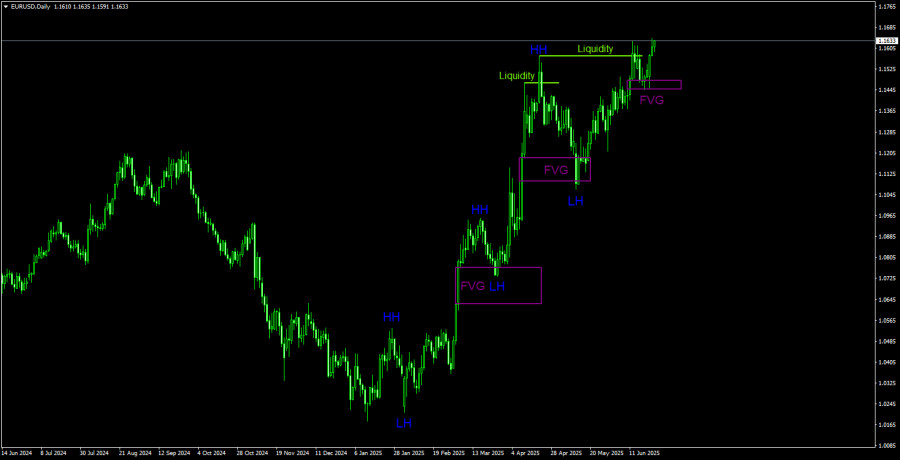

EUR/USD 1D Analysis – ICT

In the long-term view, we observe a clear upward trend. Naturally, this trend will eventually end, but the only bearish signal has been liquidity being taken from the last higher high. This week, we saw a second bounce from the bullish FVG (Fair Value Gap), which allowed for opening new long positions—or at least justified expectations of further euro growth. The upward trend structure remains relevant, especially considering the market's complete unwillingness to buy the dollar. Therefore, almost any near-term dollar strengthening is unlikely to influence the current trend. The broader fundamental backdrop still works against the U.S. dollar.

COT Report

The most recent COT report is dated June 10. The chart above shows that the net position of non-commercial traders has long been bullish. Bears gained the upper hand briefly at the end of 2024 but quickly lost it. Since Trump assumed the presidency, only the dollar has been falling. We cannot say with 100% certainty that the dollar will continue to fall, but current global events suggest this scenario is likely.

We still see no fundamental reasons for the euro to strengthen. However, there is a powerful fundamental reason for the dollar to decline. The global downtrend remains intact—but what relevance does the past 16 years of price action have now? Once Trump ends his trade wars, the dollar could begin to rise. But will Trump ever end them? And when?

The red and blue lines have crossed again, signaling a renewed bullish trend. During the latest reporting week, the number of longs held by the "Non-commercial" group increased by 6,000, and the number of shorts decreased by 4,300. As a result, the net position rose by 10,300 over the week.

EUR/USD 1-Hour Analysis

On the hourly timeframe, EUR/USD both initiated and completed the formation of a local downtrend. On the daily chart, the pair bounced off the FVG area, so further growth is more likely than decline in the near term. On the hourly chart, signs of a flat are evident, but breaking above 1.1615 will open the way for bulls to push higher. The U.S. officially entering the war against Iran did not support the U.S. currency as many expected, and the rapid conclusion of the war only added pressure on the dollar.

For June 26, we identify the following trading levels: 1.1092, 1.1147, 1.1185, 1.1234, 1.1274, 1.1362, 1.1426, 1.1534, 1.1615, 1.1666, 1.1704, 1.1750, as well as the Senkou Span B line (1.1502) and the Kijun-sen line (1.1548). Note that Ichimoku indicator lines may move throughout the day and should be considered when identifying trading signals. Don't forget to set your Stop Loss to breakeven if the price moves 15 pips in the right direction. This will help protect against potential losses in case of a false signal.

On Thursday, the only significant events are the reports of the U.S. GDP report and durable goods orders. As before, even if these reports show strong results, the dollar can only expect slight strengthening—which may fade quickly and without an apparent reason.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.