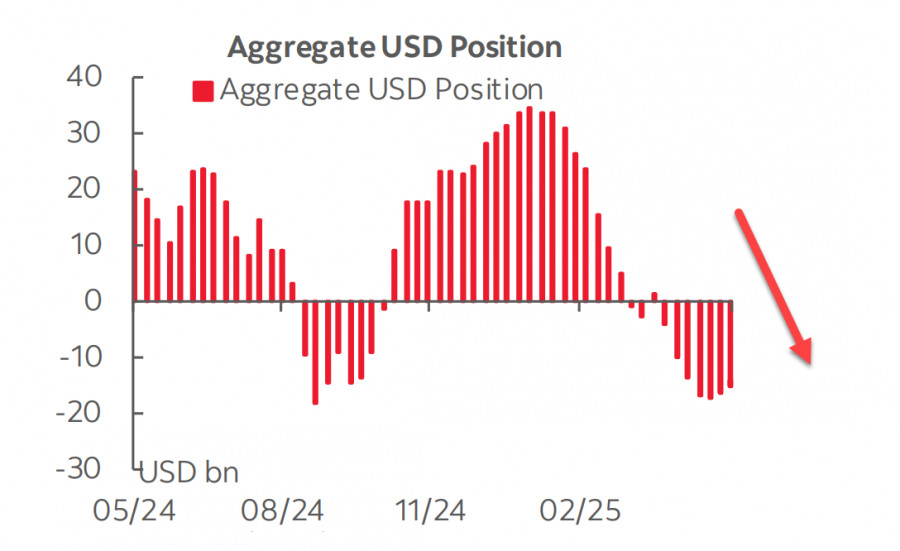

The latest CFTC report published on Friday showed that the U.S. dollar sell-off has stopped, but at the same time, the accumulated short position against major currencies remains significant, and its reduction is progressing extremely slowly.

There have been only minor changes against the yen, euro, and pound—the dollar managed to strengthen only against commodity-linked currencies. Additionally, long positions in gold have increased, which, overall, does not indicate any more bullish prospects for the U.S. dollar than the week before.

For several months now, newsfeeds have been filled with reports of new U.S. tariffs being introduced, canceled, or revised; negotiations starting or pressure resuming. Amid this backdrop, another process has received little attention—one that, if it develops further, could have no less of an impact on markets than tariffs: tax reform. This is what Trump aims to implement to create favorable conditions for reshoring industry to the U.S. This is the other side of the coin—exert pressure in one place and establish an investment destination in another. Without such a process, higher tariffs alone make no sense, as they would only lead to inflation and product shortages.

On May 22, the U.S. House of Representatives narrowly passed Trump's "One Big Beautiful Bill" by a single vote. The bill aims to make the 2017 tax cuts permanent, reduce spending on social programs like Medicaid, and raise the national debt ceiling to $4 trillion.

To maintain stability, debt growth should not outpace economic growth. Trump is seeking ways to stimulate the U.S. economy, but according to the University of Pennsylvania's Wharton School, GDP would be only 0.5% higher over ten years under the new budget, while the national debt would rise by 7.2%.

Federal budget expenditures on debt servicing already make up about 15%. If interest in bond auctions continues to fall—since U.S. bonds are no longer seen as reliable after Moody's downgraded the U.S. credit rating—bond yields will rise, putting even more pressure on the budget. Rising yields, in turn, will accelerate debt growth, as additional funds will be needed to service previous obligations.

What does all this mean for foreign investors? There's no reason to buy U.S. bonds if yields are low and the dollar is expensive. Accordingly, in order to attract funding for the budget, yields must remain high while the dollar continues to weaken. Only time will tell whether this scenario materializes, but at present it appears the most realistic.

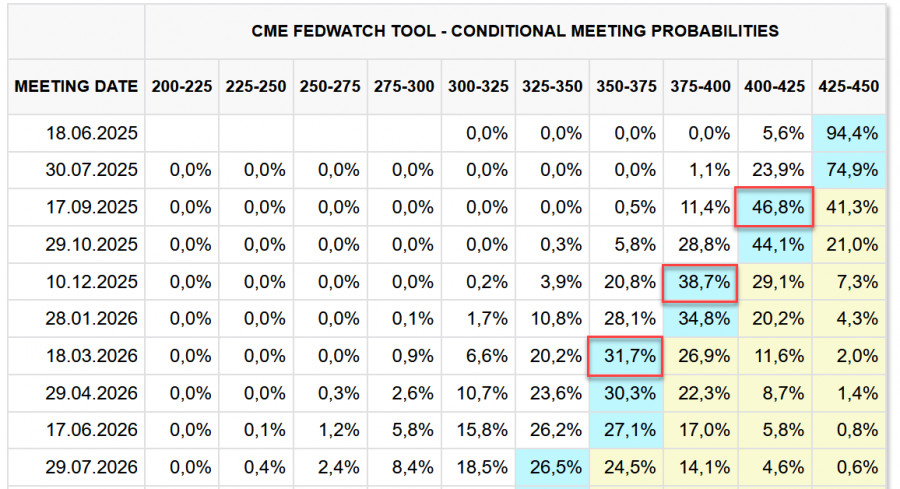

High yields suggest that the market believes the Fed will not rush to cut rates. Currently, the market expects only two rate cuts in 2025, with the first now pushed from July to September or even the beginning of Q4. However, this has not strengthened the dollar. Even Trump's Friday statement about his readiness to impose 50% tariffs on EU imports starting July 1 only caused temporary stabilization of the dollar, not a major rebound as it might have a few months ago. Fed officials, overall, emphasize the need to wait and observe, reflecting the market's sentiment.

Trump's attempt to force manufacturers to relocate production to the U.S. through persistent pressure on trade partners appears quite questionable from the outset. On the surface, things look fine—huge consumer and capital markets, favorable tax regimes, subsidies, etc. But the risks clearly outweigh the benefits—high labor costs, a significant shortage of skilled workers, separation from the main supplier clusters located in Asia, and enormous capital expenditures required for such a move, especially for giants like Apple.

The S&P 500 Index appears poised to resume growth after a brief pullback to the 5780 support level. Holding above this level, the index has shown potential for further strengthening.

The index reacted positively to Trump's extension of the deadline for the 50% tariffs on EU goods to July 9. Additionally, the U.S. Treasury made optimistic remarks about the outlook for negotiations with China. Macroeconomic data was also favorable—jobless claims dropped to 227,000, the business activity index for May rose to 52.1 points, and the decline in home sales was less severe than expected. Company reports may add to the picture—Xiaomi's report is due May 27, Nvidia's on May 28—but overall, there's no reason for panic, and under such conditions, historical patterns favor growth over decline.

At the same time, there are still few solid reasons for a rally. The threat of recession remains, especially after Moody's downgrade of the U.S. sovereign credit rating. On Tuesday, durable goods order data for April will be published, and markets do not expect positive results. The S&P 500 may respond with a decline. We continue to believe that the U.S. stock market is more likely to trend downward than upward, and that Trump's desperate efforts to revive U.S. manufacturing are ultimately doomed to fail.