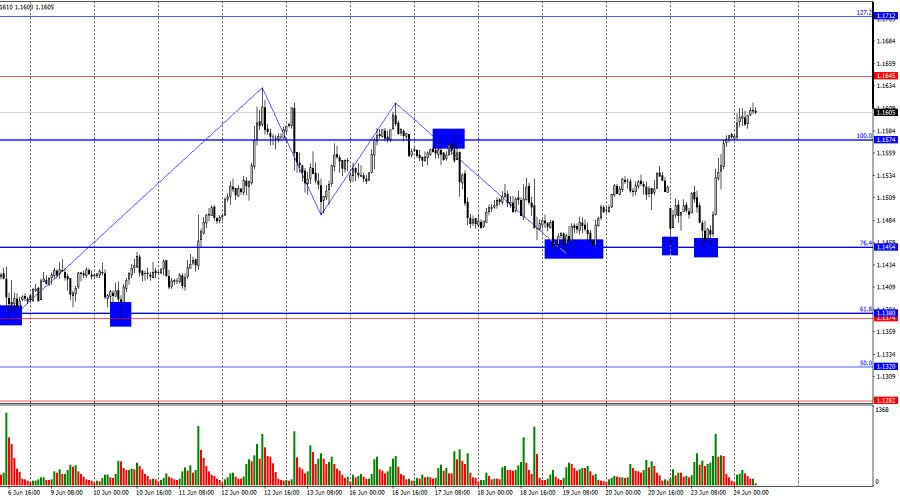

On Monday, the EUR/USD pair on the hourly chart performed two rebounds from the 76.4% Fibonacci retracement level at 1.1454, reversed in favor of the euro, and rose to the 100.0% Fibonacci level at 1.1574, consolidating above it. As a result, the upward movement may continue toward the next level at 1.1645 and further to the 127.2% retracement level at 1.1712. The bulls have once again regained the initiative in the market, preventing the bears from accomplishing anything.

The wave situation on the hourly chart remains simple and clear. The last completed downward wave broke the low of the previous wave, and the new upward wave broke the previous high. Thus, the trend has once again turned "bullish." The lack of real progress in U.S.–China and U.S.–EU negotiations discourages bears from launching new attacks, and the FOMC meeting failed to support the U.S. dollar. As I anticipated, the "bearish" trend turned out to be neither strong nor lasting.

Monday's news background was very eventful, and traders were overwhelmed with information. Economic reports on business activity were almost forgotten, as developments in the Middle East were not only unfolding rapidly but also appeared quite strange. First, Trump announced the complete destruction of three nuclear sites in Iran. Shortly after, Iranian officials issued a formal statement mentioning only minor damage. Later, it became known that no one was harmed in the U.S. airstrikes because Iran had been warned hours in advance and had managed to evacuate. In the afternoon, reports came in about Iran's retaliatory strikes on U.S. military bases in Qatar and Syria, but again, there were no casualties, as the American side had also received prior warnings. This creates a very peculiar kind of war, where adversaries notify each other about upcoming strikes. Traders reasonably concluded that with such formally-executed hostilities, the conflict would soon die down. Bulls resumed their offensive, as the dollar was left without informational support.

