Industrial Sector's Strong Start Faces a Reality Check

Despite a turbulent year on Wall Street, the industrial sector has emerged as a clear frontrunner in 2025. However, with earnings season approaching, its resilience is about to be tested.

Outpacing the Market

The S&P 500 industrials index, which includes aerospace firms, electrical equipment manufacturers, engineering companies, transportation, and construction material producers, has surged 15% this year. That's the highest gain among all 11 S&P sectors and more than double the overall index's growth.

Spotlight on Earnings

Market attention is shifting toward a pivotal week filled with corporate earnings reports. Over one-fifth of the S&P 500 companies are set to unveil their Q2 results, including Alphabet and Tesla — the first among the so-called "Magnificent Seven" tech giants to report.

A Rebound from Recession Fears

Since April, the S&P 500 has advanced 26%, buoyed by investor confidence returning after recession fears faded. Those concerns were initially stoked by former President Donald Trump's tariff announcement on Independence Day.

Aerospace and Defense Gain Ground

Stocks in the aerospace and defense sector have seen notable gains this year, driven by escalating geopolitical tensions in Ukraine and the Middle East, as well as renewed defense spending commitments from Germany and other nations.

Defense Drives the Charge as Industrials Brace for a Busy Week

Aerospace and defense stocks have delivered impressive returns in 2025, setting the pace for the broader industrial sector. But with a new wave of earnings just ahead, markets are gearing up for a reality check.

Defense Sector Takes the Lead

The aerospace and defense segment of the S&P 500 has jumped by 30 percent this year. Coming next week are earnings reports from key defense players including RTX, Lockheed Martin, and General Dynamics.

GE's Dual Surge: Aerospace and Vernova Shine

GE Aerospace has seen its stock price soar by roughly 55 percent year-to-date. On Thursday, the company raised its full-year profit guidance, underlining its strong momentum.

Meanwhile, GE Vernova, a spin-off from General Electric focusing on energy equipment, has emerged as the industrial sector's fastest climber — gaining over 70 percent in 2025. Its financial results are scheduled for release on Wednesday.

Uber Lends an Unlikely Boost

Interestingly, Uber has become an unexpected pillar of strength for the industrial group. Shares of the ride-hailing giant have surged around 50 percent this year, adding fresh energy to the sector's rally.

Logistics Struggle to Keep Pace

Not all transport-related names have kept up. UPS and FedEx have seen their stocks decline sharply, while airlines such as United and logistics firms like JB Hunt have also posted negative performance year-to-date.

Earnings Watch: More to Come

Next week will also bring earnings from Honeywell, Union Pacific, and United Rentals — reports that could significantly influence sector sentiment.

Trade Tensions Simmer

Beyond earnings, Wall Street remains attuned to trade policy developments. On August first, a new round of elevated US tariffs is set to take effect, potentially shifting the outlook for global trade-dependent industries.

All Eyes on the Fed as Powell Faces Renewed Pressure

This week, market watchers will keep a close eye on developments surrounding the US Federal Reserve. Fed Chair Jerome Powell is under mounting political pressure, with former President Donald Trump calling for his resignation and pushing for swift interest rate cuts. The next monetary policy meeting is scheduled for July 29 and 30.

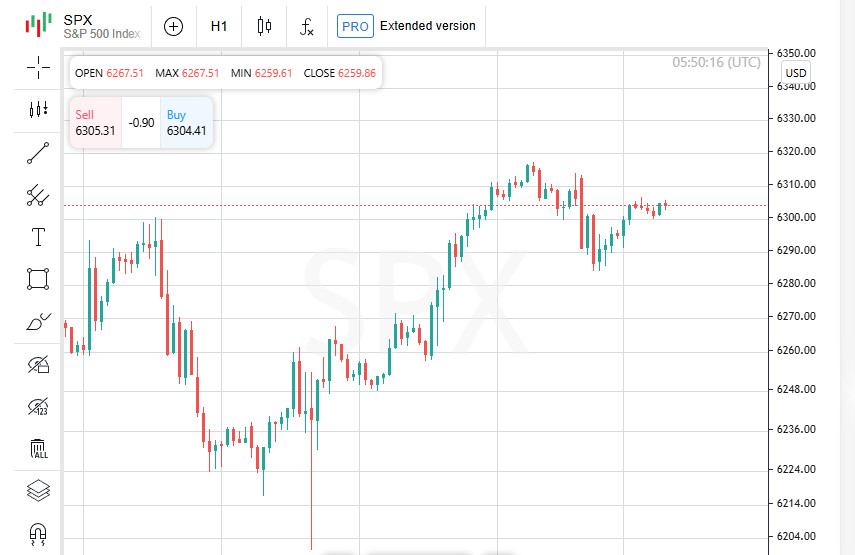

Steady Market Gains Despite Uncertainty

The broader US market continues its cautious climb. Since the start of the year, the S&P 500 has gained around 7 percent, signaling measured optimism among investors.

