EUR/USD 5-Minute Analysis

On Monday, the EUR/USD currency pair was engaged in just one activity — it was falling. Over the past six months, we haven't seen many crashes in the euro, but this time, there were valid reasons. The issue wasn't even the signing of the trade agreement between the U.S. and the European Union, which should have at least caused a modest strengthening of the dollar. The real issue was the content of the agreement that was signed. In short, it contains no real benefits for the EU. The only advantage the EU can claim is avoiding the 30% tariffs that Donald Trump had promised Brussels. However, the final tariffs for the EU ended up being 15%, which is higher than the rates during the so-called "grace period." That is, under this agreement with the U.S., tariffs are now higher than they were over the past three months.

In addition, the European Union pledged to purchase nearly $1 billion worth of energy from the U.S. and to invest $600 million in the American economy. Unsurprisingly, such terms didn't impress buyers of the European currency.

On the hourly timeframe, it's clear that the euro had been steadily moving toward the resumption of a six-month trend. But then a "black swan" appeared, and a collapse followed. Unfortunately, no one is immune from such "swans," but traders could have made solid profits from this move.

On the 5-minute timeframe, at least three strong sell signals were formed. The downward movement was intense throughout the day, though it started gradually — an ideal scenario for traders. A short position could have been opened as early as the breakout below the 1.1750–1.1760 area, and from that point on, traders could simply watch their profit grow throughout the day.

COT Report

The latest COT (Commitment of Traders) report is dated July 22. As shown in the chart above, the net position of non-commercial traders was bullish for a long time. Bears barely took control at the end of 2024, but quickly lost it. Since Trump took office as President of the U.S., the dollar has only declined. While we can't say with 100% certainty that this decline will continue, current global developments suggest this scenario is likely.

We still see no fundamental factors supporting the euro, but one strong factor remains weighing on the U.S. dollar. The global downtrend remains intact, but what does it matter where the price has moved over the last 16 years? Once Trump ends his trade wars, the dollar may begin to rise — but when will that happen?

The position of the red and blue lines in the indicator continues to show a bullish trend. During the last reporting week, long positions held by the "Non-commercial" group increased by 6,200, while shorts increased by 8,900. Therefore, the net position decreased by 1,700 contracts — a negligible change.

EUR/USD 1-Hour Analysis

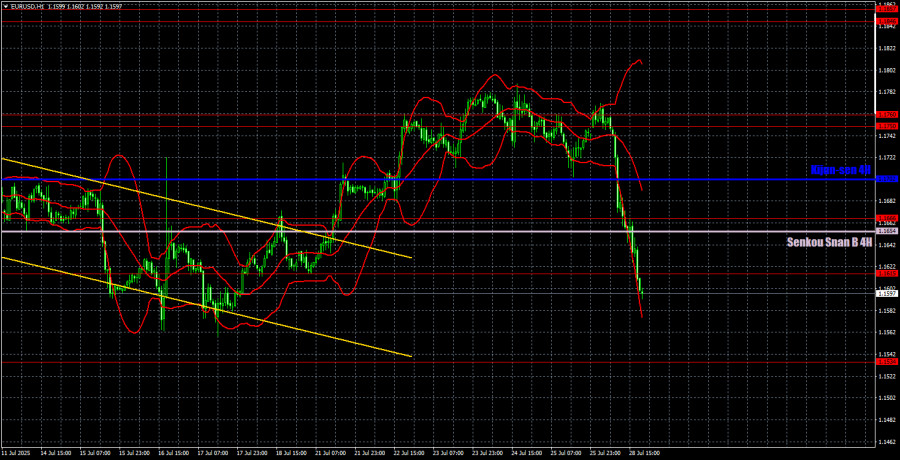

In the hourly timeframe, EUR/USD has started falling sharply, and now it will be interesting to see how long the market reacts to the failure of the European negotiation team. Of course, the deal between Trump and the EU was a significant blow to the euro, but one single event isn't enough to drive the price back to levels from early 2025. Moreover, given that all tariffs remain in place for countries that signed trade agreements with the U.S., we do not believe the trade war can be considered over.

For July 29, we highlight the following trading levels: 1.1092, 1.1147, 1.1185, 1.1234, 1.1274, 1.1362, 1.1426, 1.1534, 1.1615, 1.1666, 1.1750–1.1760, 1.1846–1.1857, as well as the Senkou Span B line (1.1654) and Kijun-sen (1.1702). The Ichimoku indicator lines may shift throughout the day, which must be taken into account when identifying trading signals. Don't forget to move your Stop Loss to breakeven once the price moves 15 pips in the right direction — this helps protect against potential false signals.

On Tuesday, there are no significant events scheduled in the Eurozone. In the U.S., we'll receive the JOLTs job openings report, which, although not critical, may still attract interest. Today's market will also remain focused on the outcome of the U.S.–EU trade agreement.

Trading Recommendations

On Tuesday, we may well see a continued decline in the euro, though from the daily perspective, this is still just a standard, mild technical correction. It could come to an end soon. Yesterday, several high-quality sell signals were formed, and these setups may still be relevant today. Buying during a collapse is probably not the best decision.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.