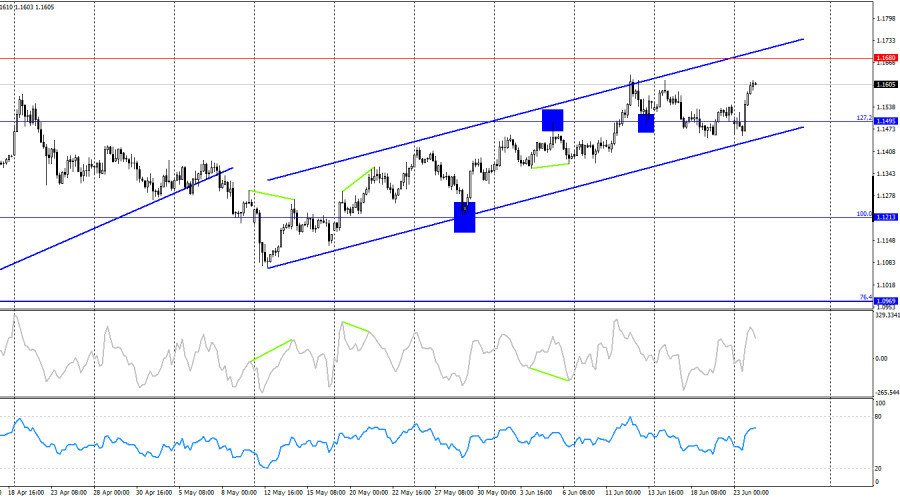

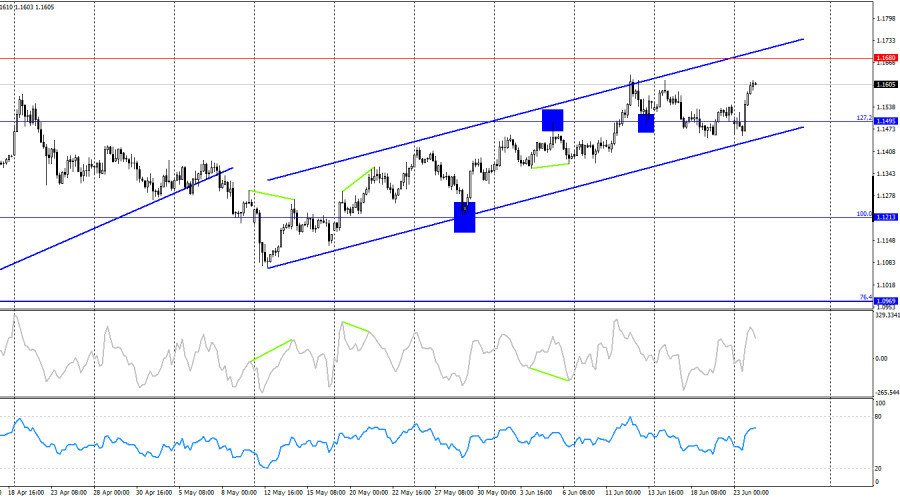

On the 4-hour chart, the pair returned to the 127.2% retracement level at 1.1495 and reversed in favor of the euro. Thus, the upward movement has resumed toward the 1.1680 level within the ascending trend channel. Only a consolidation below the channel would suggest the possibility of a "bearish" trend. No emerging divergences are currently observed on any indicator.

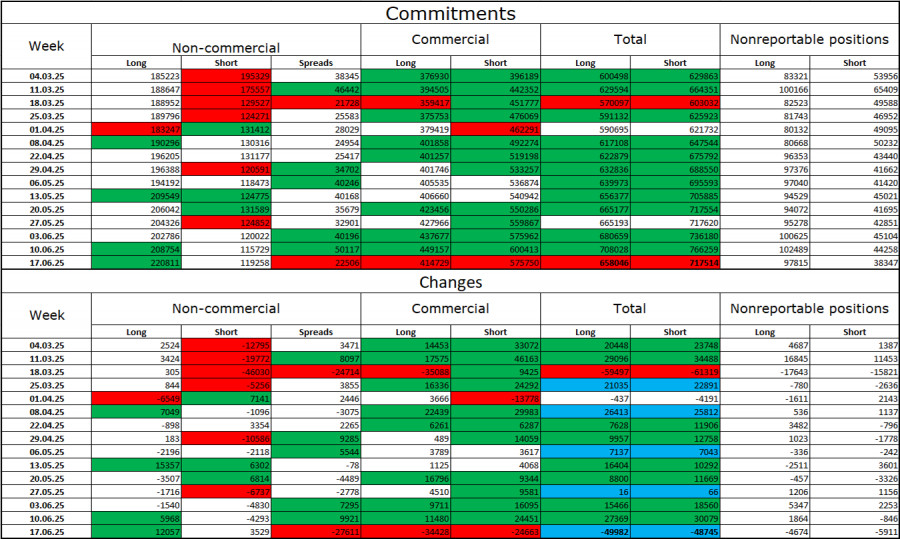

Commitments of Traders (COT) Report:

During the latest reporting week, professional traders opened 12,057 long positions and 3,529 short positions. The sentiment among the "Non-commercial" group remains "bullish" thanks to Donald Trump and continues to strengthen over time. The total number of long positions held by speculators now stands at 221,000, while short positions amount to 119,000 – and the gap (with rare exceptions) continues to widen. Thus, the euro remains in demand, while the dollar does not. The situation remains unchanged.

For twenty consecutive weeks, large players have been reducing short positions and increasing longs. The difference in monetary policy between the ECB and the Fed is already significant, but Donald Trump's policies are a more critical factor for traders, as they could trigger a recession in the U.S. economy and cause a range of long-term structural issues for America.

News Calendar for the U.S. and Eurozone:

- Eurozone – Germany Business Climate Index (08:00 UTC)

- Eurozone – Speech by ECB President Christine Lagarde (13:00 UTC)

- U.S. – Speech by FOMC Chair Jerome Powell (14:00 UTC)

The June 24 economic calendar includes at least two key events – speeches by Lagarde and Powell. Therefore, the influence of the news background on market sentiment will persist throughout Tuesday.

EUR/USD Forecast and Trader Recommendations:

Selling the pair was possible after a close below 1.1574 on the hourly chart, targeting 1.1454. This target was reached. I would not consider new short positions for now, as the "bullish" trend appears to have resumed. I previously recommended buying at a rebound from 1.1454 with a target of 1.1574. That target has been achieved, and its breakout now allows holding long positions with targets at 1.1645 and 1.1712.

The Fibonacci grids are constructed from 1.1574–1.1066 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.