Asia Holds Firm Amid Political Upheaval in Japan

Asian markets and the Japanese yen remained relatively stable on Monday, despite the ruling coalition's poor performance in Japan's recent election. The outcome, though unfavorable for the government, was largely priced in by investors. Meanwhile, Wall Street futures reflected anticipation of earnings reports from major US tech firms.

Trade Talks in Focus Ahead of Tariff Deadline

Investors remain hopeful that progress can be made in international trade negotiations ahead of the looming August 1 deadline for new tariffs. US Commerce Secretary Howard Lutnick expressed confidence that a deal with the European Union remains within reach.

US and China Talk Scheduling, EU Steps In First

Washington and Beijing are reportedly moving toward arranging a summit between Donald Trump and Chinese President Xi Jinping, though any such meeting is unlikely to happen before October. In the meantime, European Commission President Ursula von der Leyen is set to meet with Xi this Thursday.

Japanese Leadership Faces Setback in Parliament

Japan's political landscape took a hit over the weekend, as the ruling coalition lost control of the upper house in parliamentary elections. The result weakens Prime Minister Shigeru Ishiba's position just as he navigates international tensions and looming tariff threats from the United States.

BOJ Takes a Cautious Approach

The Bank of Japan remains open to the idea of raising interest rates, but market sentiment suggests that such a move before the end of October remains unlikely.

Markets Open Mixed as Asia Holds Steady and Wall Street Eyes Earnings Surge

The new trading week kicked off with a mix of cautious moves in Asian markets and modest gains in US futures, as investors look ahead to a flurry of earnings reports and continue to monitor global economic signals.

Nikkei Flat, Asia Shows Divergence

Japan's Nikkei index remained closed, with futures holding steady at 39820 points — virtually unchanged from the previous session's close. The MSCI index for Asia-Pacific excluding Japan slipped 0.1 percent. South Korea's stock market gained 0.5 percent, while China's blue chips rose 0.3 percent after the People's Bank of China left key interest rates unchanged, in line with expectations.

European Futures Under Pressure

Major European equity futures opened in negative territory. EUROSTOXX 50 and DAX futures declined by 0.3 percent, while FTSE futures edged down 0.1 percent. Investor sentiment remains cautious amid concerns over slowing growth and ongoing geopolitical uncertainty.

Wall Street Poised Near Highs

US stock futures advanced slightly, with both the S&P 500 and Nasdaq up 0.1 percent, trading close to all-time highs. This week marks a key moment for earnings season, with reports expected from heavyweights like Alphabet, Tesla, and IBM.

Defense Stocks Stay in Focus

Defense contractors continue to attract attention, with investors awaiting results from RTX, Lockheed Martin, and General Dynamics. The global increase in government military spending has helped propel the aerospace and defense segment of the S&P 500 to a 30 percent gain this year.

Euro Stalls, Dollar Strengthens Slightly

The euro held steady at 1.1622 dollars in early trading, having lost 0.5 percent last week and retreating from a near four-year high of 1.1830. Meanwhile, the dollar index inched higher to 98.465, reflecting continued demand for safe-haven assets.

Gold Holds Steady, Oil Trapped Between Sanctions and Supply Prospects

Commodities markets opened the week on a cautious note, with gold prices remaining flat and oil navigating between potential supply boosts and geopolitical tensions.

Gold Flat as Platinum Shines

Gold prices stayed nearly unchanged at 3348 dollars per ounce, reflecting a brief pause after recent volatility in the precious metals space. Platinum had surged to its highest level since August 2014 last week, signaling renewed investor interest in industrial metals.

Oil Market Caught in a Tug of War

Crude prices are treading a narrow path as traders weigh two conflicting dynamics — expectations of higher production from OPEC Plus and the risk of tighter export restrictions from the European Union targeting Russian oil within the framework of sanctions pressure.

Brent and WTI Edge Up

Brent crude nudged up by 0.1 percent to 69.36 dollars per barrel, while US West Texas Intermediate rose 0.2 percent to 67.45 dollars. For now, oil remains highly sensitive to global headlines, with markets awaiting clearer direction on both supply and sanctions.